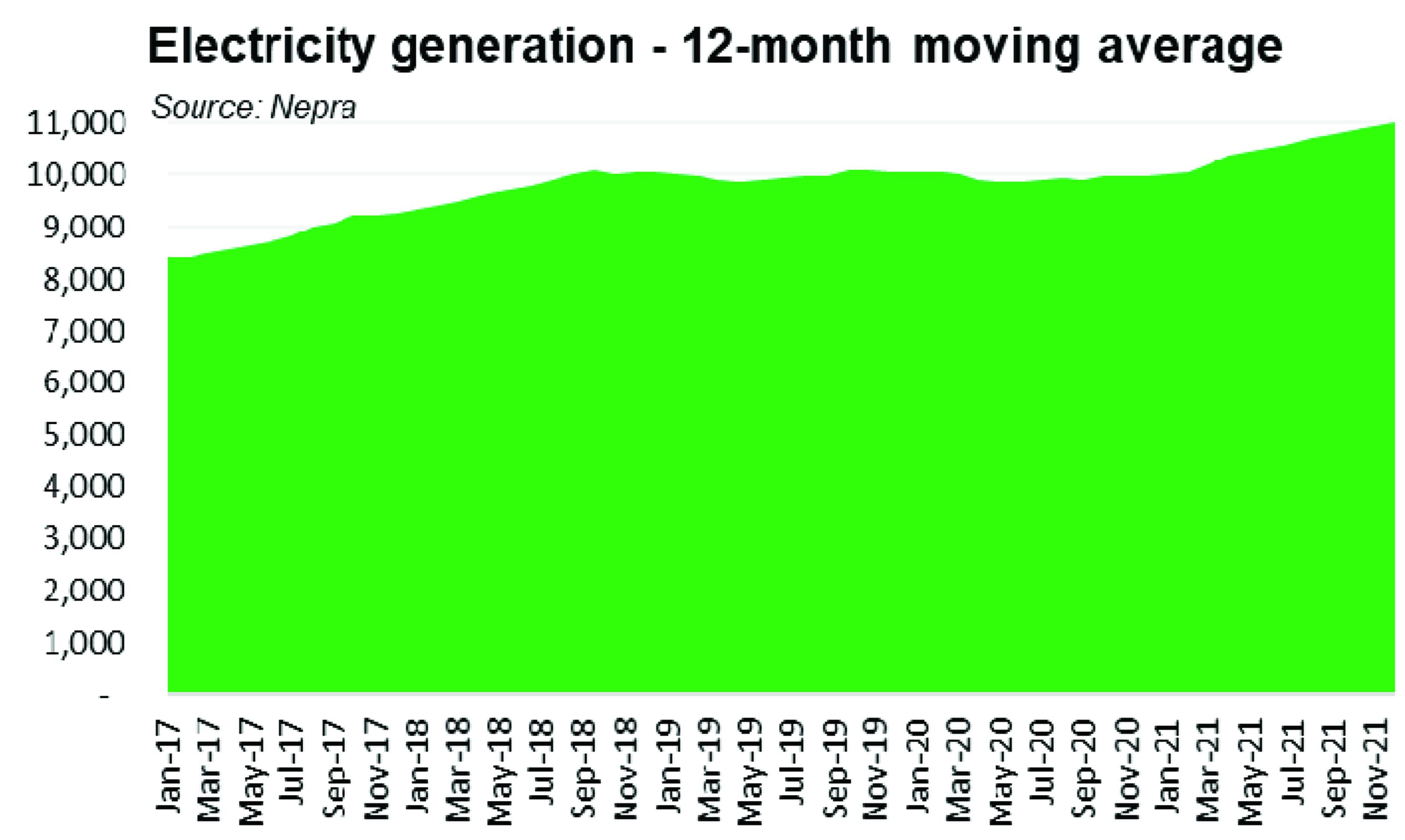

Having stayed virtually stagnant for two years, Pakistan’s grid electricity generation in 2021 went up by 10.4 percent year-on-year. Power generation at 132 billion units for CY21 is easily the highest ever, finally breaking free from the three-year rut. That said 10 percent year-on-year power generation growth is not unprecedented or extraordinary. It appears the demand in the economy is just reverting to the mean trajectory that was apparent before 2019.

The power generation on a 12-month trailing basis at an average 11 billion units monthly is a fairer reflection that irons out the base effects of Covid. There definitely is organic demand growth in an expanding economy but may not necessarily be a result of urban consumers making the switch from gas to electricity in big numbers as a result of incremental winter consumption package.

The generation mix makes for an interesting reading, where nuclear power generation was the biggest gainer with 6 billion additional units in 2021. The nuclear share went up to 11.4 percent, up from 7.8 percent last year, and was the first-ever time that the grid generated more electricity molecules from nuclear than natural gas.

Coal continued to lead the thermal side, outstripping RLNG for the second year running, with 20 percent share in the mix. Lower water reserves meant hydel generation went down by over 2 billion units, with the share going down to 27.6 percent. This is the lowest share of hydel generation in five years. As has been the case often, hydel’s loss was furnace oil’s gain. FO based generation more than doubled year-on-year, as the system struggled with supply side constraints in terms of arranging timely fuel, amongst other ongoing technical issues.

The cumulative fuel bill for CY21 at Rs923 billion outdid the much-dreaded capacity payments. A combination of sky-high international fuel prices alongside inability to evacuate and generate from more efficient plants, violations of merit order, and delays in procurement of fuel – all chipped in to take the fuel bill higher by over 62 percent.

Much of the same is in store for another two to three months, as oil and gas prices have shown no signs of respite yet. The axe falls on the consumers in the shape of monthly fuel adjustments. For the third month running, the monthly FCA will be north of Rs3 per unit, despite the monthly reference fuel tariffs revised upwards by 50 percent.

Comments

Comments are closed.