The refinery sector has been under continuous criticism for not upgrading its archaic technology. The same factor has also played a key role in the uplift of furnace oil by the oil marketing companies amid falling furnace oil demand locally as well as globally. And the same factor has also affected the refinery sector’s profitability.

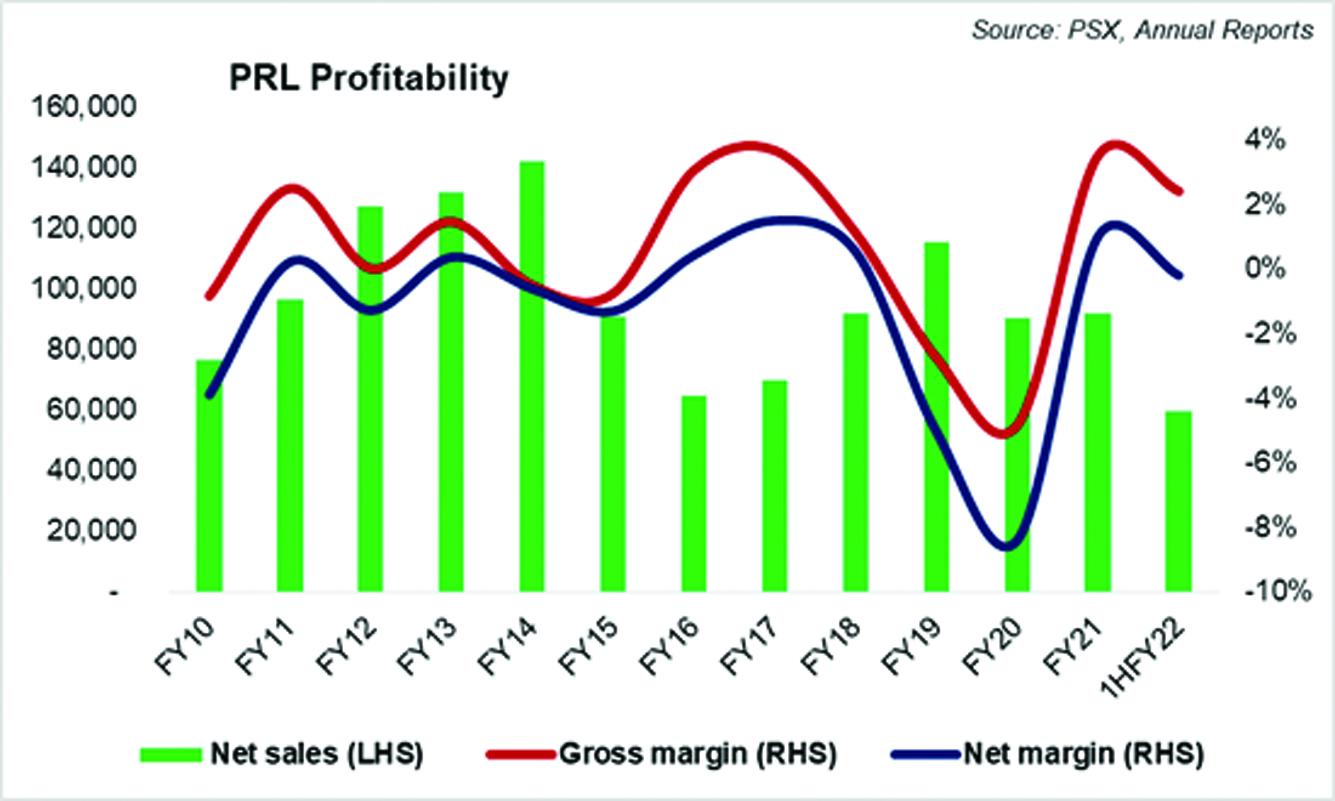

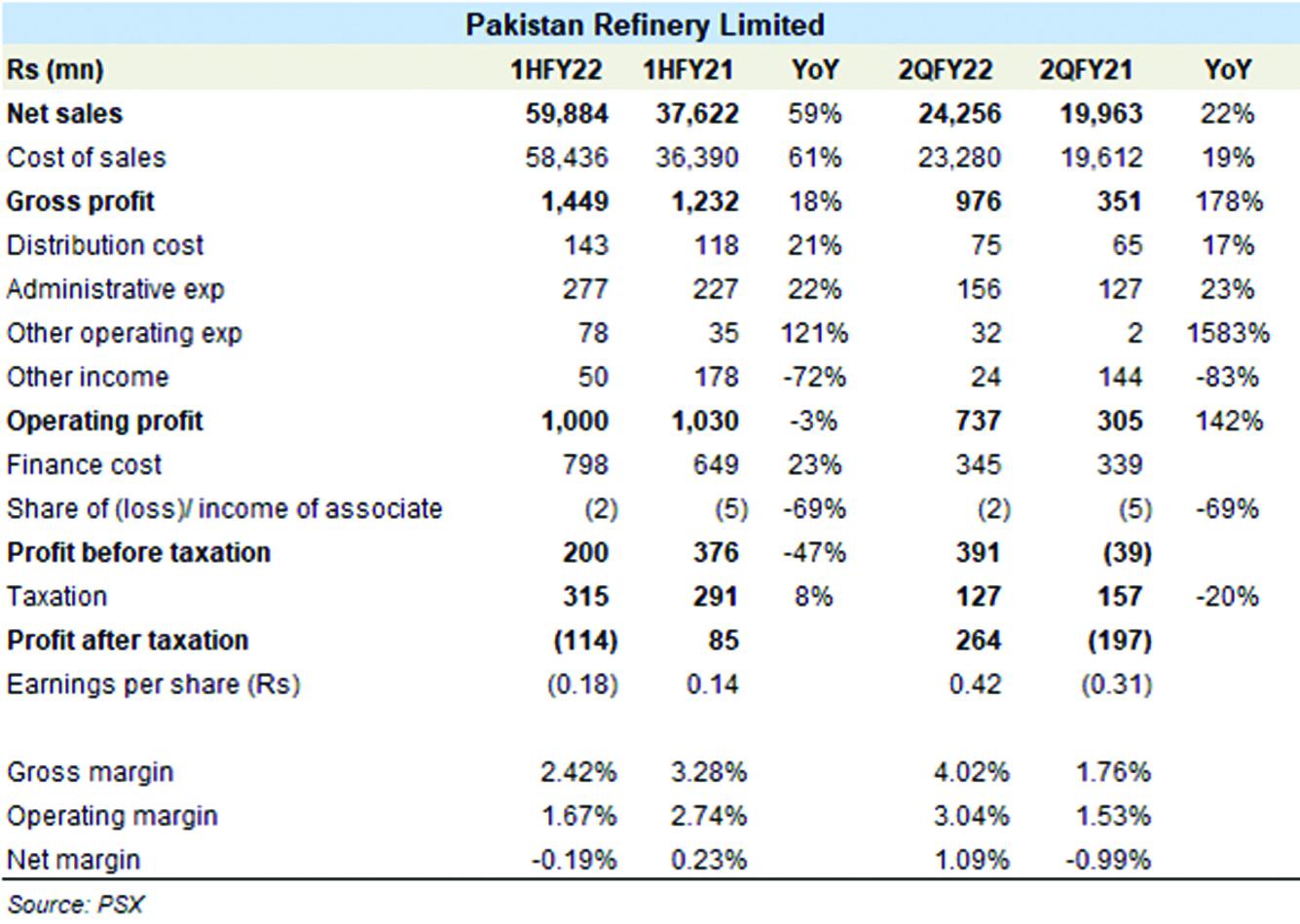

Pakistan Refinery Limited (PSX: PRL) announced its financials for 1HFY22, where the company’s earnings were seen going into the negative zone. Topline declined by 22 percent due to higher realised crude oil prices, while bottomlline contracted to a loss after tax of Rs114 million in 1HFY22, versus a profit after tax of Rs85 million in 1HFY21.

While the revenues were up, PRL’s volumetric sales were affected by the shutdown of refinery operations temporarily due to the falling demand for furnace oil and thus weak uplift by the oil marketing sector. As per the company, the decline in earnings also came from exchange losses to the tune of Rs1.4 billion. Moderate growth in expenses and finance cost also impacted the operating margins.

Where on one hand, financial performance of PRL has come under radar, the refinery is one of the only ones that is coming up with expansion and up-gradation plans. The company announcement highlights that in December 2021, the BoD made public announcement of ‘Refinery Expansion and Upgrade Project’ to produce EuroV compliant petrol and diesel, and expand the crude processing capacity to 100,000 barrels per day, and upgrade from hydro skimming to deep conversion refinery.

This will help PRL ease its furnace oil upliftment challenge. Earlier, management had decided to find exports markets for its stored furnace oil at Port Qasim – which is also another problem as the global market is now left with very few FO importers.

Comments

Comments are closed.