Nagina Cotton Mills Limited (PSX: NAGC) was established in 1967 as a public limited company under the Companies Act, 1913. It is part of the Nagina Group of Companies, and it manufactures and sells yarn.

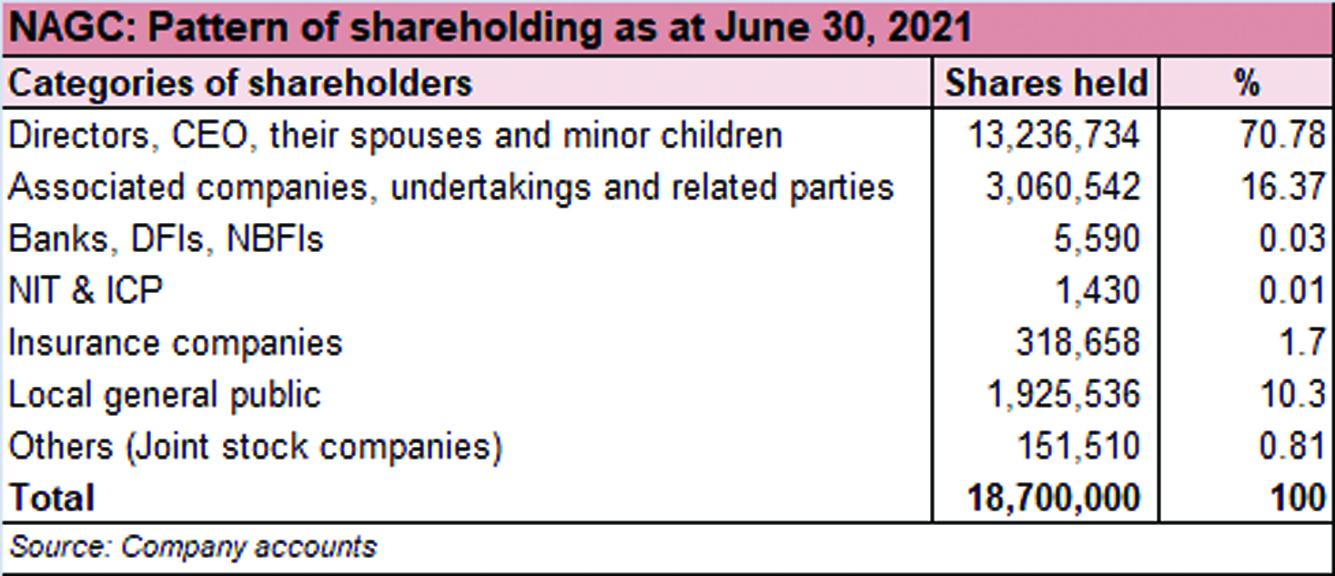

Shareholding pattern

As at June 30, 2021, close to 71 percent of shares are held by the directors, CEO, their spouses, and minor children. Within this category, roughly 17 percent shares are held by Mr. Shahzada Ellahi Shaikh, Mr. Shaukat Ellahi Shaikh, and Mr. Shafqat Ellahi Shaikh. Another over 16 percent of shares are owned by associated companies, undertakings, and related parties. The local general public owns 10 percent shares while the remaining 2 percent shares are with the rest of the shareholder categories.

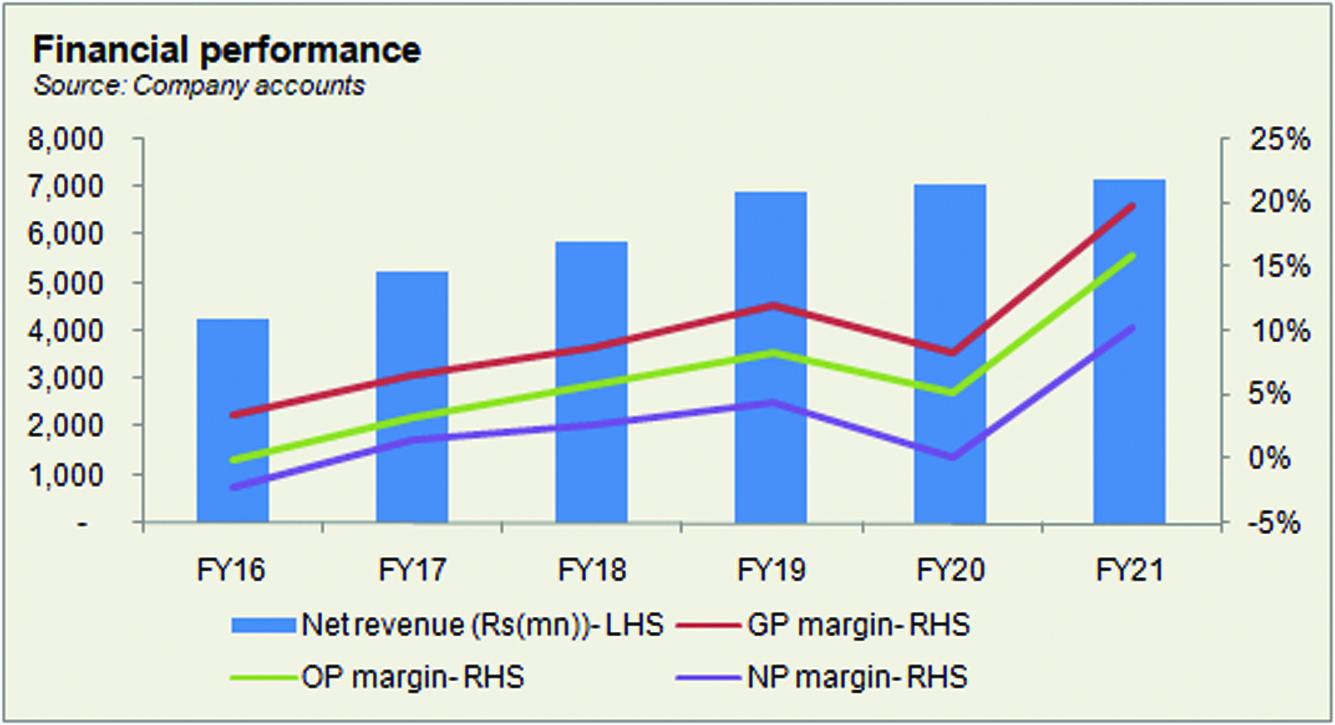

Historical operational performance

Nagina cotton Mills has mostly seen a rising topline, with the exception of FY15 when it contracted by 7.9 percent. Profit margins, on the other hand, followed a gradual upward trajectory until FY19, after which they dipped in FY20, before improving again in FY21.

After growing at a high of nearly 23 percent in FY17, revenue continued its momentum in FY18 as it posted a growth of over 12 percent. This was attributed to several factors such as higher selling prices, changes in the exchange rate and “benefits of export drawback scheme”. A lot of this growth in sales, about 45 percent, was concentrated in local sales. As a result, the gross margin was raised to 8.7 percent. Combined with this was the decrease in expenses overall, which had a positive impact on the bottomline. The latter doubled year on year in value terms, from Rs 79 million in FY17, to Rs 158 million in FY18, whereas net margin was also posted at a higher 2.7 percent, up from 1.5 percent seen in FY17.

Revenue growth in FY19 was also one of the highest, at 17.9 percent, with a topline nearing Rs 7 billion in value terms. Coupled with better prices and volumes was the currency devaluation that encouraged local sales and export sales, both of which witnessed growth at double-digits. Production cost fell below the 90 percent mark after a period of four years, raising the gross margin to 12 percent. The majority of the fall in production cost was attributed to fuel expense that consumed a lower share in total cost year on year. While there was not much change in operating expenses, finance expenses, however, increased markedly to consume 3 percent of revenue, due to a rise in interest rates. But this was offset by the improvement in topline, and net margin continued to grow, recorded at 4.5 percent for the year.

In FY20, revenue growth was subdued at almost 2 percent, due to the outbreak of the Covid-19 pandemic in the second half of the year. As a result, production and trade, across the globe, for the majority of the industries came to a halt. Nagina Cotton also had to shut down its manufacturing facility during the lockdown period that had an adverse effect on profit margins. This is evident from the lower gross margin of 8.4 percent. In addition, finance expenses continued to rise consuming nearly 4 percent of revenue, as interest rates did not come down for a large part of the year. Thus, the net margin was at less than a percent, and bottomline stood at a considerably lower Rs 8 million, versus Rs 309 million in FY20.

Revenue growth in FY21 remained marginal, as it grew by 1.6 percent, with topline recorded at Rs 7.2 billion for the year. However, production cost as a share in revenue fell to an all-time low of 80 percent, allowing gross margin to peak at 19.75 percent. The majority of the fall in production cost was seen in raw material expenses. This can be explained by the company’s claim of timely raw material procurement. With other elements more or less cancelling out the effect of each other, net margin also improved to over 10 percent that was the highest seen in seven years.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by over 51 percent year on year. This was attributed to a higher demand for yarn. Moreover, it must be noted that the demand was most likely adversely impacted in the first quarter of FY21 as the businesses had only started to resume normal activities. With higher product margins, production cost was considerably lower as a share in revenue year on year, at nearly 78 percent, compared to nearly 90 percent in 1QFY21. In addition, finance expense was also lower year on year; therefore, profitability was significantly better at 13.3 percent net margin, than the same period last year, when it stood at 2.8 percent.

The textile sector overall has seen a higher demand, particularly in the value-added sector such as home textiles, garments, denim, etc. But there are certain downsides as well. The company predicts a rise in raw material costs that can be exacerbated by currency devaluation. Moreover, oil prices are moving upwards globally, and freight rates for export cargo have also risen which can impact export margins. Looking at the company specifically, 10,800 new spindles are to be installed that are expected to commence commercial production by the third quarter of FY22.

Comments

Comments are closed.