The latest country report by the IMF suggests that Pakistan should take steps to improve business climate to attract FDI from different countries and reduce its reliance on debt creating foreign inflows. Attracting FDI in the country has been challenging because of the country’s inherent structural issues as well as the decline in investor interest globally during the pandemic times. FDI has been particularly doing poorly with CPEC acting as a savior. Investment from China has too slowed down due to the completion of the initial phase of CPEC, and all hopes are pinned once again to the second phase, which is yet create disruption.

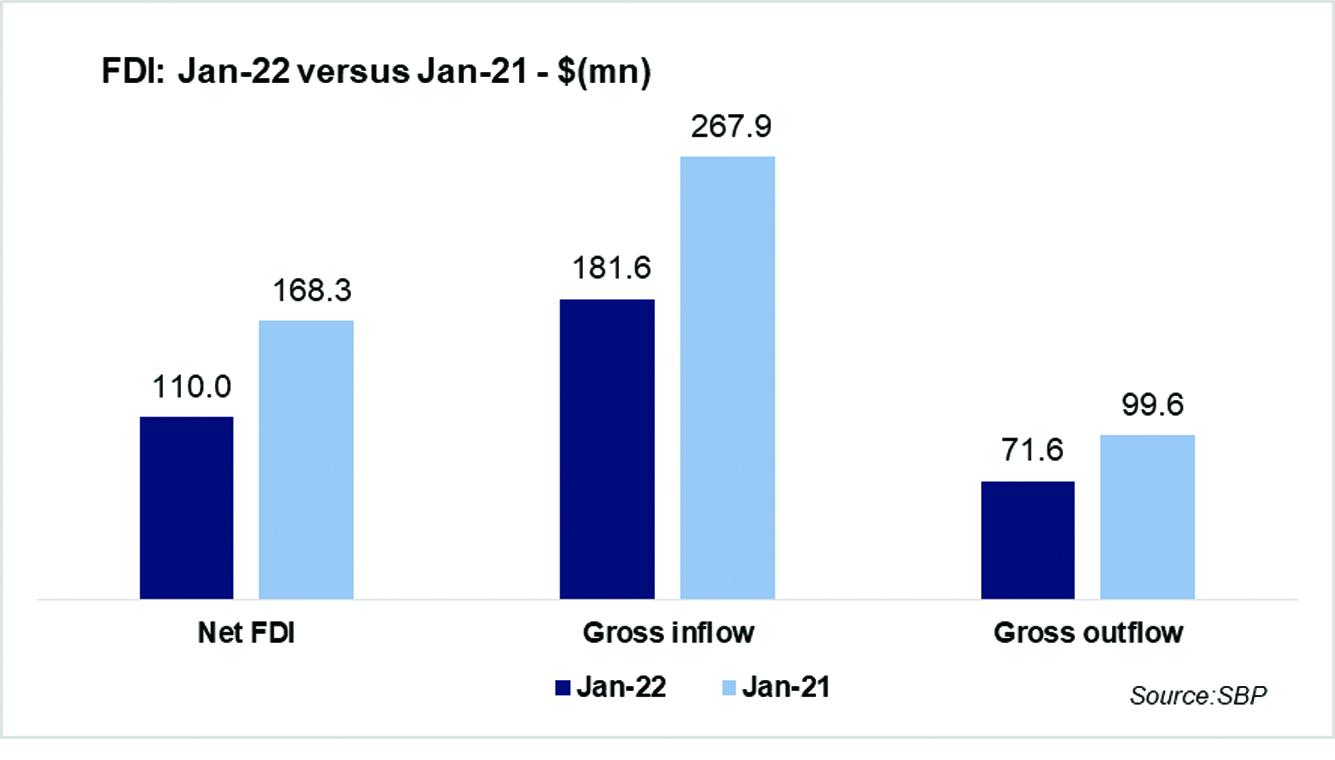

As per SBP’s recently announced data, FDI in Pakistan in January 2022 fell 35 percent to $110 million, where the gross inflows were $182 million and outflows were $72 million. The decline month-on-month was significant at 50 percent. Overall, FDI in 7MFY22 was seen rising by 11 percent year-on-year to $1.17 billion, and while it is being celebrated, note that FDI inflows in 7MFY22 declined by 11 percent year-on-year, and hence the growth in net flows was due to a decline in FDI outflows. (40 percent). Also, the growth in FY22 comes due to the small base of FY21.

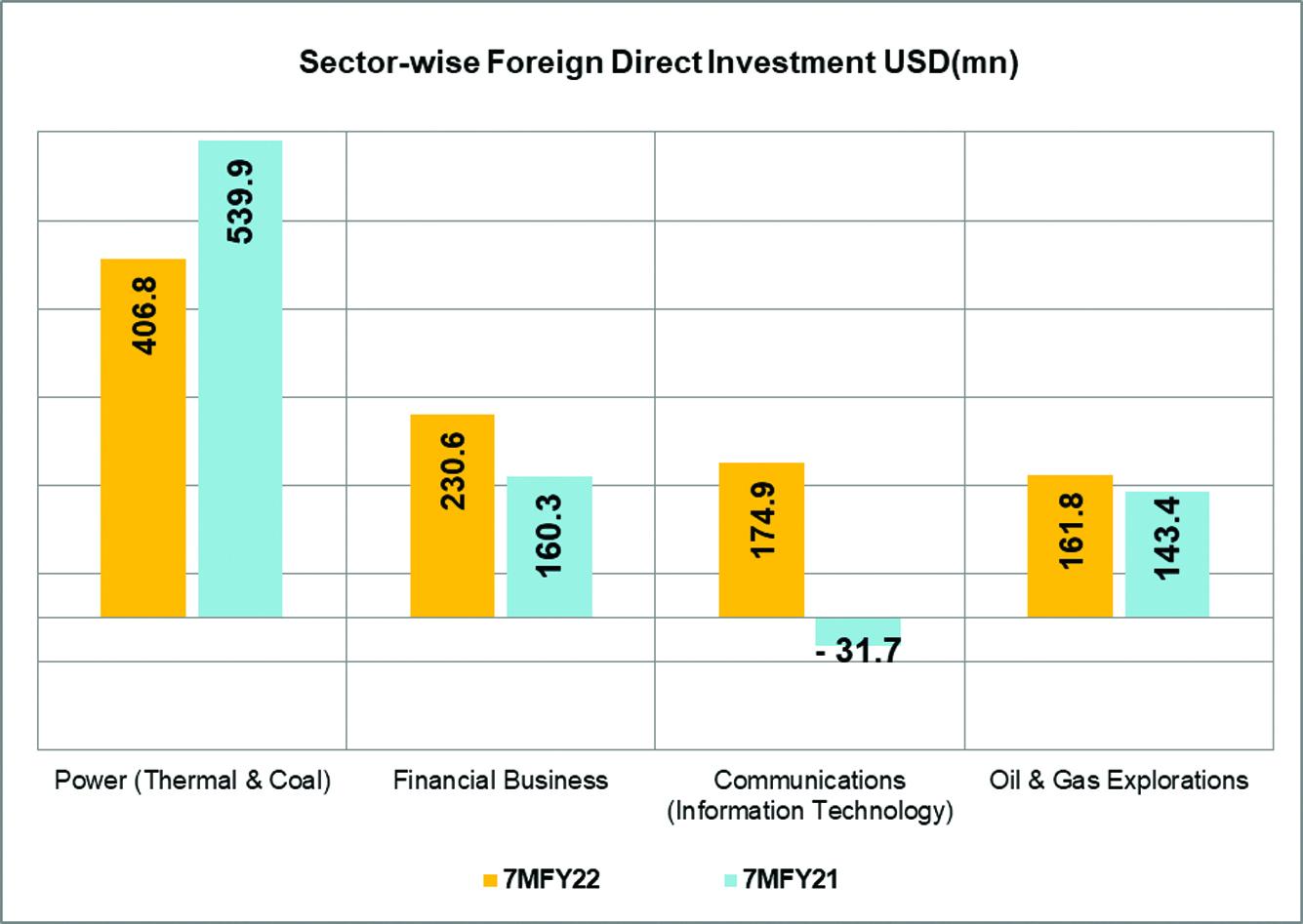

This trend of lower inflows and higher outflows has continued in FY22 which has been a key driver for overall growth in FDI (net). Sector and country wise data shows that despite declining FDI from China, it continues to hold the largest share in the country’s net FDI – highlighting the lack of diversifiacation in these foreign flows. Also, much of the investment continued to pour in power, financial businesses, communication/IT and oil and gas exploration.

Hence the story remains the same. It is obvious that FDI in the country continued to be concentrated in the traditional sectors; not only that, the investment remains small. The growth witnessed in overall 7MFY22 is much needed but may this also be known that the corresponding period was bogged down by the pandemic as well as the challneges at home that continue to create the inertia in the business climate till today.

Comments

Comments are closed.