Pakistan Petroleum Limited (PSX: PPL) announced its financial performance for 1HFY22 last week where its earnings for the six-month period were seen increasing by 21 percent year-on-year. The same was seen growing by 24 percent year-on-year in 2QFY22. The growth in bottom line was however not due to higher oil and gas production.

Though PPL is an aggressive E&P sector giant, the declining reserves and small discoveries in general in the upstream oil and gas sector in the country have been stagnating crude oil and gas exploration and production. During FY21, PPL’s natural gas production declined by around 4 percent year-on-year. The declining gas production coupled with a fall in the Sui wellhead price were the main factors for dragging the E&P giant’s revenues in FY21. In 1HFY22, the oil and gas production were both down; along with the squeeze in production variance from 1QFY22, oil and gas production in 2QFY22 was down by over 9 and 7 percent year-on-year, respectively.

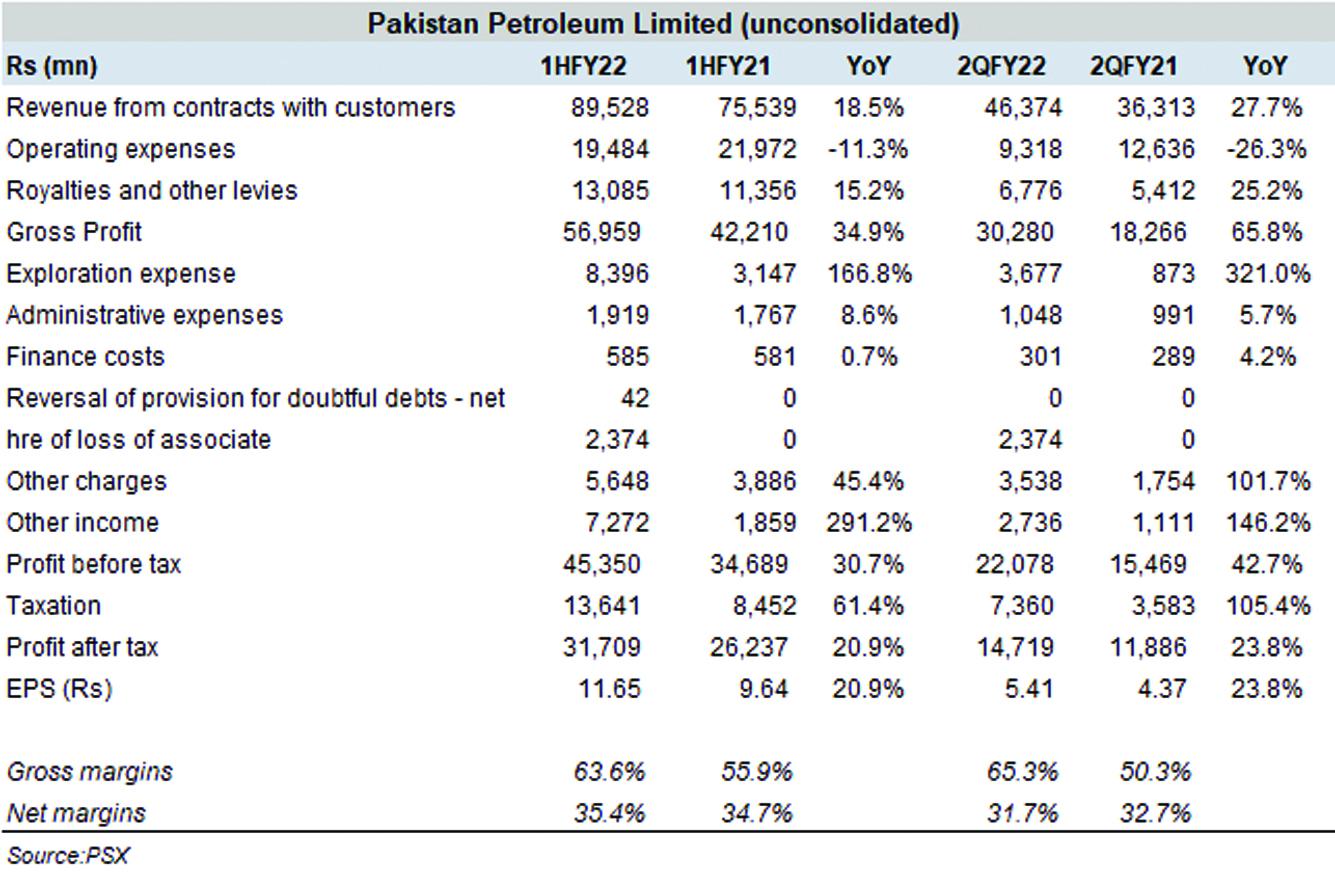

However, revenues from contracts with customers were seen increasing by 19 and 28 percent year-on-year, respectively in 1HFY22 and 2QFY22. This was primarily due to staggering oil prices hike of around 77 percent year-on-year 1HFY22 and 83 percent in 2QFY22. Along with prices rise, the revenues were up due to hike in Sui gas wellhead price and currency devaluation.

PPL’s bottomline was seen growing in 1HFY22 due to topline growth as well as over three times increase in other income due to exchange rate variance on FX denominated assets. On the expense side, the exploration and prospecting expenditure was significantly up in 2QFY22 as well as 1QFY22, which the research note by AKD Securities highlights could be due higher exploratory and drilling activities from firming of oil prices and better recoveries made during period under review. Apart from that, PPL also incurred loss from its associate, Pakistan International Oil Limited, which affected the bottomline growth.

Going forward with production flows under pressure, the key could lie in the change in gas pricing – gas price increase due to WACOG will be beneficial for E&P companies to at least control the buildup of receivables further – leaving more room for spending on exploration and prospecting activities.

Comments

Comments are closed.