D. G. Khan Cement Company Limited

D. G. Khan Cement Company Limited (PSX: DGKC) was established under the repealed Companies Act, 1913 (now Companies Act, 2017) in 1978. The company produces and sells Clinker, Ordinary Portland, and Sulphate Resistant Cement. It has two plants at Dera Ghazi Khan, one at Khairpur Distt. Chakwal and one at Hub Lasbela District (Balochistan).

Shareholding pattern

As at June 30, 2021, close to 32 percent of shares are with the associated companies, undertakings, and related parties. Within this category, the major shareholder is Nishat Mills Limited that holds 31.4 percent shares. The local general public holds 19.5 percent shares, while a little over 6 percent shares are owned by each of the following: insurance companies and modarabas, and mutual funds. Another 6 percent are owned by Mr. Mian Umer Mansha and Mr. Mian Hassan Mansha, each. The directors, CEO, their spouses, and minor children together own 4.3 percent shares while the remaining 19 percent are with the rest of the shareholder categories.

Historical operational performance

D. G. Khan Cement has largely seen a growing topline since FY12, except for in FY15 and FY20 when it contracted by 1.6 percent and 6 percent, respectively. Profit margins, on the other hand, have been on a gradual decline after FY16 until FY20, and only improved in FY21.

In FY17, topline growth stood at 1.4 percent that was comparatively subdued than that seen in FY16 when it grew by nearly 14 percent. In terms of volumes, sales had also seen a similar rise; local sales registered an 11 percent raise, while export sales fell by 18 percent. The latter was a general trend observed in the industry as, on one hand, exports to Afghanistan reduced, while on the other the African market was “becoming stringent”. Owing to the “furnace oil and coal expense”, production cost, as a share in revenue went up to nearly 61 percent of revenue, from over 57 percent seen in FY16. Thus, gross margin declined to 39.3 percent; with a notable increase in finance expense, net margin fell further to over 26 percent for the year.

Subdued revenue growth continued in FY18 as sales revenue posted a growth rate of 1.8 percent. Dispatches grew by 7.4 percent. The sales distribution reveals that local sales continued its growth momentum as it witnessed an almost 12 percent rise; on the contrary, export sales decrease exceeded 21 percent. This was attributed to reduced exports to India, Afghanistan, and Sri Lanka, while the presence of Iranian cement increased competition in the African market. So far, most of the exports of the company were transported by road, about 77 percent. With the new plant near the port, the company hopes to export more via sea. In addition, it also expects to extend export markets to countries that do not have limestone reserves. On the costs side, production cost consumed nearly 87 percent of revenue, shrinking gross margin to 28.5 percent. Moreover, the escalation in other expenses due to impairment on operating fixed assets offset the rise in other income, thus operating margin also reduced. But the positive expense for the year, allowed net margin to increase to 28.8 percent.

Revenue in FY19 recovered significantly, as it posted an all-time high growth rate of 32 percent, with topline crossing Rs 40 billion in value terms. Total cement sales grew by 16.4 percent. While local sales registered a 22 percent rise, exports shrunk further by 41 percent. Due to the slowdown in the world economy, the production from the new plant that operated the entire year increased, but could not find export markets. Moreover, exports were further hampered, to India due to the Pulwama incident, and Afghanistan as Iranian cement took over. The increase in utility prices led to a rise in production cost, which reduced gross margin to 13 percent. The borrowing undertaken for the Hub plant increased the finance expense that further trimmed net margin to nearly 4 percent- the lowest seen thus far.

In FY20, revenue contracted by 6 percent. In terms of volumes, cement sales reduced by nearly 2 percent, while clinker sales saw a big increase as the company made export sales of 1.7 million metric tons of clinker. The downward pressure on local cement sales prices reduced domestic sales. The latter was due to lower demand, the Covid-19 pandemic, and increasing competition. With production cost consuming almost 96 percent of revenue, and other expenses continuing to rise, the company incurred a loss for the year at Rs 2 billion.

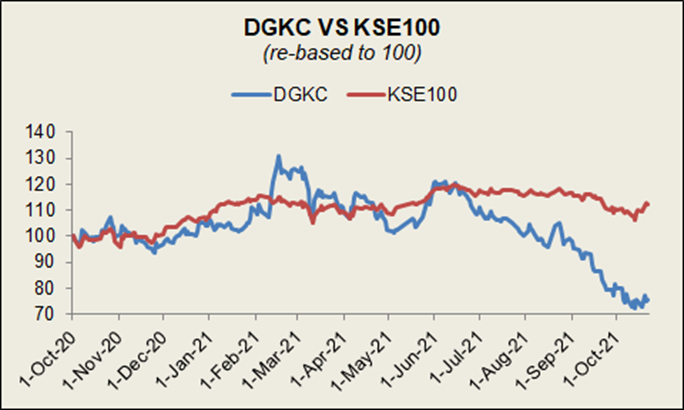

Recent results and future outlook

Revenue in FY21 registered an 18.6 percent rise on the back of stable cement prices, as well as recovery in demand as business activities, began to resume. Production cost went down significantly to consume 82 percent of revenue as the Waste Heat Recovery plant became operational in the second of the year to provide some relief in cost pressure. As a result, the gross margin improved to 17.9 percent. In addition, finance expenses fell due to lowering of the discount rate, thus net margin also improved to over 8 percent.

Despite the challenges in the economy, construction activity is maintained and increasing due to the need for housing, CPEC related projects, and ongoing work on dams.

Comments

Comments are closed.