Al Shaheer Corporation Limited

Al Shaheer Corporation Limited (PSX: ASC) was established in 2012 under the repealed Companies Ordinance, 1984. The company trades in various kinds of meat such as that of goat, cow, chicken and fish. The company sells to the global market as well as is present in the local market. Some of its export destinations include Dubai, Saudi Arabia, Oman, Kuwait, Bahrain and Qatar. Locally, it is primarily present in Karachi, Lahore and Islamabad.

Shareholding pattern

As at June 30, 2021, close to 27 percent shares are held by the directors, CEO, their spouses and minor children. Within this category, majority of the shares are held by Mr. Kamran Khalili, the CEO of the company. About 42 percent shares are with the local general public, followed by 13 percent in modarabas and mutual funds. Over 8 percent shares are under the “others” category and 6 percent in insurance companies. The remaining roughly 3 percent shares are with the rest of the shareholder categories.

Historical operational performance

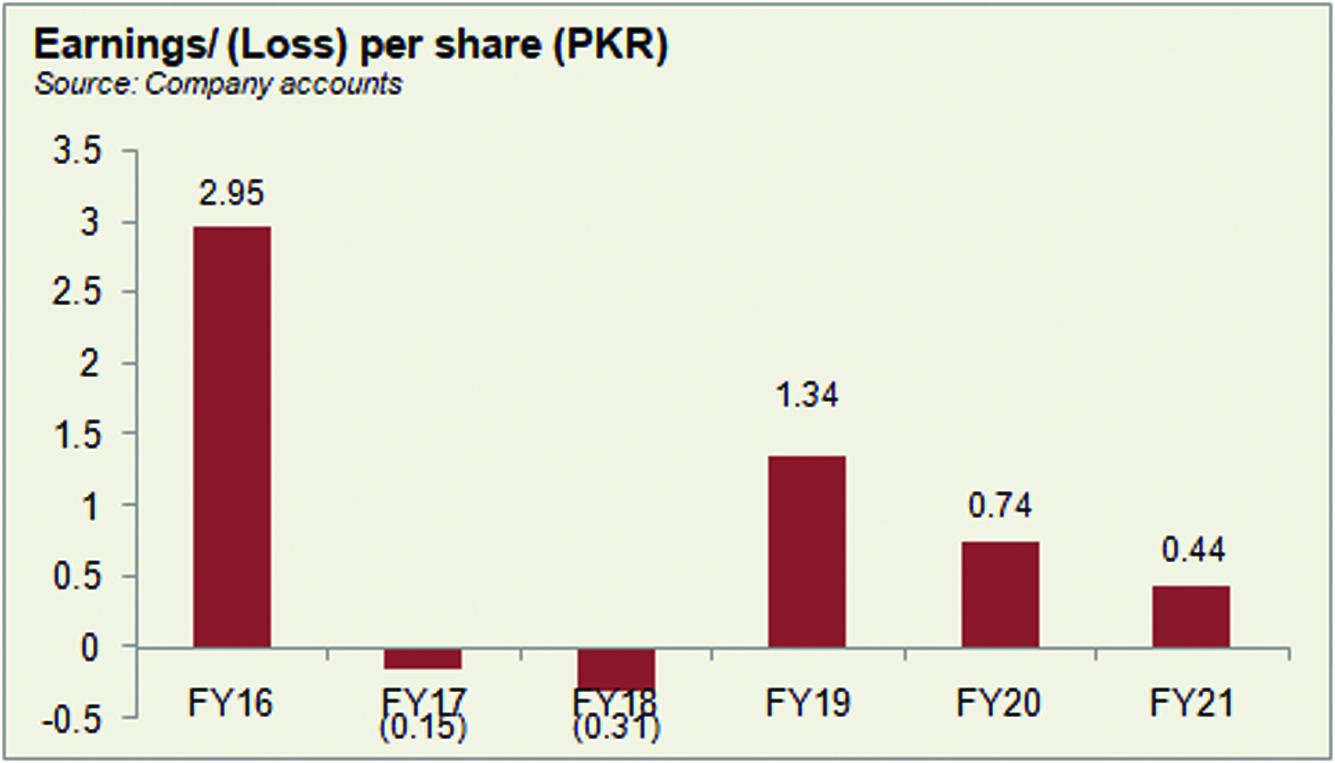

The company’s topline has been fluctuating over the years, with profit margins increasing gradually till FY20, before declining in FY21.

The company witnessed the biggest contraction in revenue in FY18 thus far, by 16 percent. Despite the currency devaluation that benefitted a lot of the companies that were export-oriented, Al Shaheer saw its exports declining by 25 percent. This was attributed to cheaper alternatives provided at the same export destinations by countries like India, Brazil and Australia. The company itself also faced supply related issues that affected production and therefore sales. As a percentage of revenue, cost of production increased only marginally to over 77 percent from 76 percent in the previous year. Therefore, gross margin was also marginally lower at 22.7 percent. This also trickled down to the bottomline that was recorded at a loss of Rs 43 million. Net margin at a negative 0.8 percent did not decrease immensely due to some support coming from other income. The latter was sourced from a net exchange gain.

Revenue in FY19 saw an even bigger contraction by 22 percent. Export sales fell by 7 percent. The country’s export industry was generally faced falling volumes due to the prevalent macroeconomic factors. Moreover, the company’s institutional sales faced competition from the unorganized sector, in addition to the company’s cashflow problems that was the rationale most likely for the 30 percent decrease in cost of livestock purchases. Moreover, the company also reduced its workforce as is evident from the “number of employees”. Thus, cost of production reduced to 70 percent for the year, making room for some profitability after two consecutive years of losses. Net margin was also higher at 4.5 percent for the year.

In FY20 revenue fell for the fourth consecutive year, by 6.6 percent, reducing to an all time low of Rs 3.9 billion in value terms. The first half of FY20 saw lower sales due to Edi-ul-Azha. Sales in the third quarter were encouraged due to generation of cash through a rights issue, whereas the last quarter witnessed 33 percent of the annual sales. This was due to the demand for clean and safe products due to the outbreak of Covid-19. So while gross margin improved to 32.8 percent, net margin remained flat at close to 4 percent due to the escalation in finance expense.

After contracting for four consecutive years, revenue in FY21 witnessed one of the largest growths, at over 37 percent, with topline crossing Rs 5 billion. Export sales posted a growth of 37 percent, with the company opting for sea routes due to logistics arrangement arising due to the pandemic. Opting for sea routes also proved to be less costly, as is evident from a 12.4 percent reduction in cargo cost year on year. However, due to the higher prices of livestock, cost of production increased to consume over 75 percent of revenue, up from last year’s 67 percent. Therefore, gross margin reduced to 24.5 percent. But the decrease in net margin at 2 percent was less pronounced due to a reduction in administrative and finance expense as a share in revenue.

Quarterly results and future outlook

The first quarter of FY22 saw revenue lower by over 7 percent year on year. This was attributed to the general economic situation of the country, particularly, the inflationary pressure. The latter also resulted in an increase in price of livestock that increased the cost of production. This is reflected in cost of production consuming a higher share in revenue at over 79 percent in 1QFY22 compared to 73.6 percent in 1QFY21. However, net margin was supported by higher other income at Rs 151 million for the period, while 1QFY21 saw zero other income. Thus, profitability was slightly better with a net margin of 9.16 percent.

The company’s poultry and frozen food plant that had previously been shelved was completed with primary processing unit beginning commercial production since August 2021 and further food processing unit of frozen food facility in September 2021.

Comments

Comments are closed.