Hum Network Limited (PSX: HUMNL) was set up as a public limited company in 2004 under the repealed Companies Ordinance, 1984. The company launches transnational satellite channels and presents content of cultural heritage. Its main operations include production, advertisement, entertainment and media marketing.

Shareholding pattern

As at June 30, 2021, close to 30 percent shares are owned by the directors, CEO, their spouses and minor children. Of this, majority are held by Mr. Duraid Qureshi, the CEO of the company. Another almost 30 percent shares are held under “others”, followed by over 27 percent shares held by the local general public. The remaining roughly 13 percent shares are owned by the rest of the shareholder categories.

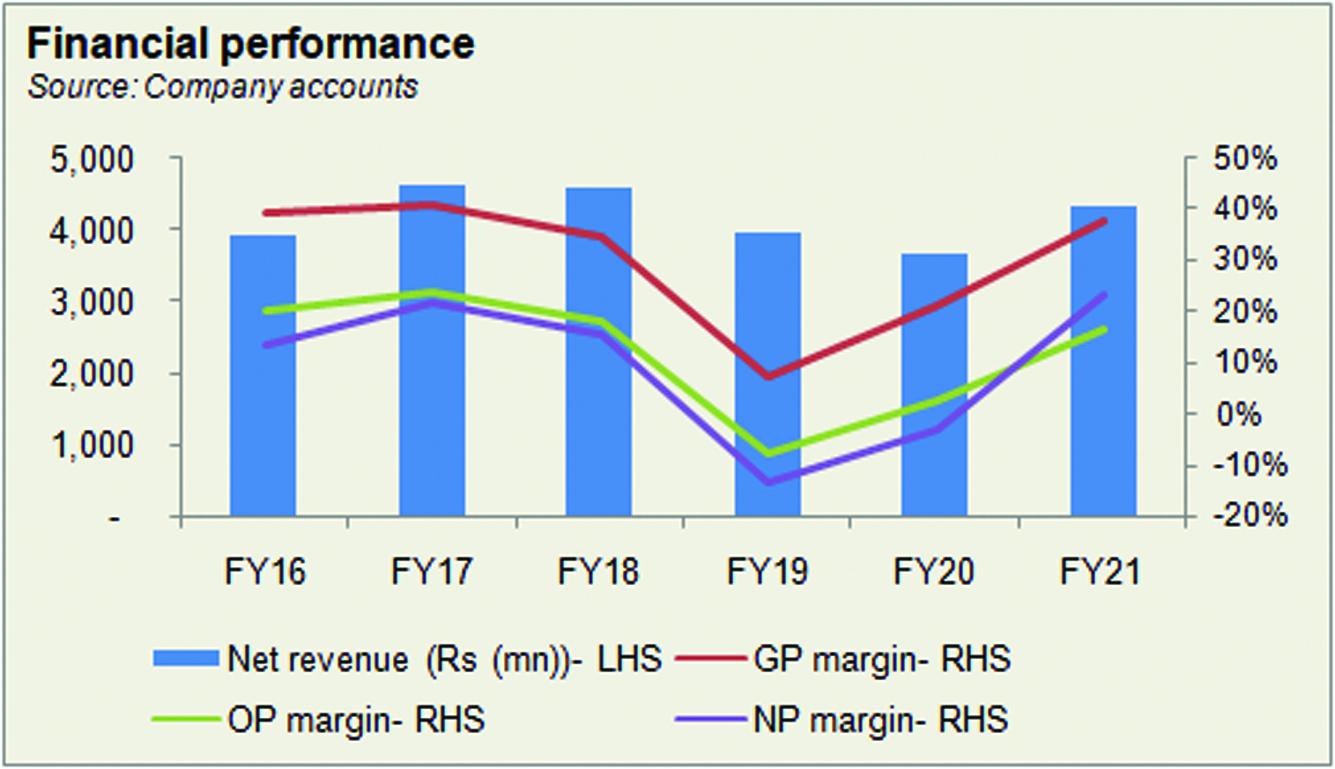

Historical operational performance

The company has mostly seen a growing topline, except for three consecutive years between FY18 to FY20, when it contracted. Profit margins followed a downward trajectory until FY19 before rising again.

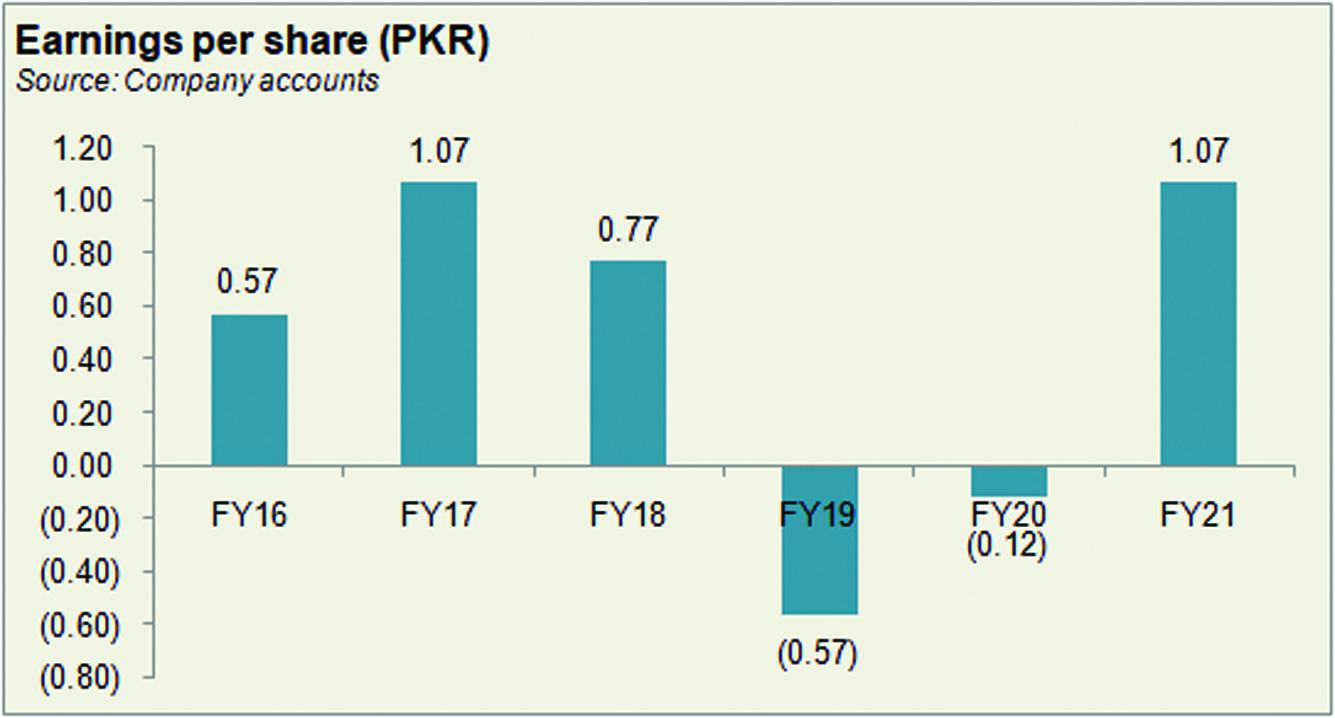

After growing at double-digits in FY17, revenue in FY18 fell marginally by close to 1 percent. The company earns majority of its revenue from advertisement. During the year, advertisement revenue reduced by 4.3 percent, whereas subscription income and film distribution revenue picked up. Commercial airtime and production revenue shrunk by Rs 203 million, due to political instability as the general elections were to be held. On the other hand, production cost increased from over 59 percent of revenue in FY17 to nearly 66 percent in FY18. This was attributed to the launch of Hum News. Thus, profitability fell from a net margin of almost 22 percent in FY17, to almost 16 percent in FY18.

The company witnessed the biggest contraction in revenue in FY19 as it fell by 13.7 percent. Advertisement revenue decreased significantly by 17 percent. This was again attributed to the instability in the political and economic arena, with low foreign reserves and depreciating currency. As a result, production cost made up nearly 93 percent of revenue. Although other income increased notably, having a more than 5 percent share in revenue, it could not keep the company from incurring a loss as finance expense also escalated due to rising interest rates. Thus, the company posted a net loss of Rs 536 million for the first time since FY12.

Revenue declined for the third consecutive year in FY20, by 7.5 percent. Advertisement revenue further reduced, by 8.2 percent, whereas film distribution nearly disappeared, from Rs 137 million in FY19 to Rs 15 million in FY20. The economy was barely on track after the general elections and the new government, when the pandemic outbreak occurred in the second half of FY20. But despite the loss in revenue, gross margin improved on the back of cost cuttings. Majority of the reduction was associated with the cost of outsourced programs. Thus, gross margin was recorded at 21 percent. However, with the sizeable finance expense that made 6.5 percent of revenue, the company did incur a loss of Rs 113 million, it was lower than that seen in the previous year.

After declining for three consecutive years, revenue finally recovered in FY21 as it posted a growth of 17.6 percent, crossing Rs4 billion as it did in FY17 and FY18. Advertisement revenue regained momentum as it grew by 13.7 percent. Subscription income also increased remarkably as it grew from Rs 484 million in FY20, to Rs 705 million in FY21. The improvement in revenue reflected in the profitability as gross margin was posted at 37.5 percent that also trickled down to the bottomline. Net margin was also supported by additional income of Rs 477 million coming through gain on sale of non-current asset held for sale. Thus, net margin was recorded at an all-time high of over 23 percent.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by over 33 percent. During the period, the company saw some of its best shows on air that became immensely popular as reflected in the significant number of views garnered on the YouTube channel. As a result, gross margin was notably higher year on year at 50 percent, compared to 33 percent in 1QFY21. However, the first quarter of FY21 saw additional one-off revenue coming from gain on sale of non-current asset that raised net margin for the quarter. This was absent in the first quarter of FY22, therefore net margin was comparably lower at 20.6 percent. If the additional income were to be removed from the equation in 1QFY21, 1QFY22 saw better profitability.

With several channels under its belt and diversifying into other businesses such as Hum Mart, the company has a positive outlook. Moreover, given the rising internet penetration in the country, it is indicative of Pakistan as a profitable digital market.

Comments

Comments are closed.