MLCF: A bit of luck, a bit of good management

Despite a demand slump in the domestic market and a sharp decline in exports cross-border—particularly Afghanistan—Mapleleaf (PSX: MLCF) has doubled its earnings in 1HFY22. The credit goes to strong retention pricing in the north market where MLCF sells and a considerable control over costs of production—relative to improving retention—despite coal prices in the global markets running amok.

MapleLeaf has a captive coal fired power plant which allows the company to minimize the electricity it buys from the grid. The company also commissioned a waste heat recovery plant which represents a third of the power mix. Mapleleaf is sitting on top of its power and fuel costs which for any cement maker constitute bulk of the cost of production. Meanwhile, prudent procurement practices, use of pet coke and shifting to fairly cheaper Afghan coal accessible from next door all enabled a controlled increase in costs.

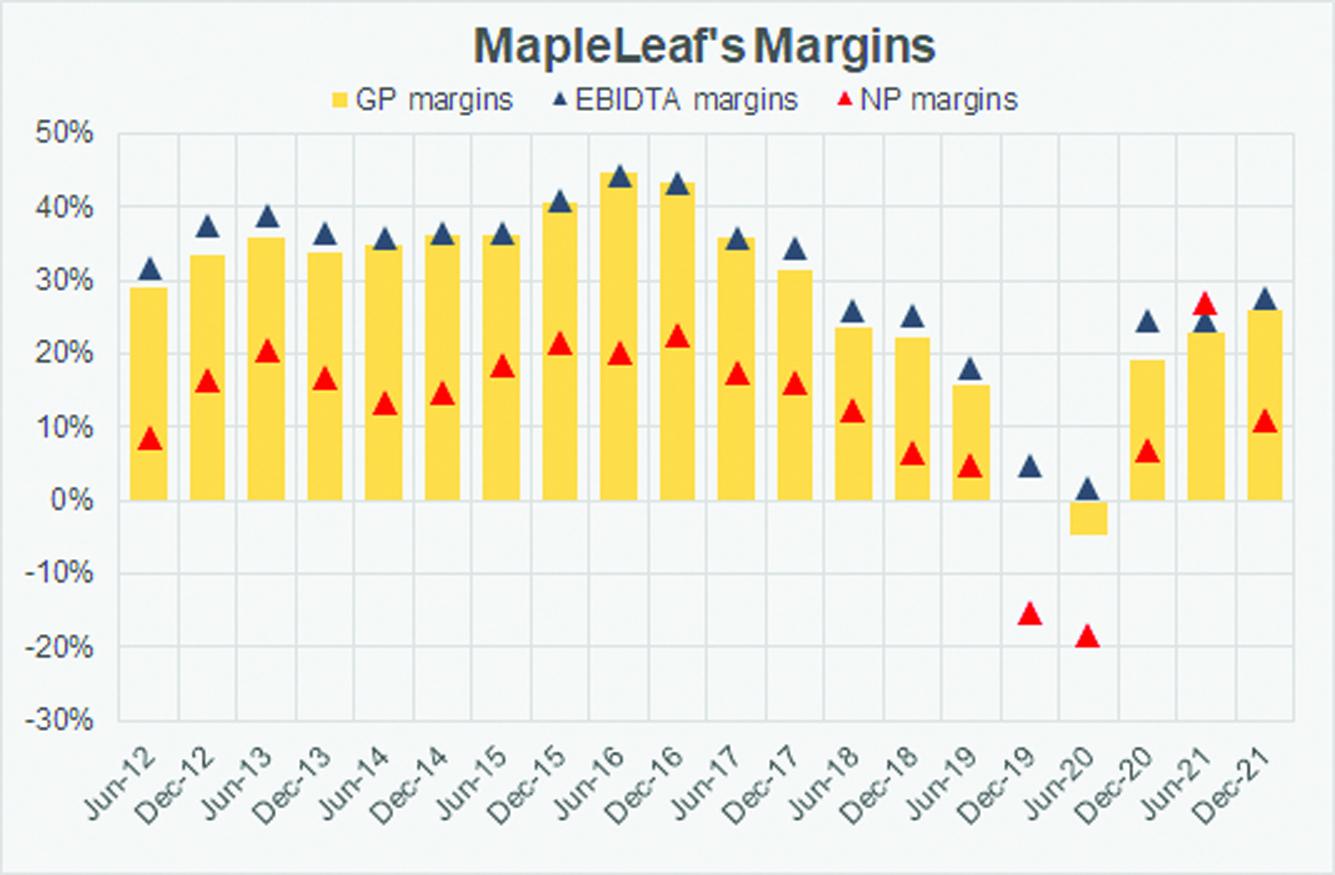

Based on estimated sales, the company’s revenue per ton sold rose 43 percent versus the costs of sales that increased 31 percent. This resulted in an upward jump in margins to 26 percent during 1HFY22 compared to 19 percent in this period last year. Though the company’s overheads and other expenses are still high—at 8 percent of revenue—and have increased since last year, finance costs fell to 3 percent of revenue from 5 percent. The net affect was unchanged expenses.

The company’s “other income” component contributed only 1 percent to the before-tax profits unlike this period last year when it buttressed the bottom line by 7 percent. Even so, the company’s earnings doubled.

Now comes the tough part though. Even with a tighter leash on costs, there is only so much that retention can take the company forward. Prices will have to give in if domestic demand continues to be lacklustre. The construction slowdown that was visible from demand thus far during the year where cement offtake remained sluggish at best, may not recover if building material costs continue to go up. The government’s several infrastructure and hydropower projects however will likely rebound but slowly. Private sector demand, however, may be a little hard to coax up, despite government’s mark-up subsidy scheme for housing underway, given massive inflationary pressures consumers are facing.

Upcoming quarter does not bring too good news. Interest rates are up, Afghan coal is also becoming pricier whilst being short in supply, and retention prices cannot be maintained at their current levels. Even if companies continue to procure Afghan coal, they will have to contend with lower demand and dole out discounts to maintain capacity utilization. Mapleleaf must enjoy its 2x earnings for now, because that is not sustainable, until domestic demand recovers.

Comments

Comments are closed.