In an earlier comment two months ago, BR Research had noted that the textile export growth story has its roots in the phenomenal increase of concessionary working capital to the industry, which has grown by over two-thirds both in dollar and rupee terms in the past 2 years. Since then, in its latest monetary policy SBP has signalled its intention to unwind the monetary stimulus. If the central bank decides against further raising EFS limits for commercial banks, will the value-added segment be able to maintain its export growth momentum?

Before that question is addressed, some context is necessary. The central bank extends concessionary working capital loan called Export Finance Scheme to value-adding export-oriented industries. Within textile, manufacturers of all export goods - other than raw cotton and cotton yarn - are eligible for short-term loans on concessionary mark-up currently capped at 3 percent per annum. As a trade finance facility, EFS is extended for 6-months on roll-over basis.

As part of Covid relief measures, SBP had enhanced EFS limit to commercial banks by Rs 100 billion in August 2020. Earlier, aggregate loan outstanding (to private sector) against EFS stood at a little under Rs 500 billion, which has since shot up, flirting with Rs600 billion in recent months. Since the difference between commercial banks’ cost of funds (i.e. Kibor) and EFS rate is borne by SBP, the central bank bears the loss on markup. Logic then dictates that further raising EFS limits at a time when central bank is tightening the policy rate may exacerbate the pace of loss accrual. It remains to be seen whether the central bank will have an appetite to raise EFS limits to prop up exports or not.

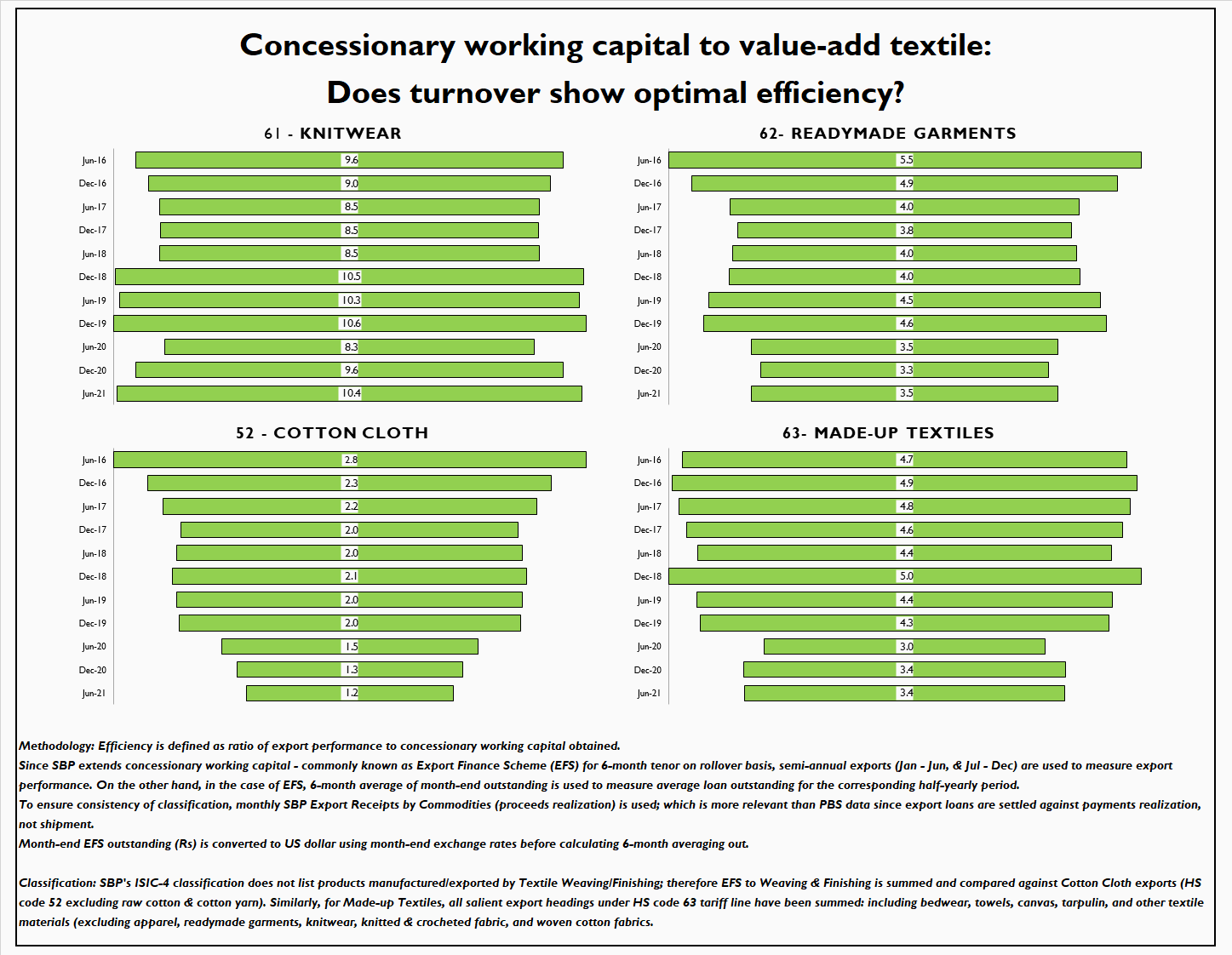

But before the central bank goes down that path, it may help to measure the impact of EFS loans on various value-adding segments, and their export performance. In the accompanied visual, BR Research has made an academic attempt to do the same. The central bank, however, is best placed to conduct such analysis independently, so that any enhancement in EFS limits may be justified in the policymaking circles.

As explained above, EFS loans are rolled-over on semi-annual basis. At minimum, the borrowing entity must demonstrate export performance equivalent to the loan amount. Of course, that is not an ideal scenario: in effect this would mean that all export is financed through working capital loans obtained on concessionary basis. In reality, things aren’t as bleak either: ratio of EFS loans to various value-adding segments within textile is significantly higher than 1x. Ideally, higher the ratio, the more optimal is the export performance (read methodology below).

Of course, if the central bank were to conduct a similar exercise, it could precisely measure the number of times any given company – or industry – has rolled over the EFS facility in any given period, and whether the turnover of borrowed amount has improved over time. That would confirm whether concessionary loans are being utilized efficiently or not. For example, if a given industry displays a very high level of EFS turnover, it may help allocate more funds to exporters within that exporting segment. On the other hand, a very low turnover (below 2x for example), may indicate that the firms in the industry are not highly export competitive, suggesting that a chopping exercise may be in order.

In the spirit of transparency, it is important to highlight that any analysis conducted without access to raw loan turnover data is fraught with risks of misinterpretation. For example, BR Research’s analysis shows that export performance of Knitwear segment has very high level of EFS turnover and is thus far more efficient than any other value-adding segment. However, a less likely but (still possible) explanation could be that most knitwear exporters currently do not have access to EFS lines; thus the ratio of knitwear export value to loans obtained is currently very high.

On the other hand, the very poor performance by cotton cloth segment may appear highly intuitive on surface. Pakistan’s fabric exports are fast declining in value as well as volume terms, so poor efficiency ratio may not come as a surprise. Why then do cotton cloth manufacturers – classified as weaving and finishing – have a share of more than one-third in total EFS extended to textile? Turns out, this could very well be a classification error. What’s that you ask?

Consider that SBP’s data on loan to private sectors is based on information supplied by commercial banks. Thus, if a commercial bank has misclassified any borrower’s industry, the same will feed into central banks’ data. But it is just as likely that the borrower may have initiated the banking relationship at the time it was concentrated in spinning business, but has since diversified to garment manufacturing. Or quite simply, that the borrower is a composite textile unit. The most obvious evidence of this problem is that over 13 percent of EFS extended to textile is classified under “spinning”, even though cotton yarn export is not eligible for concessionary working finance!

But that does not mean that any such exercise shall be in vain. For every export made through the banking channel, the central bank also has 8-digit HS code data and firm details to the tee. With a little effort, the central bank can compare value of exports under each HS code line to the amount of EFS loan obtained by the firm, and just repeat the same for the thousand odd EFS borrowers.

The policymakers at the central bank may find it unwise to continue raising concessionary borrowing limits indefinitely, merely to support export growth. Given more precise analysis, they may not have to!

Methodology: Efficiency is defined as ratio of export performance to concessionary working capital obtained.

Since SBP extends concessionary working capital - commonly known as Export Finance Scheme (EFS) for 6-month tenor on rollover basis, semi-annual exports (Jan - Jun, & Jul - Dec) are used to measure export performance. On the other hand, in the case of EFS, 6-month average of month-end outstanding is used to measure average loan outstanding for the corresponding half-yearly period.

To ensure consistency of classification, monthly SBP Export Receipts by Commodities (proceeds realization) is used; which is more relevant than PBS data since export loans are settled against payments realization, not shipment.

Month-end EFS outstanding (Rs) is converted to US dollar using month-end exchange rates before calculating 6-month averaging out.

Classification: SBP's ISIC-4 classification does not list products manufactured/exported by Textile Weaving/Finishing; therefore EFS to Weaving & Finishing is summed and compared against Cotton Cloth exports (HS code 52 excluding raw cotton & cotton yarn). Similarly, for Made-up Textiles, all salient export headings under HS code 63 tariff line have been summed: including bedwear, towels, canvas, tarpulin, and other textile materials (excluding apparel, readymade garments, knitwear, knitted & crocheted fabric, and woven cotton fabrics.

Comments

Comments are closed.