Pakistan Oilfields Limited (POL)

Primarily engaged in the exploration, drilling and production of crude oil and gas in the country, Pakistan Oilfields Limited (PSX: POL) is a key player in the local E&P oil and gas sector and is a subsidiary of the Attock Oil Company Limited (AOC). Its key products include crude oil, natural gas, and LPG that it markets under its brand name POLGAS as well as its subsidiary, CAPGAS (Private) Limited. POL also produces solvent oil and sulphur and has a vast pipeline network for transporting the crude oil to the Attock Group’s refinery, and its associate company: Attock Refinery Limited (ATRL).

Company associates and shareholdings.

More than half of the company’s shareholding rests with the Attock Oil Company (AOC), which is the group. Attock Oil Company is vertically integrated oil Conglomerate Company. A category-wise breakup of the shareholding is shown in the illustration. Besides Attock Refinery Limited, POL’s other associate companies include National Refinery (NRL), Attock Petroleum Limited (APL), Attock Cement Limited, Attock Gen. Limited, and Attock Information Technology Services.

Historical six year performance

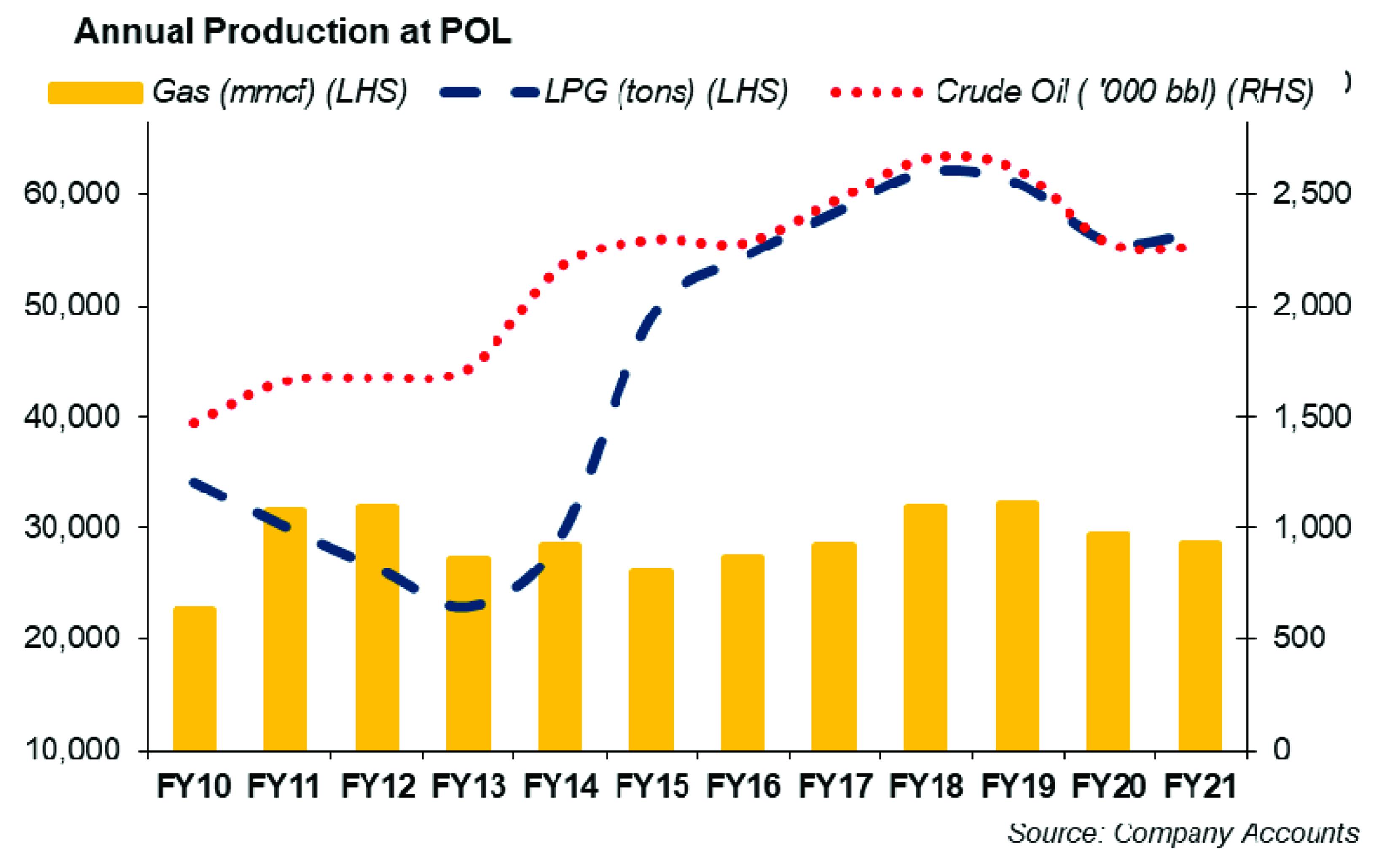

Pakistan Oilfields Limited has mostly been an oil heavy company where its crude oil revenues have accounted for over 55-60 percent on average, while natural gas has accounted for 20-25 percent of the total sales. A look at the company’s past six years show that POL’s revenue growth in FY16 was constrained as the oil prices touched historic lows at that time, which also impacted the bottomline that declined by 14 percent, year-on-year. The E&P company’s volumetric growth was also marred with slowing down production by around 2-3 percent. However, lower exploration and prospecting expediture partially offset the decline to the bottomline brought by the decline in revenues.

The following year i.e. FY17 turned out better for the E&P sector as the oil prices recovered. POL’s revenues and earnings were up by 10 percent and 34 percent, year-on-year respectively after declining for the two previous years. However, the company’s production flows again dropped during the year. On the other hand, exploration costs remained under control.

Operations turned up a notch in FY18 as POL made new discoveries and new exploratory successes. Three of its development wells were also successful in the fiscal year. Revenues climbed by over 19 percent, and earnings grew by 17.6 percent, year-on-year. Growth in the topline came from better crude oil prices as well as highest crude oil production in the last decade. Exploration costs remained on the higher side due to higher operational activity, seismic data acquisition, and also dry and abandoned wells. The firm’s bottomline benefitted with exchange gains due to depreciating currency.

Oil prices continued to climb higher in FY19 resulting in higher average oil prices. Along with that, significant domestic currency devaluation propped up earnings for the E&P sector. POL’s topline grew by 25 percent, year-on-year, which came from around 14 percent year-on-year increase in international crude oil prices. However, volumetric sales remained tepid especially that of crude oil with only slight increase in gas volumes. POL’s earnings for FY19 jumped by 48 percent, year-on-year; and apart from oil prices, lower exploration and prospecting costs and higher currency depreciation helped lift the company’s bottomline. The main factor behind lower exploration and prospecting was the absence of a dry well and also lower seismic acquisition.

FY20 was scarred by COVID-19 and the lockdown, as well as the crash in oil prices which were the key factors for slower growth in earnings of the oil and gas exploration and production sector. POL’s revenues came down by 13 percent, year-on-year, where the 4QFY20 saw a 48 percent decline in sales revenue – a period when the pandemic struck the country. The decline in revenue was due to falling volumetric sales as well as oil prices. During FY20, oil and gas production for POL plummeted by 13 and 9 percent year-on-year, respectively, while the average oil prices tumbled by 25-26 percent year-on-year. Exploration and prospecting expenditure remained lower in FY20 due to the absence of any dry well during the year. With lower interest rates during the year, other income and finance costs also decline for POL. POL’s earnings in FY20 were hence flat.

Slow hydrocarbon production as well as weak international crude oil prices during most part of the year was the main higlight of FY21. These factors along with exchange losses affected the sector’s profitability in FY21 including POL. Overall, POL’s revenues in FY21 were flattish, declining by one percent year-on-year. The company’s earnings were lower by around 18 percent year-on-year primarily due to exchange loss, lower income on bank deposits and higher taxation due to lesser exploration and development cost. During the year, production of crude oil and gas were lower by 0.77 percent and 2.5 percent year-on-year, respectively, while LPG production was higher by 1.58 percent year-on-year.

FY22 and beyond

FY22 started off on a higher note for the E&P sector as oil prices spiked. The rise in international crude oil prices drove earnings of the E&P companies in 1QFY22 along with significant currency depreciation. POL posted 27 percent rise in revenues and a 45 percent year-on-year growth in earnings. The increase in the E&P firm’s topline resulted from an almost 70 percent increase in crude oil prices. At the same time, the currency depreciation also played its part in lifting the revenues for the 1QFY22. However, POL’s oil and gas production declined by 11.3 percent and 9.1 percent year-on-year, while LPG was lower by 14 percent year-on-year during the year. There was also a hefty growth in exploration and prospecting expenditure - rising by 6 times in 1QFY22 versus 1QFY21 due to increased seismic activity. Finance costs also escalated by 17 times during the quarter.

A concern for the oil and gas exploration and production sector is weakness in production volumes. Where oil and gas production was up in the last quarter of FY21, it was down again in 1QFY22. Higher international oil prices along with significant discoveries and higher oil and gas production are what drive earnings for the sector.

Comments

Comments are closed.