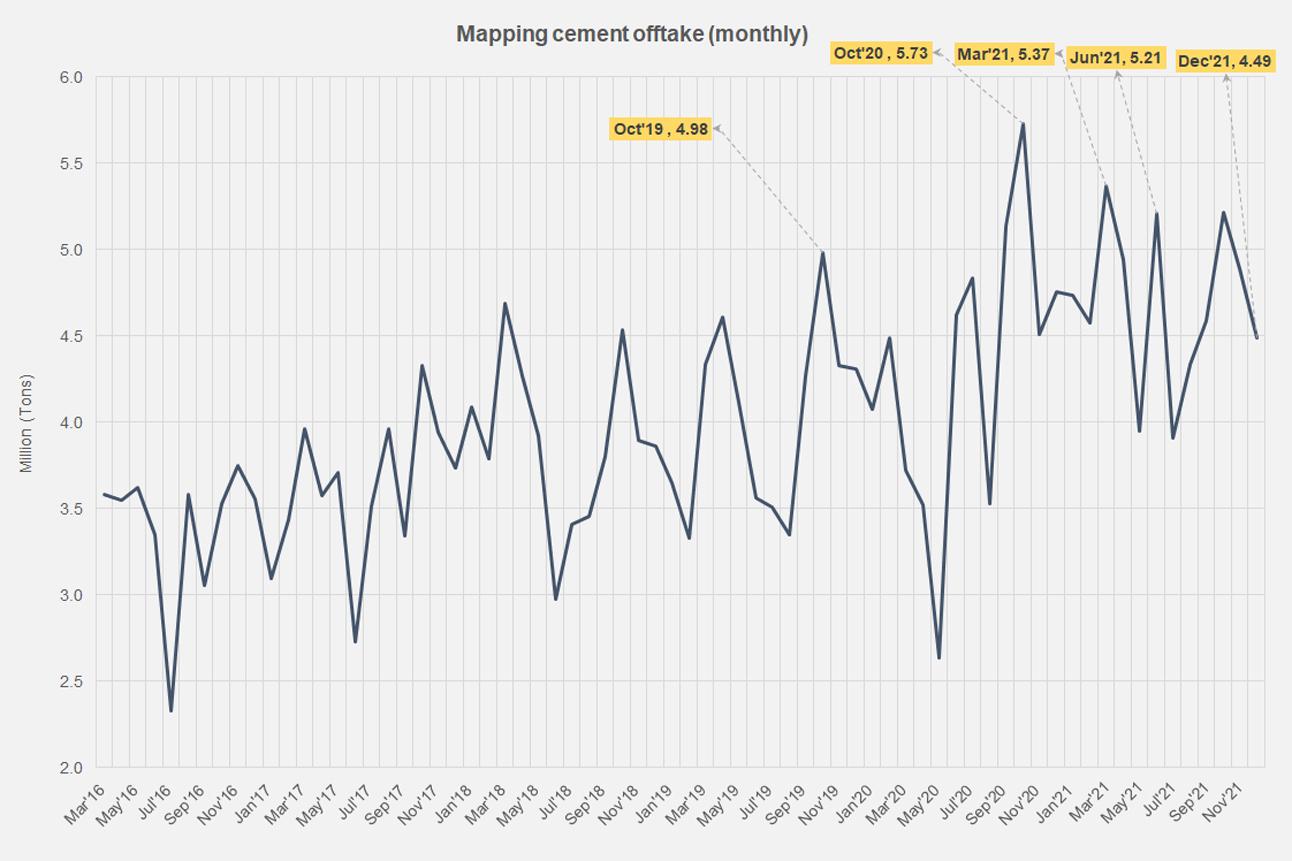

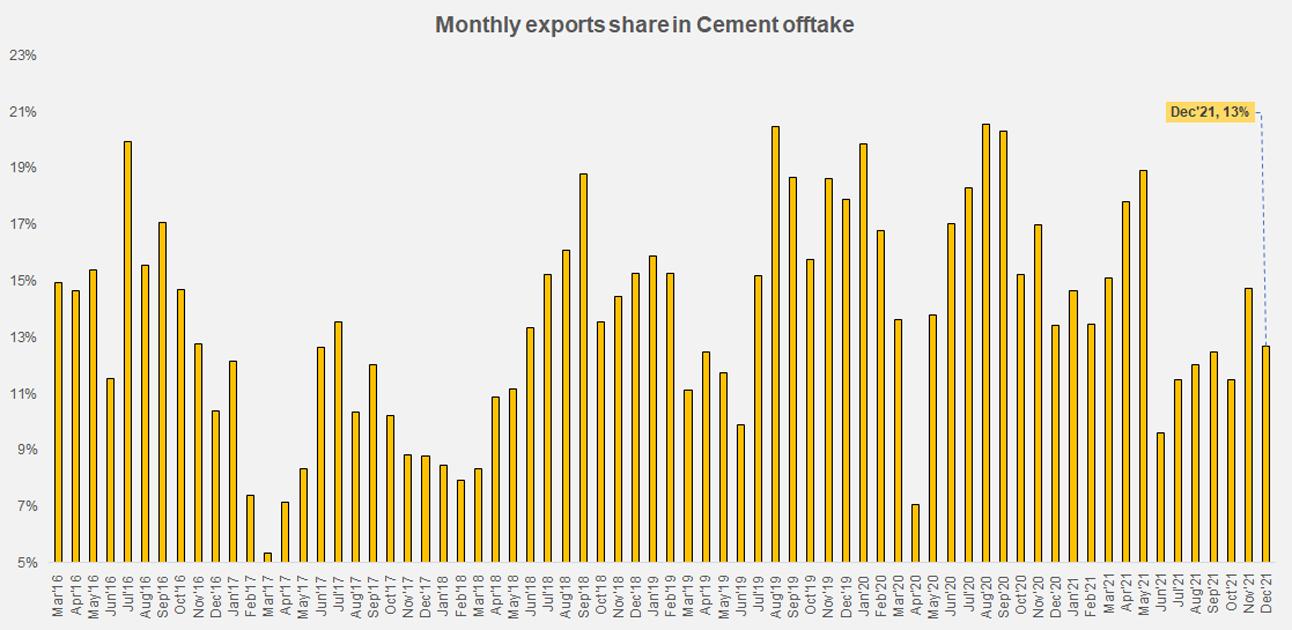

Cement offtake in 1H remains unimpressive. Total dispatches dropped 4 percent (local: up 2%, exports: down 30%). But at this point, it should stop surprising cement makers even if it should give them pause about their short-term forecasting models. Domestic demand is not nearly as robust as they were expecting, and as predicted in this space, exports are not going to recover any time soon (read: “Cement exports under pressure”, Jan 5, 2022) as most historically traditional markets: Afghanistan, India, South Africa and now Sri Lanka have all but dissipated in thin air. What’s left are a handful of far-flung African markets. In Dec, the exports share in total dispatches has dropped to 13 percent. Not too bad, but unlikely to cushion the fall if domestic demand continues its lull.

While the government would have one believe the Naya Pakistan Housing Program (NPHP) and construction amnesty are successfully leading to a ground-breaking turnaround in construction materials production and in housing stock—there is very little evidence to support this enthusiasm (read more: “Construction and housing: Boom, doom or bust”, Dec 31, 2021). Month on month sales for cement have been lacking lustre. Average monthly sales this year stood at 3.99 million tons, roughly the same as the average number last year. There is virtually no growth that has happened.

Despite this visible slowdown, it does seem cement makers expect this to be temporary as near all players are embarking on a capacity enhancement program to raise total industry capacity to almost 100 million tons, from its current 70 million (read: “Cement’s pecking order”, Nov 15, 2021). The demand expectations of 8-10 percent annually are almost aspiration. This year, with the rate of current trajectory, the industry would likely reduce dispatches by 4 percent, selling about 55 million tons against 57 million tons last year.

One could blame cement prices for the demand slowdown—and that could certainly be the reason—but in comparison to other commodities, the increase in cement prices is less. By Nov-21, prices for steel bars had increased 64 percent compared to cement prices growing by 16 percent. The total construction costs however have certainly risen for builders and developers who have been vocal about the same seeking government intervention in terms of price controls. It is possible that inflation has hit pause on many construction plans but the likely scenario is that there is simply not as much organic construction and housing demand as was expected under post construction amnesty.

If higher construction cost is the primary cause for demand slowdown, cement manufacturers should heed that and space out the price increases. But that might not be easy as they are in a classic rock and a hard place situation given higher energy costs, freight expenses and a depreciating rupee that balloons the import bill they have to foot for their raw material. Coal prices had started to decline after their massive year-long rally and smart procurement managers should have purchased enough inventory for at least the next quarter as coal is beginning to heat up again. The other option for cement manufacturers is relying on domestic coal which is not the best option for them.

While construction in hydro power projects and other infrastructure plans underway will carry on, demand from private sector construction may not deliver this year. Like the rest of the economy, cement manufacturers must brace for a rough landing.

Comments

Comments are closed.