Adam Sugar Mills Limited (PSX: ADAMS) was established in 1965 Pakistan as a public limited company under the provisions of the Companies Act, 1913 (repealed with the enactment of the Companies Ordinance, 1984 and later the Companies Act, 2017. It was initially set up by the name of Bahawalnagar Sugar Mills Limited but two decades later in 1985 the name was changed to what it is today. The company manufactures and sells white sugar at its plant located in District Bahawalnagar, Punjab.

Shareholding pattern

As at September 30, 2021, over 79 percent shares are held under the category of individuals followed by almost 21 percent in joint stock companies. Within the category of directors, CEO, their spouses and minor children, Ghulam Ahmed Adam, the CEO of the company is a major shareholder. The remaining negligible percentage of shares is with the rest of the shareholder categories.

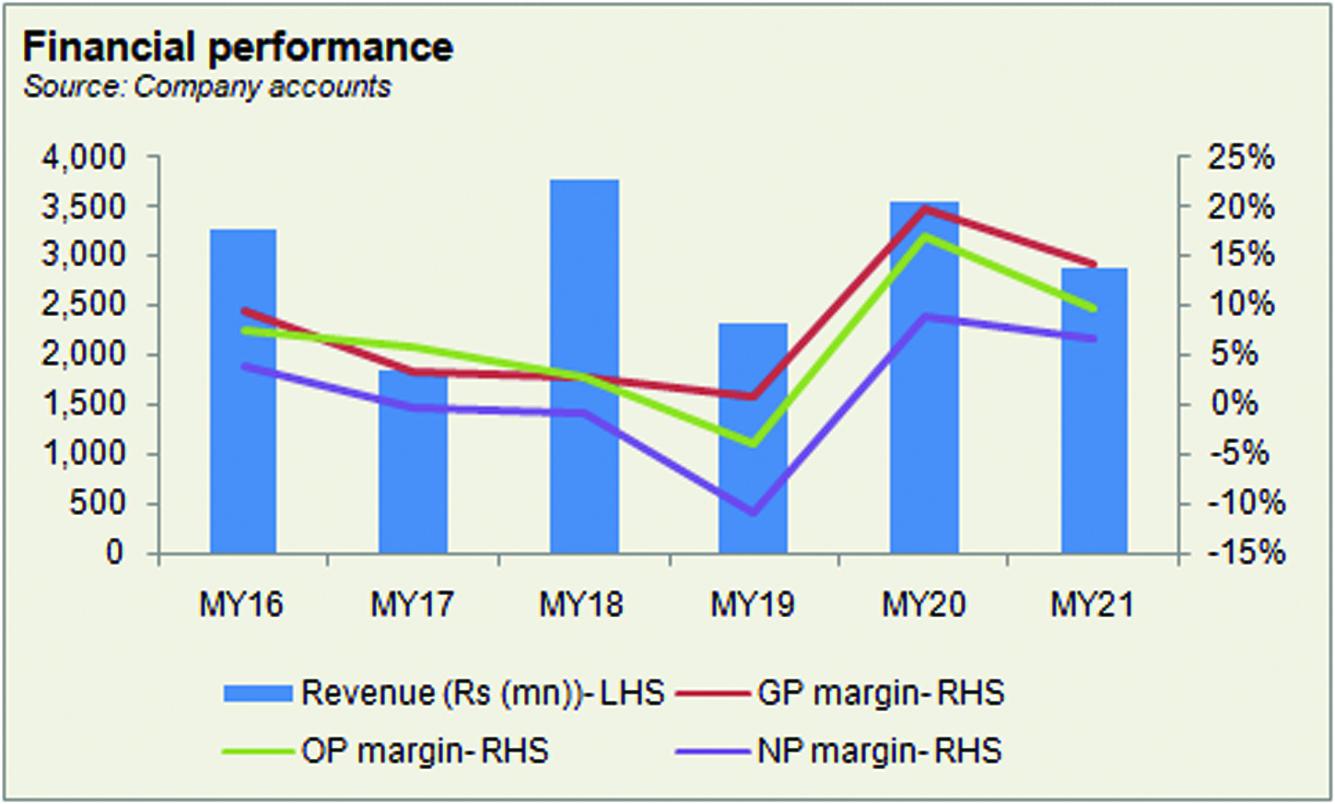

Historical operational performance

Adam Sugar Mills Limited has seen a fluctuating topline over the years, while the profit margins declined between MY16 to MY19, grew till MY20, and decreased again in MY21.

In MY17, the company witnessed the biggest contraction in revenue as it fell by over 43 percent, to reach Rs 1.8 billion, from Rs 3.3 billion seen in the previous year, despite the improvement in sugar production by 48 percent. A significant decline in local sales was observed, by almost 33 percent, while export sales of molasses also more than halved year on year. Thus, gross margin reduced to 3.4 percent. With a rise in finance expense the company could have incurred a higher loss, however it was contained at Rs 3 million due to a significant support coming from other income sourced from deposits forfeited.

Revenue in MY18 more than doubled year on year to reach Rs 3.8 billion despite sugar production being lower at 57,835 metric tons compared to 65,097 metric tons. Average recovery was also better at 9.53 percent, versus 9.17 percent. Local sales of sugar more than doubled from Rs 1.3 billion to Rs 2.7 billion, while export sales also increased by over two times. However, due to the rise in cost of production to over 97 percent of revenue, gross margin decreased marginally to almost 3 percent. With further expenses incurred, particularly finance expense, combined with a rise in distribution expense due to export expenses, the company incurred a loss of Rs 31 million.

In MY19, revenue contracted again, by over 38 percent to reach over Rs 2 billion. Sugar production fell to 32,204 metric tons compared to 57,835 metric tons in MY18. Local sales registered an 11.4 percent decline, while export sales were eliminated entirely. On the other hand, cost of production consumed nearly all of the revenue, leaving little room for absorption of other costs. Moreover, other income reverted to previous levels, while finance expense elevated further to make up almost 10 percent of revenue. Thus, the company incurred the highest loss seen thus far at Rs 254 million.

Topline bounced back in MY20 as it grew by over 53 percent to reach Rs 3.5 billion. Sugar production reduced marginally by 1.4 percent at 31,952 metric tons compared to 32,402 metric tons. However, average recovery was better at 10.21 percent. On the other hand, cost of production fell to an all-time low at 80 percent of revenue. The company had a relatively higher closing stock in the previous year that reduced in the current period. Thus, gross margin reached a peak at close to 20 percent that also trickled to the bottomline with an all-time high net margin of nearly 9 percent. Finance expense had also reduced, both in terms of value as well as a share in revenue. This can be attributed to a reduction in interest rates.

In MY21, revenue contracted by almost 19 percent, to fall below Rs 3 billion. There was a reduction in sugar production, at 29,543 metric tons, compared to 31,952 metric tons. Average recovery also reduced to 8.74 percent. This was attributed to widespread crop disease and pest attack in the region during the season that impacted production. This in turn had a negative impact on the company’s results. Therefore, gross margin was recorded at a lower 14.24 percent. Net margin was also lower at 6.8 percent but the decrease was contained due to a substantial reduction in finance expense owing to lower interest rates.

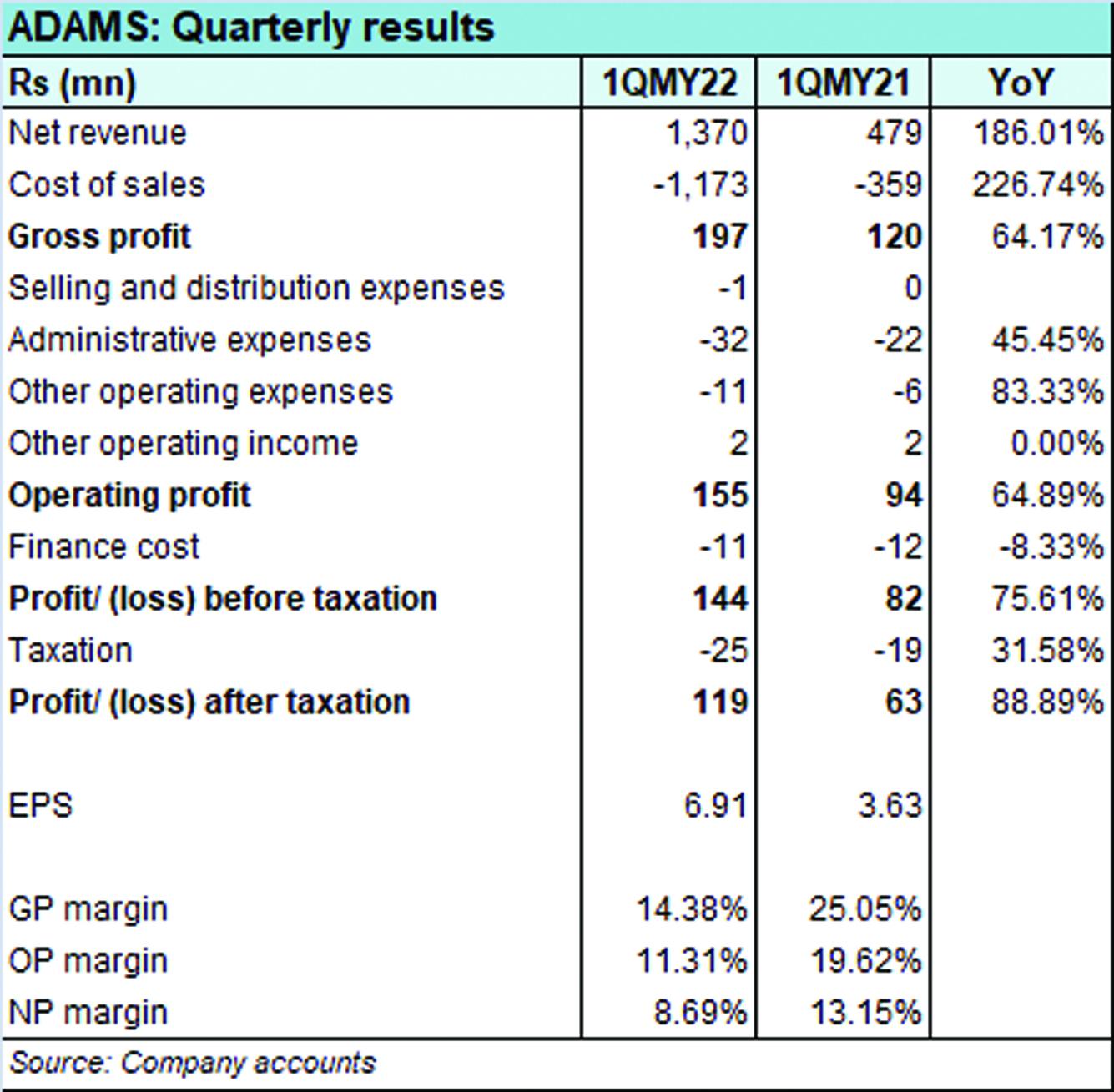

Quarterly results and future outlook

Revenue in the first quarter of MY22 was higher by almost three times year on year with sugar production nearly double year on year at 19,060 metric tons compared to 9,915 metric tons in 1QMY21. Average recovery also improved to 9.01 percent, versus 7.76 percent in the same period last year. However, the improved topline did not translate into higher profitability due to a rise in cost of production that is attributed to the cost of raw material that is higher than the notified price by the government. Throughout the last decade, Adam Sugar Mills has seen its cost of production hovering close to 90 percent of revenue. With any drastic changes in raw material price and interest rates, the company’s profitability becomes uncertain.

Comments

Comments are closed.