Fauji Foods Limited (PSX: FFL) was set up in 2015 when Fauji Foundation, together with Fauji Fertiliser, took over Noon Pakistan Limited. Noon Pakistan Limited was established as a public limited company in 1966.

Fauji Foods Limited is part of the Fauji Group which was formed in 1954; other companies in the group are Fauji Fertiliser Bin Qasim Limited, Fauji Cement Limited, Fauji Meat Limited, etc. Fauji Foods processes and sells toned milk, milk powder, fruit juices, allied dairy, and food products.

Shareholding pattern

As at December 31, 2020, close to 76 percent of shares were held by the associated companies, undertakings, and related parties, followed by over 20 percent owned by the local general public. Close to 3 percent of shares are owned by the joint-stock companies, while the remaining roughly 1 percent of shares are distributed with the rest of the shareholder categories.

Historical operational performance

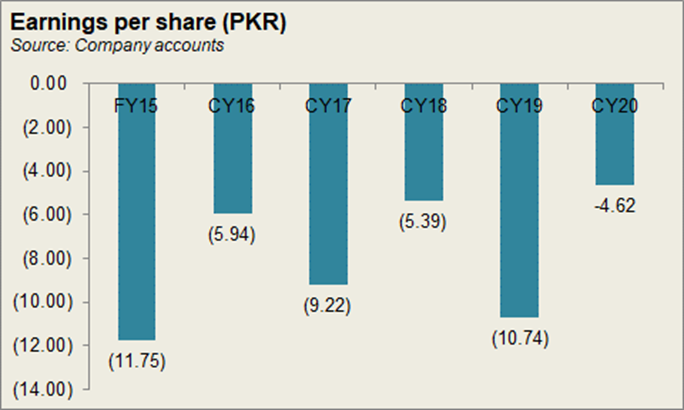

Since CY16, the company has mostly seen a growing topline at increasingly varying rates, while profit margins slightly fluctuated between FY15 to CY18; there was a major drop in CY19 before profits rose again in FY20.

In CY17, the topline of the company grew remarkably, posting a growth of over 100 percent, year on year; topline also crossed Rs7 billion, compared to Rs3.37 billion seen in CY16. This was somewhat attributed to the BMR activities that it had undertaken that allowed the production capacity to improve, particularly for the liquid products; it grew from a production the capacity of 116.8 million litres of liquid products in CY16, to 227.7 million litres in CY17. During the year, it also commissioned its Ultra Heat Treatment (UHT) plant, alongside adding products to its portfolios such as fruit juices and low-fat UHT milk for the health-conscious market. Despite this, the company could not improve profitability as the cost of production made over 97 percent of revenue, leaving little room for absorption of other costs. With further increases in distribution expense as well, primarily due to advertisement, net loss for the year escalated to Rs2.3 billion.

Revenue in CY18 continued to rise, albeit at a subdued rate of over 9 percent due to an adverse impact observed in the UHT milk category as a consequence of the Supreme Court order. Although the order was reversed after milk testing, sales had already been affected. In addition, the availability of loose milk as a cheaper alternative distributed through informal channels continues to be a challenge for the company. On the other hand, production cost reduced slightly to over 95 percent of revenue, which allowed gross margin to improve somewhat to 4.7 percent. But the rise in finance expense and a decrease in the positive tax figure for the year escalated the net loss to Rs2.85 billion.

After rising consecutively for the last three years, since the acquisition, revenue in CY19 fell drastically, by nearly 25 percent, to reach Rs5.7 billion for the year. The dairy industry as a whole faced challenges such as the availability of loose milk along with no government support regarding it. Moreover, the company could not come to an agreement with a Chinese company for the latter to acquire Fauji Foods. On the other hand, although production cost in value terms was lower, year on year, it exceeded the topline for the year, resulting in a gross loss. With further expenses incurred, a continued rise in finance expense due to rising interest rates, and a significantly higher tax expense, net loss was posted at a whopping Rs5.8 billion.

Fauji Foods had been looking to diversify and expand its product portfolio. Gauging the dairy industry environment, it focused on value-added products rather than focusing on achieving higher volumes. In CY20, revenue bounced back, recording a growth of over 28 percent to reach Rs7.4 billion for the year. This was achieved by maintaining supply chains and making changes in the distribution systems, while also introducing value-added products such as cheese, butter, and unsalted butter. This was also reflected in the lower expenses for distribution and administration. However, since production cost still consumed nearly all of the topline, the company incurred a loss for the year, albeit lower than that seen in the previous year, at Rs3 billion.

Quarterly results and future outlook

The first quarter of CY21 saw revenue higher by 43 percent year on year, as the company managed its supply chain and distribution that remained unhindered by the emergence of the Covid-19 pandemic. During the period the company also launched a dairy cream that received a positive response from the market. Production cost for the period was lower than that seen in the same period last year, although eventually, the company did post a loss for the period of Rs 347 million, which was considerably lower than that in 1QCY20.

The second quarter also saw higher revenue year on year, by 35 percent, while production cost reduced as a share in revenue, compared to the first quarter of CY21. Despite the lockdowns initiated because of Covid-19, the company managed to maintain its food supply chain. Compared to 2QCY20, the loss incurred in 2QCY21 was lower at Rs 411 million, but higher than that in 1QCY21. No adverse changes have been made in the FY22 budget for the dairy industry, while the latter also received zero-rating that would allow for some tax relief. With the reduction in costs, as they continue to consume more than 90 percent of revenue, profitability can improve.

Comments

Comments are closed.