Gharibwal Cement Limited (PSX: GWLC) was established as a public limited company in 1960. It was listed on the stock exchange two years later, and by 1965 it began commercial production, starting with a production capacity of 1,200 tons per day.

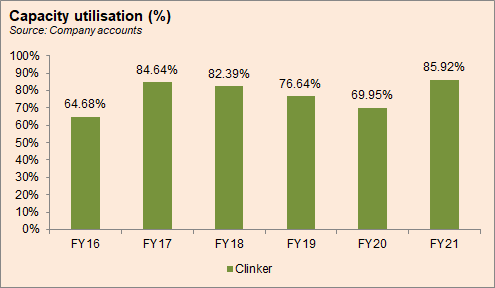

Today it has an annual production capacity of 2,010,000 tons of clinker; the company is in the business of producing and selling cement.

Shareholding pattern

As per the company’s annual report of FY21, nearly 89 percent shares are owned by the directors, CEO, their spouses and minor children. Within this category, majority of the shares were owned by Mr. Muhammad Tousif Peracha, the CEO of the company. over 9 percent shares were with the local general public, while the remaining close to 2 percent shares were with the rest of the shareholder categories.

Historical operational performance

Gharibwal Cement has consistently seen a growing topline except for in FY19 and again in FY20, while profit margins have been on a decline since FY16, reached the lowest in FY20, before improving again in FY21.

In FY17, revenue growth stood at its lowest thus far, at 6.7 percent, crossing Rs 11 billion in value terms. Volumetrically, cement dispatches for the company were higher by 4.6 percent to reach 1.6 million tons. Volumes have generally been on a rise for the last six years, but revenue has been rather subdued due to lower selling prices that has been a result of tax impositions and duties.

On the other hand, owing to rising fuel and energy prices, production cost as a share of revenue grew to 65.7 percent, from over 60 percent in FY16. Thus, gross margin reduced to 34 percent for the year. This also trickled down to the net margin that was recorded at over 20 percent, down from 25.5 percent in FY16.

Revenue growth in FY18 fell further to 4.3 percent, with cement dispatches recorded at 1,891,808 tons after rising by 18 percent. However, there were zero clinker dispatches. Moreover, export sales fell by 40 percent, whereas local sales picked up by 10 percent, despite a reduction in selling price in the local market. Therefore, revenue growth was contained at near 4 percent. On the other hand, currency devaluation, from Rs 105/US$ on June 30, 2017 to Rs 121.60/US$ on June 30, 2018, led to an escalation in production costs to nearly 75 percent of revenue. As a result, gross margin fell to 25 percent. With increases in expenses in other elements too, net margin fell to 12.9 percent for the year.

After growing consecutively for the last eight years, revenue in FY19 contracted by 4.5 percent. Volumetrically, cement dispatches fell to 1,675,906 tons, posting a reduction of 11.4 percent. Moreover, both export and local sales declined; the tension on Pakistan-India border adversely impacted export sales as India is one of the destinations for cement exports from Pakistan. Local sales, on the other hand, saw an 11.4 percent decrease in volumes, but the decrease is local sales was not as much, due to an upward movement of selling price in the domestic market. With production costs further rising to claim nearly 78 percent of revenue, gross margin contracted to 22 percent for the year. With a higher finance expense and taxation, net margin was recorded at 6.6 percent.

In FY20, the company saw the biggest contraction in revenue at 22 percent, reducing topline to Rs 8.7 billion, from Rs 11 billion in FY19. However, this was largely a function of price, as cement dispatches declined marginally by 1 percent, whereas selling price fell by 21 percent. the decline in volumes was mostly concentrated in the months of lock down imposed due to the outbreak of Covid-19. On the other hand, production cost as a share in revenue jumped to 99 percent due to increase in “the rate of royalty on raw materials with effect from July 2019 that increased the respective expense by 161 percent year on year”. Therefore, the company posted a loss before tax of Rs 562 million.

In FY21, topline grew by nearly 39 percent- the highest seen since FY13, whereas volumes were higher by 7 percent, with cement dispatches recorded at 1,776,484 tons. The improvement in gross margin to 26 percent was attributed to increase in selling prices, and some reduction in energy prices; production cost made up 73.8 percent of revenue. This also trickled down to the bottom-line, that recovered to Rs 1.55 billion for the year, compared to Rs 131 million in FY20, while net margin for the year was recorded at 12.8 percent.

Quarterly results and future outlook

Although sales volumes were lower by 8.9 percent in 1QFY22 year on year, revenue was higher by 21.7 percent. News suggests that cement prices rose in 1QFY22, which could most likely serve as a rationale for the rise in revenue during the period. With a marginal decline in production cost as a share in revenue, gross margin increased year on year to 22.8 percent. Other income also provided support, that led net margin also to improve to 12 percent.

While there is no shortage of demand in the domestic market as per the company’s report, the company’s financial performance could adversely be impacted by the rising input prices.

Comments

Comments are closed.