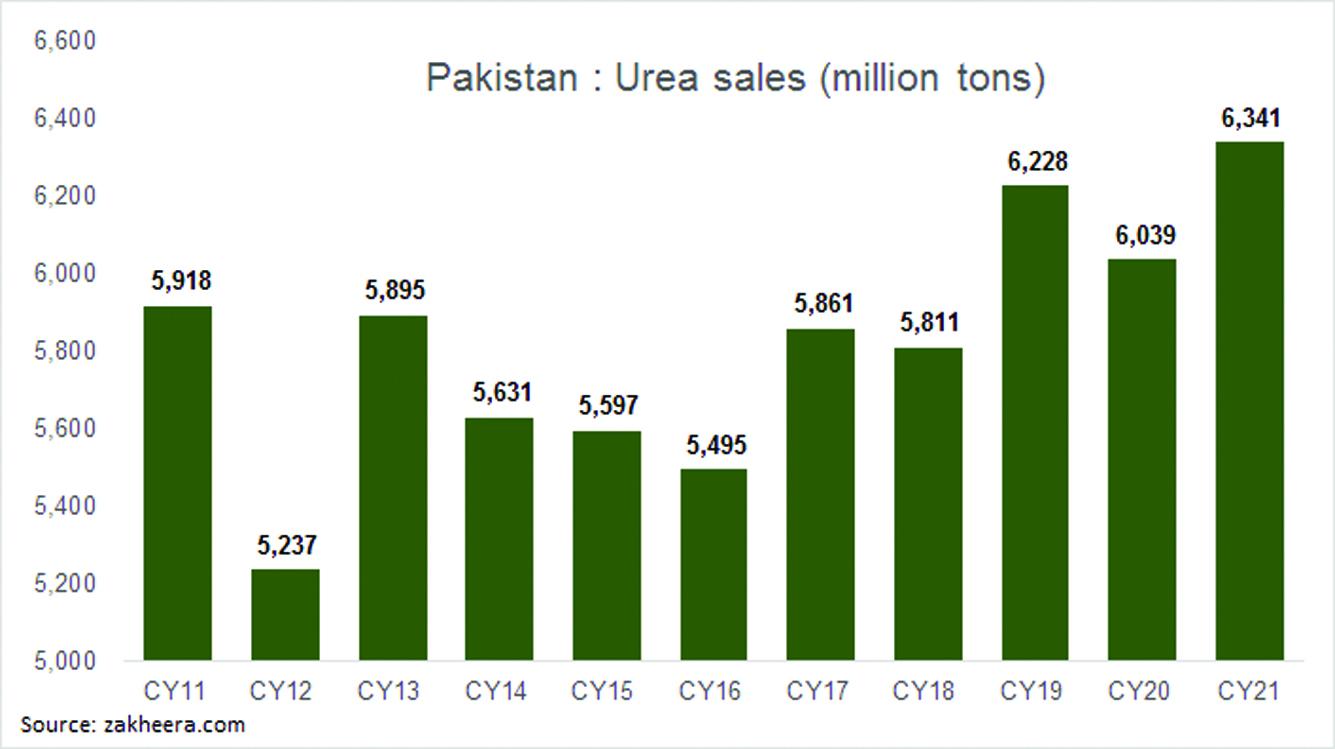

The urea sales in 2021 were at all time high at 6.34 million tons. The area under cultivation has not increased as such. Still the government is importing urea. The math does not add up. However, by incorporating reportedly 343,000 tons of urea missing, the shortage is evident. This comes at the time of wheat crop application which could adversely impact the yield. The other problem is higher prices of DAP (another fertilizer). Due to higher prices, DAP application is low (evident by low sales), and that could impact the wheat crop adversely.

A few months back, urea producing companies were advocating for exports of urea due to surplus capacity. And today we are importing. The problem is of growing international urea prices which currently are at 4-5 times that of local prices. There is immense incentive for smuggling or hoarding. Urea dealers are doing so. And the government in response is importing urea.

Urea prices internationally are linked with gas as the chief raw material in urea is gas. One ton of urea is made by using 30 mmbtu of gas. The index is 1:30. Higher the gas prices, higher are the urea price. In Pakistan, gas is provided at steep discount to urea manufacturers to make urea cheap in the country. The gas is used in feedstock and fuel stock, and both are provided at different rates. Feedstock is at Rs300/mmbtu and fuel stock at Rs1,023/mmbtu. One ton urea production uses 24 mmbtu of feed stock and 6 mmbtu of fuel stock.

The cocktail price comes around Rs500/mmbtu ($3/mmbtu). International spot LNG prices are hovering around $30/mmbtu. That is translating into higher urea spot prices in the world. The prices averaged at $890/ton in December. The price in Pakistan is at around $200/ton (market price is Rs 1,768/ 50kg bag). Higher the delta of international and local prices, higher is the incentive to hoard and smuggle.

In Sep21, the international urea prices were at $418/ton. Its steep increase thereafter to more than double the prices in two months is mouthwatering.

At that time, fertilizer companies were advocating to use spare capacity in two plants for exporting purposes. They were asking for providing LNG to the fertilizer producers and use that surplus to export. However, to do that, these companies should buy LNG at spot. In that case, there is no incentive. If the government provides LNG at lower price, the government would be at loss by providing imported gas to re-export in the form of urea while the gains are made by fertilizer companies.

Anyhow, exports story is gone with the wind. Now the issue is to bridge the domestic demand supply gap. In October, Urea sales at 514k tons were the highest ever sales in October – up by 24 percent year on year. The application for wheat crop usually starts in November, and October is a slow period. Industry experts say that dealers picked higher chunks in October seeing the growing international prices as they were speculating on growing domestic prices (or to smuggle). That is why sales in Nov-Dec were down by 17 percent to 1,170k tons. At the same time, the urea went missing from the market.

According to news reports, 343k tons stocks of urea went missing. With prices doubling in two months and at 4-5 times the local prices, dealers are losing their religion. Such kind of hoarding on commodities usually happens when the delta of international and local prices is high. The pressure is to increase domestic prices by creating shortage as the imports are too expensive. Then some may also turn to smuggling to central Asian states routing through Afghanistan.

The missing urea translates into 6,000 trucks. That quantum cannot be smuggled unnoticed. However, the delta of one truck between domestic and international prices is around Rs6-7 million. That is too good a number for all the stakeholders in between to swim. Small chunks are being seized in Quetta by the FBR. Some amount may have been smuggled. Other might be lying with the dealers.

There is not much government can do to undo such steps. Some argue for higher urea prices to avoid hoarding. If that is the case, gas prices will increase as well, or the cross-subsidization of DAP through higher prices of Urea will be needed to lure farmers for better fertilizer mix.

Anyhow, the problem is for a short time – till the international gas prices are at exuberant rates. Once gas prices come down, international urea prices will normalize too. These are exceptional circumstances and with porous borders and lack of vigilance, urea hoarding was ought to happen, and it did.

Comments

Comments are closed.