KSE-100 falls 1.48% as Covid cases, high oil prices dent sentiment

- Benchmark index bleeds due to pressure on cement, technology, and auto sector stocks

Pakistan stocks came under the hammer on Wednesday with the benchmark KSE-100 Index bleeding 674 points to fall below the 45,000 level as a rising number of Covid cases and upwards marching oil prices dented investor sentiment.

This was the worst fall for the KSE-100 Index since the massive sell-off witnessed on December 2, 2021 when it fell nearly 4.7% or 2,134.99 points.

While not as bad in comparison, selling pressure was witnessed across the board with cement, auto, and technology stocks bearing the brunt. Volume of shares traded, however, was higher.

“Initial pressure came from TRG when the stock closed at its lower limit," said brokerage house Topline Securities in a post-market comment. "Cement and banking sector also came under the hammer."

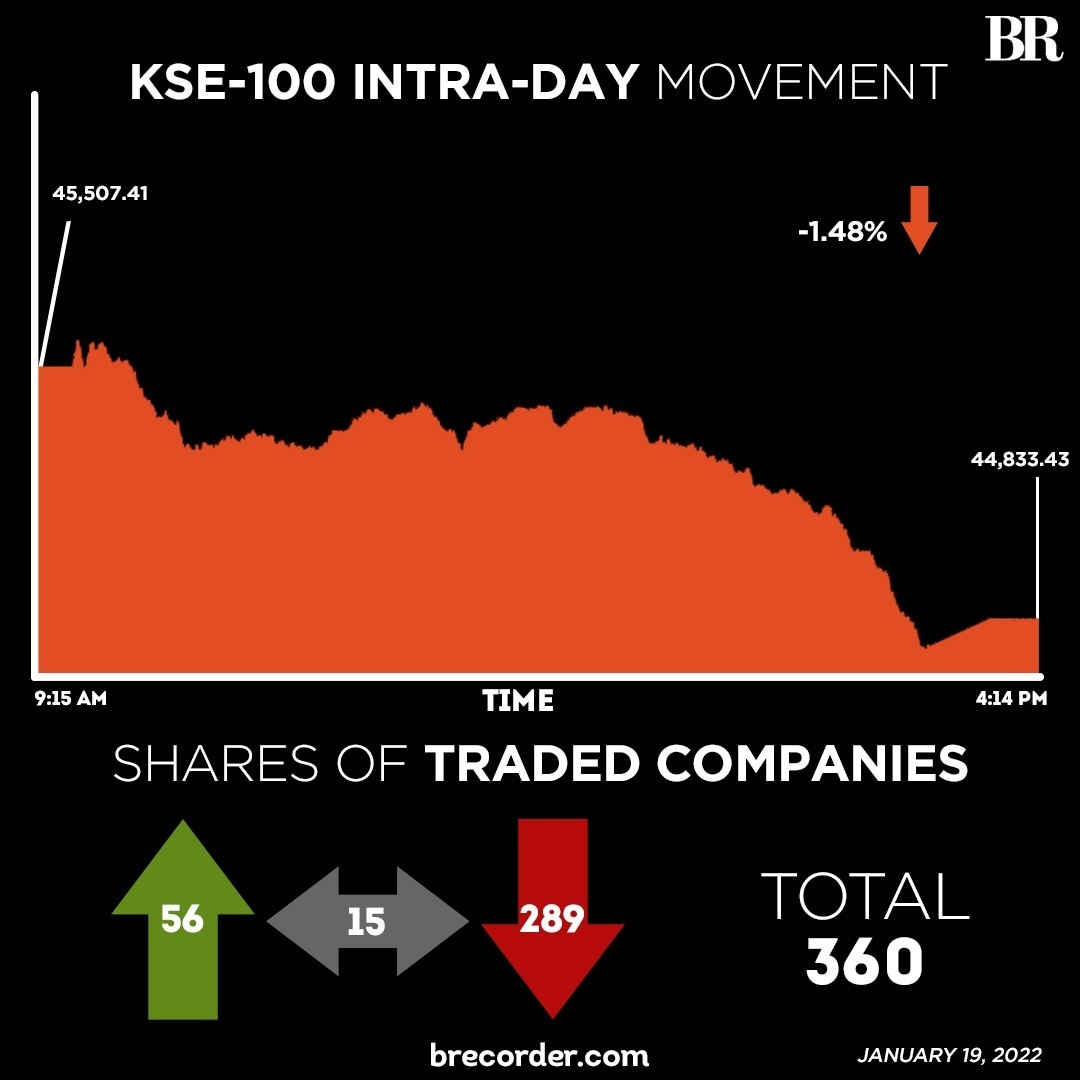

At close on Wednesday, the KSE-100 finished at 44,833.43, a decrease of 673.98 points or 1.48%.

“The rise in number of coronavirus cases and announcement of new coronavirus-related restrictions to contain the spread of the virus dented investor confidence,” said Capital Stake.

The National Command and Operation Centre (NCOC) on Wednesday announced new coronavirus-related restrictions to contain the spread of the virus. Under new restrictions, the meeting decided to completely ban indoor events in cities/districts where the infection rate is above 10%.

Meanwhile, oil prices inched up for the fourth day on Wednesday as an outage on a pipeline from Iraq to Turkey increased concerns about an already tight supply outlook amid worrisome geopolitical troubles.

"A bloodbath session was witnessed due to alarming Covid-19 cases and higher international oil prices," said Arif Habib Limited in a note. "Market opened on a bleak note and stayed in the red zone throughout the day due to selling pressure from mutual funds. Cement sector stayed under pressure due to uptick in international coal prices. In the last trading hour, across the board hefty selling was observed."

KSE-100 slips 0.23% as negativity persists

Sectors contributing to the KSE-100's fall included cement (101.11 points), technology and communication (98.79 points) and banking (73.03 points).

Volumes increased substantially, clocking in at 236.93 million on the all-share index, up from 165.14 million on Tuesday. The value of shares traded increased to Rs8.7 billion, up from Rs7.6 billion a day ago.

WorldCall Telecom was the volume leader with 27.33 million shares, followed by TRG Pakistan Limited with 20.19 million shares, and Telecard Limited with 18.79 million shares.

Shares of 360 companies were traded on Wednesday, of which only 56 registered an increase, 289 recorded a fall, and 15 remained unchanged.

Comments

Comments are closed.