The upward streak in crude oil prices eased in November. The month carried a number of bearish factors for crude oil that drove the decline in prices - albeit small. The slump comes from the efforts from key energy consuming countries to soothe the rising prices by releasing strategic reserves amid global inflation fears. The Biden Administration further released 50 million barrels of oil from the Strategic Petroleum Reserve (SPR) in a bid to continue to control the crude oil prices. The strengthening of the US dollar has also been a factor pushing crude oil prices downwards. And amid rising inflation globally and stalling economic recovery as a result, the slashing of demand forecast by the oil cartel for the end of 2021 also points towards some weakness in oil prices.

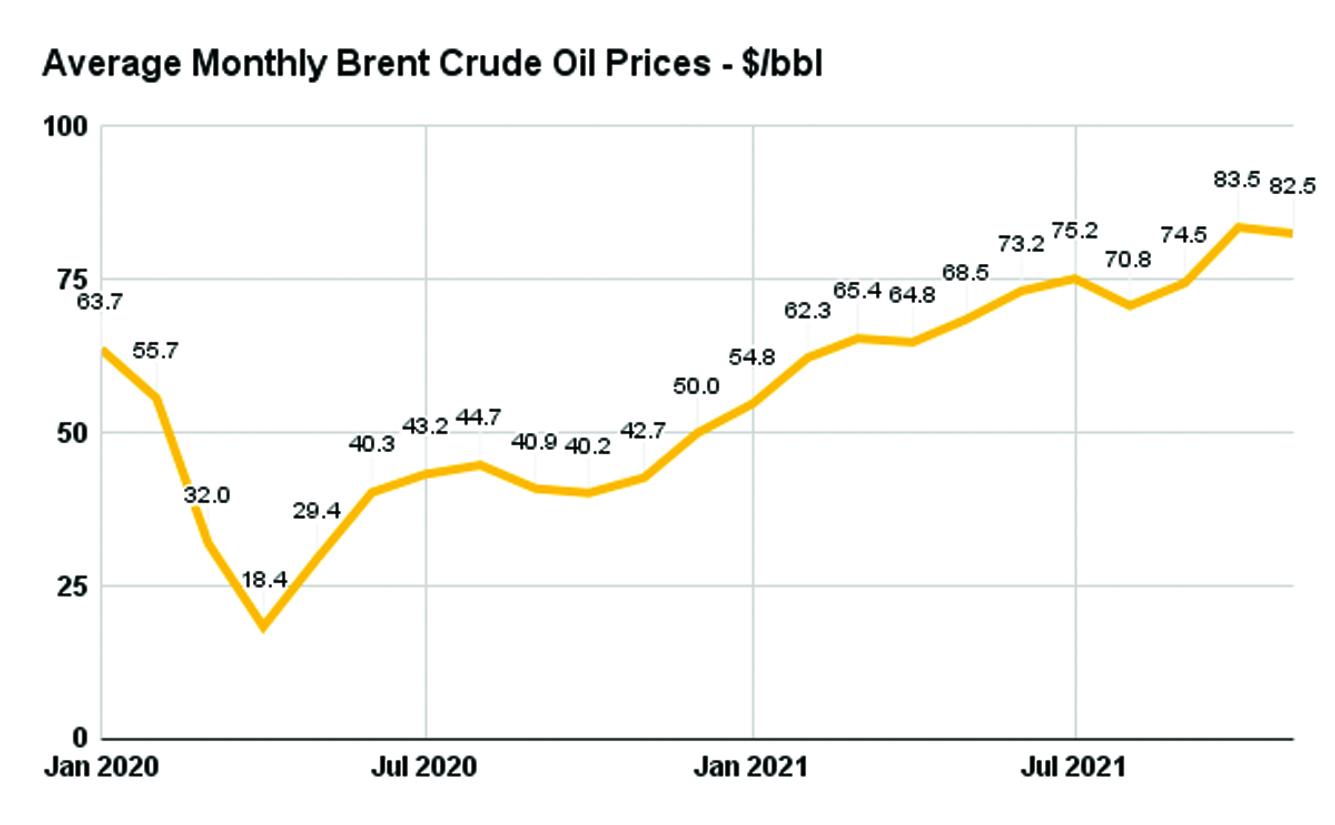

Another important factor for oil has been the pandemic. The impact of the COVID-19 pandemic has been seen in a slide in crude oil prices. However, as the counties came out of lockdowns and economic activity resumed, prices have been on a climb as demand started recovering.

But the recent news of the emergence of a possibly vaccine-resistant Covid variant with African origin has threatened to eat away the gains to the recovering economic activity. The South African variant spreading has been a blow to the otherwise spiking commodity price trend amid travel restrictions by many countries. Brent crude oil was seen tumbling by over 10 percent last week, while WTI blend slipped by over 11 percent - highest since early this year.

The upcoming meeting in early December would determine if OPEC+ suspends its plans of increasing supply due to a sudden fall in crude oil prices. If OPEC+ continues to stick to its policy of gradual increase in supply even as prices increase - as it has been doing so - bearish trends in oil prices could persist.

Comments

Comments are closed.