Stocks staged a rally ahead of the Monetary Policy Committee (MPC) announcement by the central bank, as the benchmark KSE-100 Index was up 370 points, while volumes and value improved on Tuesday.

During the day, the benchmark index made an intraday high of 43,266, up 389 points.

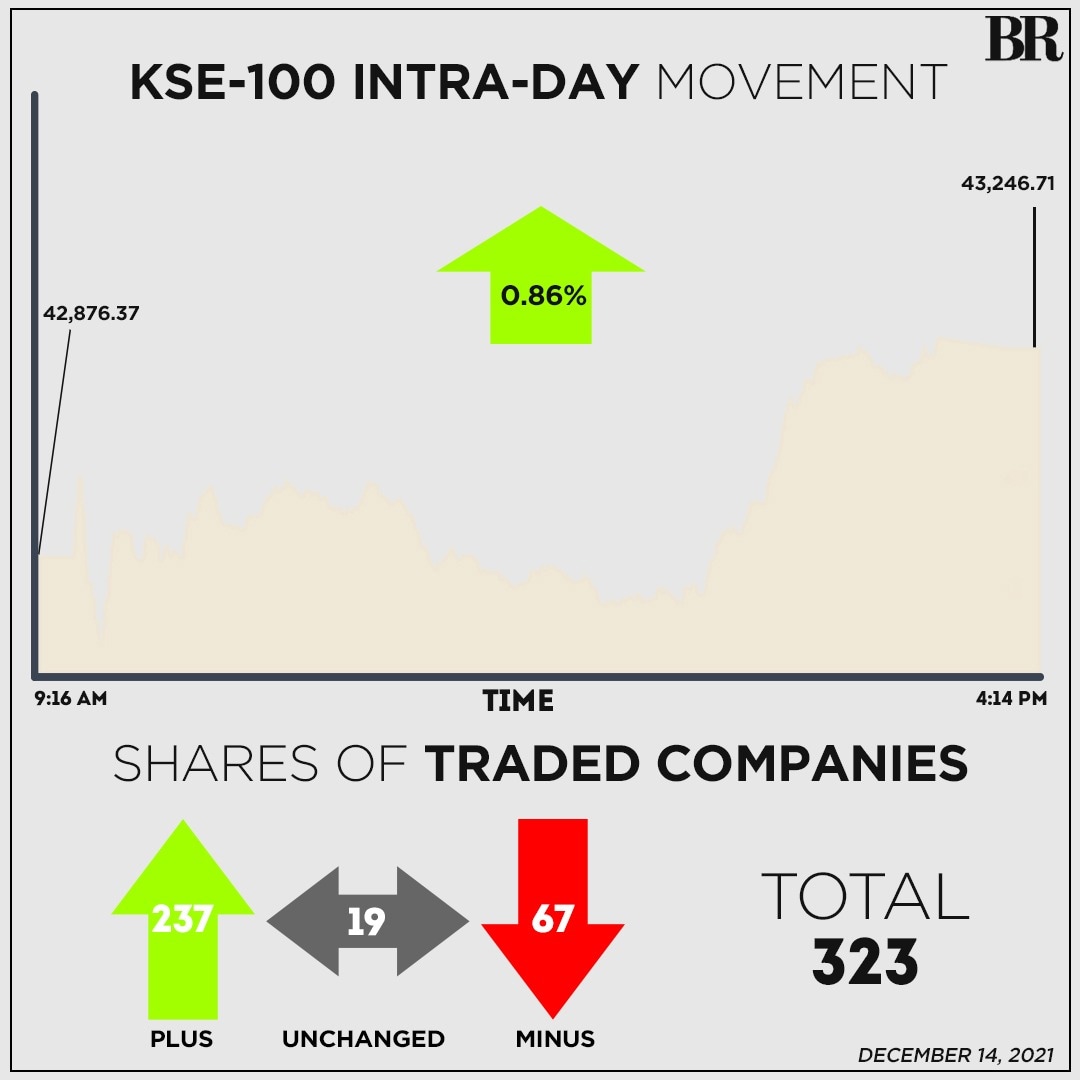

At close on Tuesday, the index settled higher by 370.34 points or 0.86% at 43,247.

The positivity comes as “investors brushed aside their nervousness over the monetary policy announcement later in the day,” commented Capital Stake.

“The KSE-100 index initially opened in a negative territory and remained sideways most of the day ahead of monetary policy announcement as scheduled in the evening. However, investors opted for value hunting across the board during the last trading hours,” said Topline Securities in a post-market comment.

In a development that came after the stock market closed, the Monetary Policy Committee (MPC) of the central bank decided to raise the policy rate by 100 basis points to 9.75% from 8.75%.

3rd successive hike: SBP increases key interest rate by 100 basis points, takes it to 9.75%

“The goal of this decision is to counter inflationary pressures and ensure that growth remains sustainable,” said MPC in a statement. “Since the last meeting on 19th November 2021, indicators of activity have remained robust while inflation and the trade deficit have risen further due to both high global prices and domestic economic growth,” MPC said.

On the economic front, inflows of home remittances during November 2021 stood at $2.352 billion against $2.517 billion in October 2021, depicting a decline of $166 million.

Investors cautious before MPC, KSE-100 ends below 43,000

Sectors taking the benchmark index in green included technology and communication (98.54 points), cement (92.70 points) and refinery (27.45 points).

Volume increased, clocking in at 212.35 million on the all-shares index, up from 150.39 million on Monday. The value of shares traded also improved to Rs6.8 billion on Tuesday.

WorldCall Telecom was the volume leader with 21.07 million shares, followed by Byco Petroleum with 16.14 million shares, and TPL Properties Limited at 12.76 million shares.

Shares of 323 companies were traded on Tuesday, of which 237 registered an increase, 67 recorded a fall, and 19 remained unchanged.

Comments

Comments are closed.