Is it really demand? To be specific, is it really housing demand? Steel prices have been spiralling and many have associated this to ballooning demand in housing. Retail prices are not recorded formally but Pakistan Bureau of Statistics (PBS) monthly price index shows prices of steel bars and sheets have increased 64 percent in Nov-21 year-on-year. Since January, the price hikes have come rapidly and in quick succession. The index during the period grew 27 percent. Demonstrably, steel prices have increased by a lot more than overall inflation; and by the looks of it, they haven’t stopped climbing.

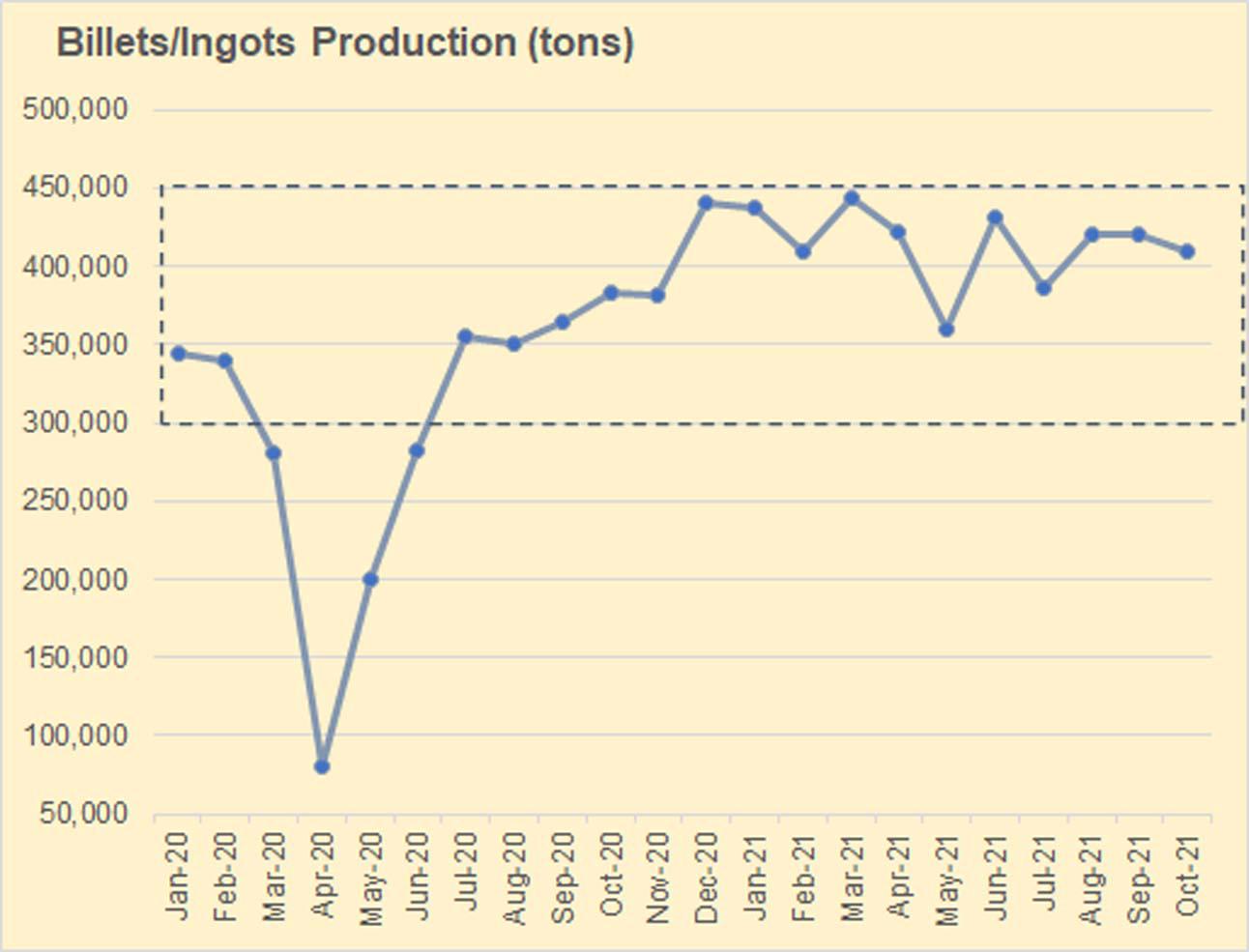

There is no denying that production of steel rebars (used mostly in construction and infrastructure) has grown considerably since the year started. In the Jul-Oct period of FY22, cumulative production has increased 12 percent compared to last year. But even at the current growth rate, steel production may not be the highest ever recorded. In FY18, production crossed 5.1 million tons and this year’s full production number may come up a little short.

This column earlier also estimated that the changing cement to steel production ratio—where this year, more steel is being used relative to cement compared to last year—indicates (if not confirms) that the demand offtake is mainly concentrated in infrastructure and hydro power projects where more steel is used; compared to cement (read: “Construction costs beg question”, Dec 13, 2021). Whether and how much of the steel demand is feeding the Naya Pakistan Housing Projects—a subject much publicized and lauded by this government—remains a big question (read more: “Housing finance: Data nostalgia”, Dec 14, 2021).

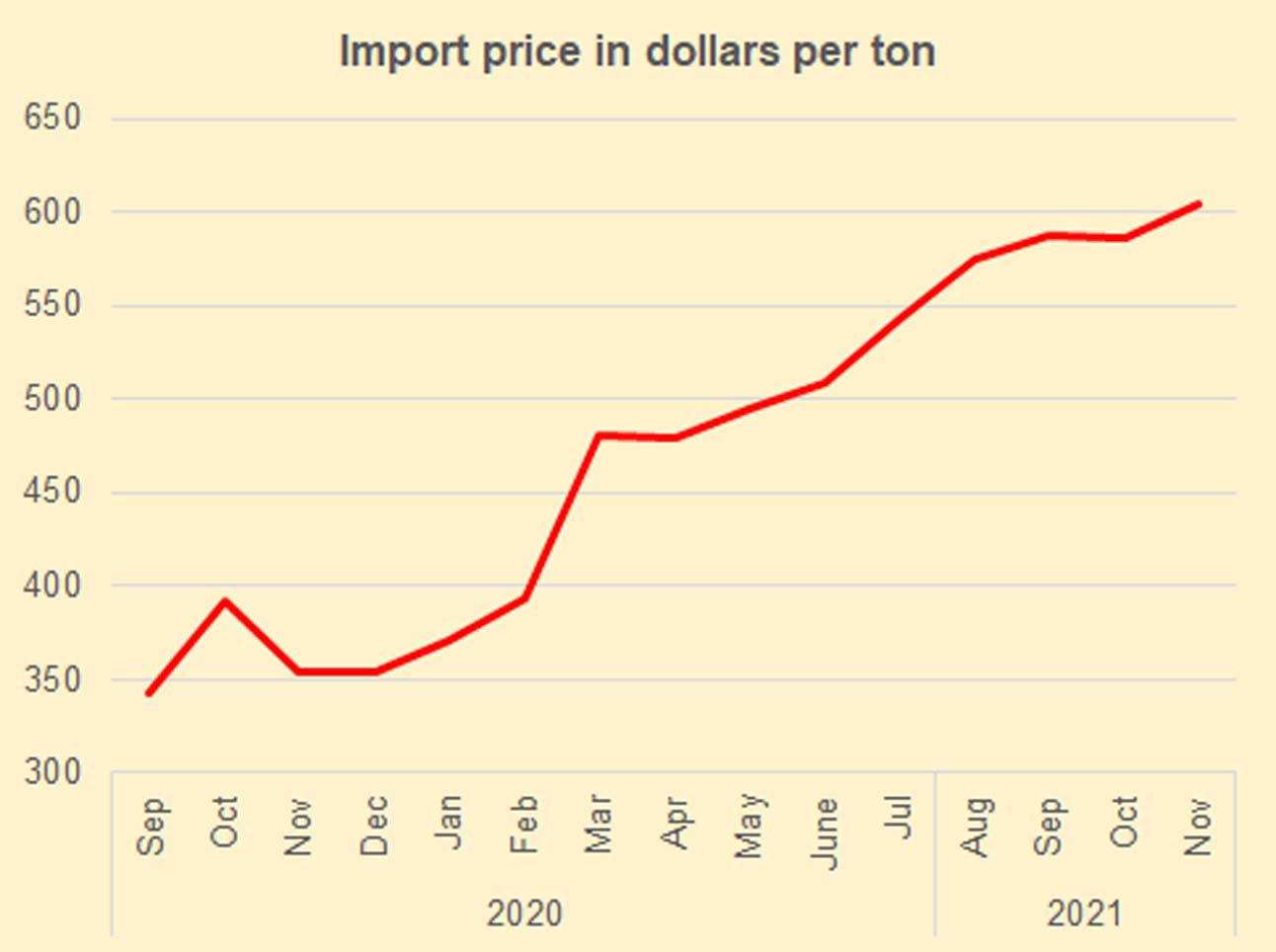

But does a 12 percent growth in production (or demand) explain the trajectory of price increases? Not really. The primary cause here is evidently the rising cost of import that has pushed steel makers to raise prices for their rebars. The industry depends largely on the import of steel scrap. In fact, Pakistan is the fourth largest importer of steel scrap according to the Bureau of International Recycling (BIR) and this remains the key raw material for long steel manufacturers.

Since 2020, scrap prices have been surging dramatically. Between Apr-Dec 2020, scrap prices increased 64 percent. Prices continued to increase till July (peaking at ~$490 per ton), but since then, they have begun to weaken. In December, scrap prices are down by $30 per ton compared to July. The rising cost of scrap has certainly put a dent on margins for rebar makers and the price hikes can be explained by the increase in production cost. This is in addition to the premium that Pakistan pays on shipping and freight. Freight costs themselves have been rising out of control. Now add, rupee depreciation to the mix.

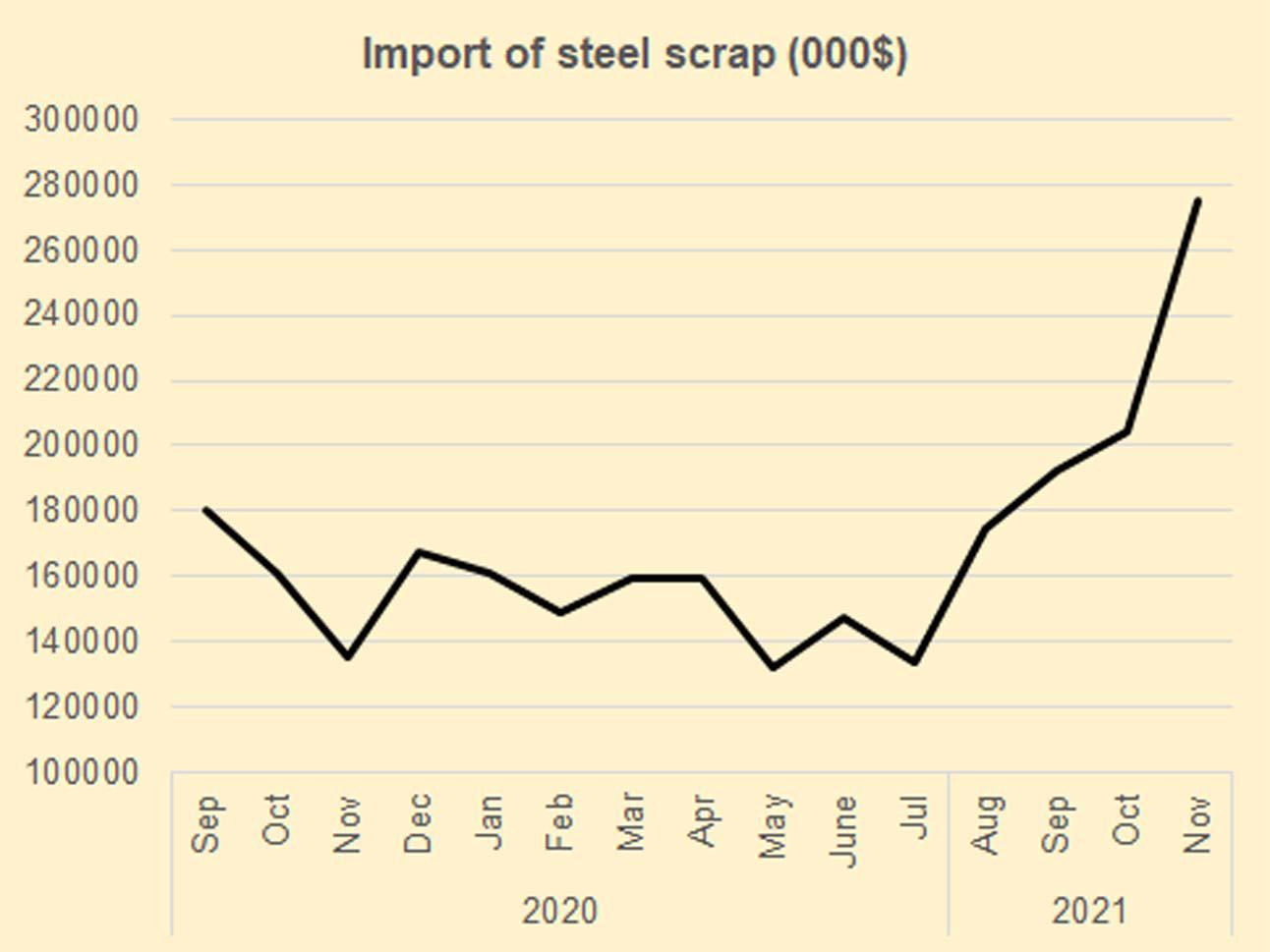

Scrap import data from the PBS shows that in the Jul-Nov 21 period, steel importers have imported less, not more, steel scrap than last year in tons—down 25 percent, but paid a much higher cost for it. Dollar per ton value during the current period rose 64 percent compared to last year. This is huge!

So, from the data available and accessible right now, three assertions can be made. One, steel is much more expensive for consumers today than it was last year (or ever was). This increase is higher than general inflation. Two, the major reason behind price increase is cost-push and three, demand may not be as exhilarating as few in the government would have one believe.

Even though, Large Scale Manufacturing (LSM) production numbers indicate strong growth thus far, scrap imports are scrappy and are not nearly as vibrant as one would hope. Given how slow the demand in cement is as well, the larger mystery of whether the government-backed Naya Pakistan Housing Plan (NPHP) is actually taking off and resulting in incremental housing stock remains unsolved. The government (via FBR) could put an end to this mystery by disclosing information on the number of projects approved under NPHP (where, when, how many etc.), but that would require an openness and transparency that is unfortunately missing.

Comments

Comments are closed.