The more they remain the same. It was inevitable that car makers would raise prices as their costs increased (price hikes were predicted in this space several times. Read more “Autos: Approaching headwinds” Oct 15, 2021). Because however much it bothers those wearing the policymakers’ hats, it was absurd to assume that slashing duties and taxes would make cars “affordable” or bring stability in vehicle prices. With freight rates skyrocketing, rupee depreciating and input costs surging, it was only a matter of time that automakers raised prices and pass on the “cost effect” to consumers. It is literally the same formula for decades—why would it change now? The impact of this, however, will likely be lagged but higher prices together with SBP’s new restrictions on car financing coupled even more with increasing interest rates is going to bring surging volumes down to a screeching halt.

Recall that the rationale behind the government cutting duties and taxes was to boost vehicle sales and make up for the loss in taxes with higher volumes. High volumes then translate to more localization, goes the logic. Sounds nice in theory. But the desire for more vehicle volumes has few takers even within the government (given how the focus has shifted back to controlling current account deficit and reducing imports. CBU and CKD imports of motor cars is up 112 percent and 162 percent in 4M. If cars keep selling, import burden will become even more burdensome; cue SBP car financing restrictions). Policy is –as often the case—all over the place.

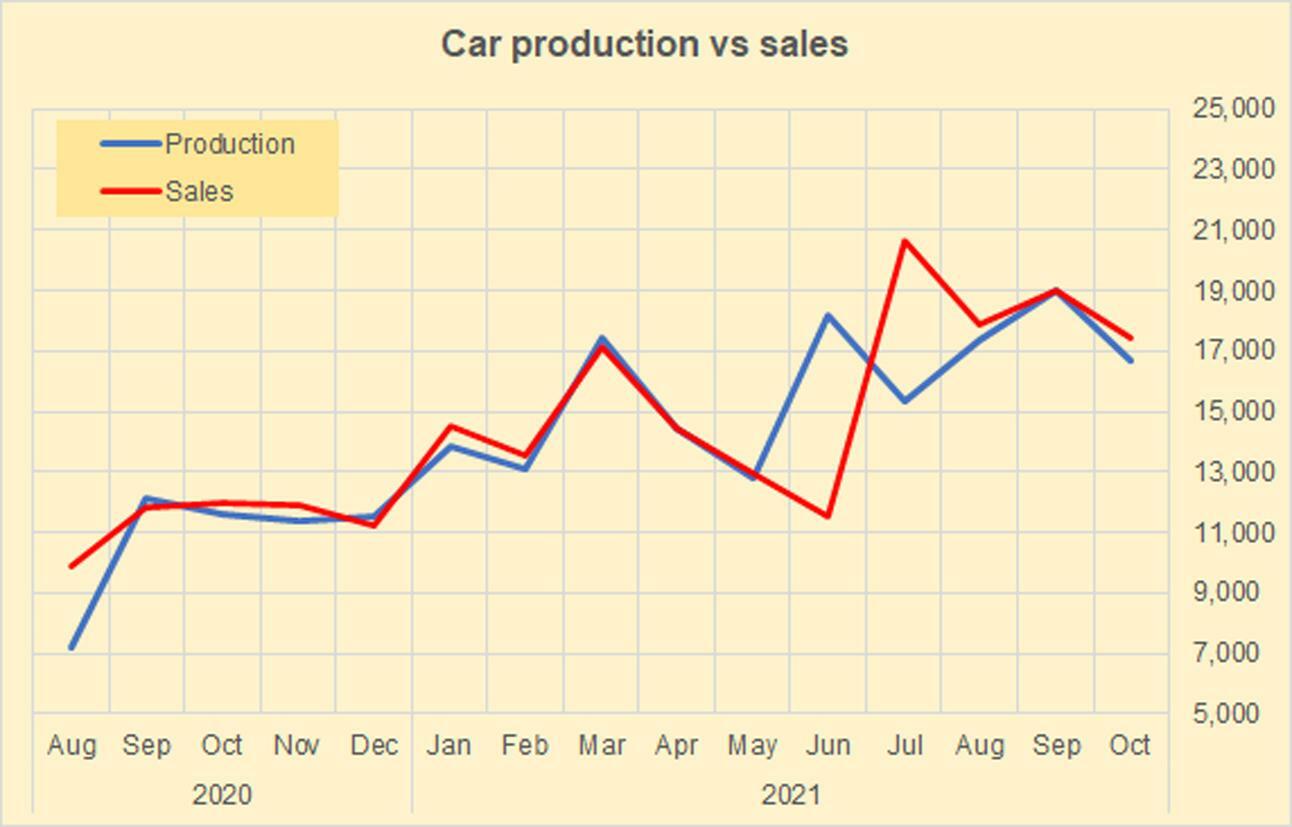

Right now, cumulatively, the industry is doing really well, with sales growing 75 percent in 4MFY22 compared to last year. This is because car buyers have paid slashed prices, and attained cheaper financing for cars thus far. Suzuki has recovered remarkably well with volumes double of last year, next to Toyota’s growth of 49 percent and Honda’s 22 percent in 4M.

October however has already started to show signs of slowdown. Total industry sales including passenger cars, LCVs and SUVs dropped 6 percent month-on-month. Production is slipping, and will continue to slip. A major crisis in the form of an acute supply shortage of semi-conductor chips erupted last year as the pandemic picked up heat causing economies and factories to temporarily shutter down. The global chip shortage is affecting a wide variety of industries specially, the automotive supply chains worldwide. The supply is tight and manufacturers have inventories piling up sans chips waiting to lock and load when they arrive. Demand on the other hand (for chips) is surging (read more: “Autos: Running late on just-in-time”, June 9, 2021).

Automakers here at home are also facing the brunt of this crisis which is causing production, and by extension, car delivery delays. Delivery delays then cause vehicle premiums to rise. Volumes will suffer, vehicles will become more expensive to the average car buyer and we are back to the basics! At least for now.

Comments

Comments are closed.