The talk of the town in economic circles right now is that Pakistan’s total debt and liabilities stock has crossed Rs50 trillion for the first time. Is this big news? Almost every year, the nominal GDP reaches its new high in rupees – but that is not news. The same is the case for the absolute number of debts too. The important number to consider instead is debt to GDP ratio. For that measure to be reflective of ground realities, the nominal GDP must be rebased. Investors, rating agencies and analysts see ratios and make calls based on these. Without rebasing GDP, Pakistan is unnecessarily, making its debt to GDP, current account to GDP, fiscal deficit to GDP uglier than what they truly are. At the same time, exports to GDP and tax to GDP are overstated.

The GDP rebasing exercise has been due since 2015-16, and three years down the road, PTI has failed to rebase the GDP. This should have been done in 2018 or 2019. The good news is that finally after three years, the vacant position of PBS Chief Statistician has been filled. Better late than never?

The other small observation is that people are confusing country’s total debt and liabilities (including private and PSEs debt) to public debt. The gross public debt is standing at Rs41.5 trillion as of 30th September – still shy of a “half century” in trillions. In terms of GDP, the total public debt is standing at 75 percent. And it’s not the highest ratio in the country’s history. The public debt to GDP was 101 percent in 1999. The country did not fall. Rather the ratio reduced to 52 percent in FY07. The debt can very much fall in years to come. The question is what could make this happen?

The intuitive and obvious response could be to enhance the GDP to make the debt lower. Absolutely, that is the case. However, in between, it is important to correct the optics to attract investment and to motivate domestic investors. For that, Planning Ministry should rebase the GDP for the country’s sake. This will benefit them in scoring points on the politics of economics which the government ministers and spokespersons are religiously doing. Do it right, sirs!

Musharraf’s team did that, deregulated the markets, and strengthened the economic regulatory institutions. The current government needs to build the right team, entice the investors and then see the magic of private sector.

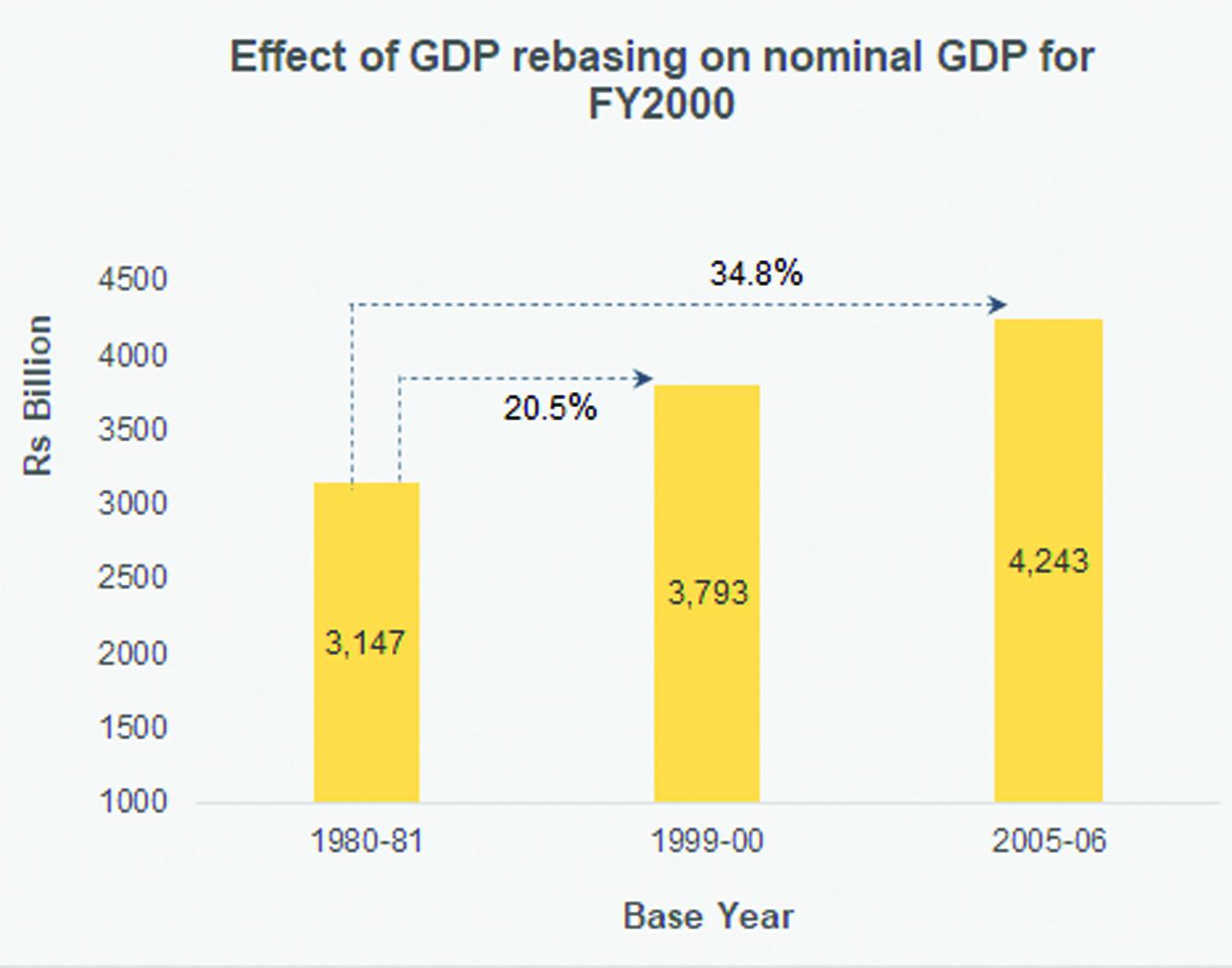

Let’s see what the impact of rebasing can be. The GDP in FY2000 was Rs3.1 trillion which was on the base of 1980-81 which remained on that base till FY2003. GDP was rebased to 1999-00 base in FY04. FY2000 GDP was revised up to Rs3.8 trillion – up by 20.1 percent on 1980-81 base. Later, GDP was rebased to 2005-06 in FY13 with series revised back to FY2000- the GDP of FY2000 revised up to Rs4.2 trillion – up by 35 percent from 1980-81 base.

And there is no jugglery here. With addition to new sectors and revision of weights on existing, GDP needs rebasing. All the countries do this and they do in their own favour. Pakistan is going against its own favour by not doing it.

It is also important to do away with the daily dose of depression that comes in the form of comparisons with other countries like Bangladesh. For instance, in the recently published SBP annual report, there was a graph (from World Bank) on GDP per person employed in 2017 where Bangladesh was fast approaching Pakistan. And by now, it is higher than Pakistan. However, it is very likely that Bangladesh is inflating its GDP as Pakistan undercuts it. This is evident by the fact that electricity sales (GWh) in Pakistan are 69 percent higher than Bangladesh and in terms of per capita, its 31 percent higher.

The point here is to not undermine any country, but to emphasize on what needs to be done, starting with expediting the GDP rebasing exercise.

Comments

Comments are closed.