The monetary policy decision is today. The committee meeting has been preponed by a week in light of recent developments in the currency movement (“Currency: Fasten your seat belts”, Nov 12, 2021). Gauging from the press release, SBP’s forward guidance stance of being accommodative could very well change due to recent “unforeseen” events. This may rule out a measured expected increase of 0-50 bps. In fact, expect more.

The question is: what are the unforeseen developments that could not have waited for (even) a week. Certainly, inflation outlook is changing, and SBP will likely revise up its inflation forecast from 7-9 percent. Its forward guidance would be hinged upon new forecast and expectations. But this alone cannot be the reason to prepone the review.

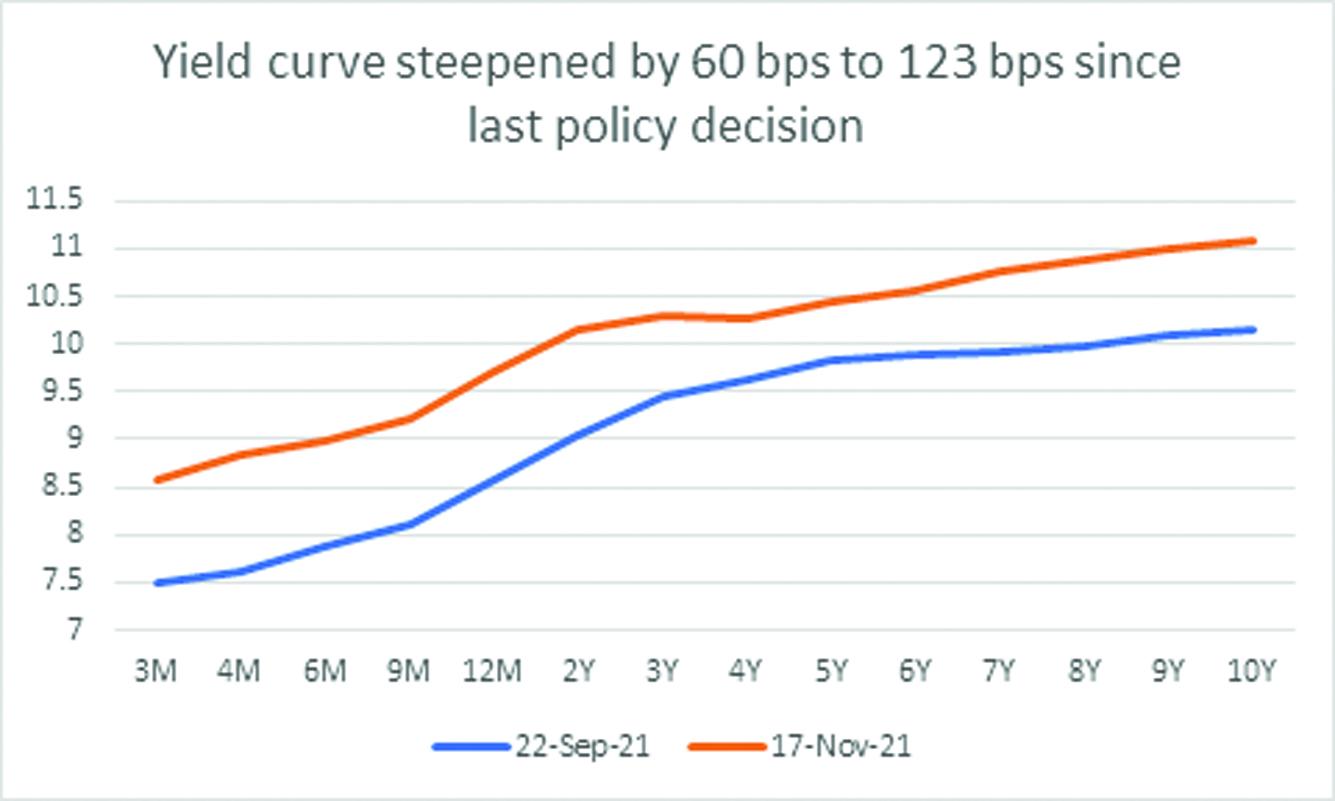

There are no visible uncertainties due to monetary policy in the capital market (both money and stock) to pressurize SBP to call the meeting earlier. The secondary market yields in the money market have already moved up by 100-125 bps over the last policy rate change and any change in the policy rate (up to 100-125 bps) is already priced in.

And there is no primary auction in the next week which could have enticed SBP to call the meeting earlier. In fact, day before yesterday, a T-bill action took place and almost all market (competitive) bids were rejected. Had the SBP not announced policy review earlier, there could have been some interest in 3M papers. The government accepted mere Rs500 million in the 3M paper at the previous auction’s cut-off yield. The government was lucky to get Rs55 billion in non-competitive bids in 3M. Government got nothing in the 6M and 12M papers.

The dampening sentiments are in the currency market, and that are sending jitters across the board. It seems SBP is clearly not happy with the market dynamics and that is owed to the growing concerns on the external account (balance of payments) stability. The drip-by-drip currency depreciation in the currency market is altering the inflation outlook and could adversely affect other decisions. Perhaps, SBP wants to take prompt actions to counter the sentiments, and alter the views through its new forward guidance.

This argument is supported by a recent blunt and surprised decision of increasing the CRR rate by 1 percent to 6 percent (on average) and minimum of 4 percent (from 3%). Usually, such decisions are clubbed with monetary policy. Doing it in advance is perhaps to arrest the falling currency trend. It did work marginally. However, it seems SBP probably wants to send a clearer message through monetary policy communication without waiting another week.

CRR increase is supposed to reduce the growth in the real money supply – to curb the demand which is putting pressure on imports and overall current account deficit. The decision of possible higher hike in the policy rate is meant to curb the demand as well, and do inflation targeting in a better way. But as described earlier, market rates are already up by 100-125 bps from the previous policy rate and so is KIBOR. The tightening impact on demand through reduced private credit is already happening. Plus, SBP has already put curbs on consumer finance (through restrictions on auto loans).

Seeing all that, there seems to be no other reason, but to arrest the falling currency trend by calling the meeting earlier. One other reason, as per conspiracy theorists is that it’s an IMF pre-condition to increase the policy rate earlier.

The question is how much SBP may increase the rate today. Market is expecting 75-100 bps. Different surveys are depicting the same. Topline Securities poll suggests an increase of 75 bps or more. Arif Habib Limited survey suggest that major participants are expecting 100 bps increase. Ismail Iqbal Securities poll is saying that money managers are expecting 75-100 bps increase.

Although in every survey, participants expect an increase of over 100 bps, chances of that happening are thin. SBP may not want to disregard the credibility of its forward guidance. At the same time, SBP desires to communicate urgently to address uncertainties. Seeing all these, the rate hike might be in the range of 75 bps to 100 bps – nothing more and nothing less. As, an impact of 50 -100 bps is perhaps already attempted to pass on through CRR increase.

The key would not be the policy rate change (which is already priced in). The message could be to communicate change in forward guidance and inflation (and other variables) outlook.

Comments

Comments are closed.