Cherat Cement Company Limited

Cherat Cement Company Limited (PSX: CHCC) was established in 1981 as a public limited company. It is part of the larger Ghulam Farooque Group. The company manufactures markets and sells cement. Its manufacturing plant is located at District Nowshera.

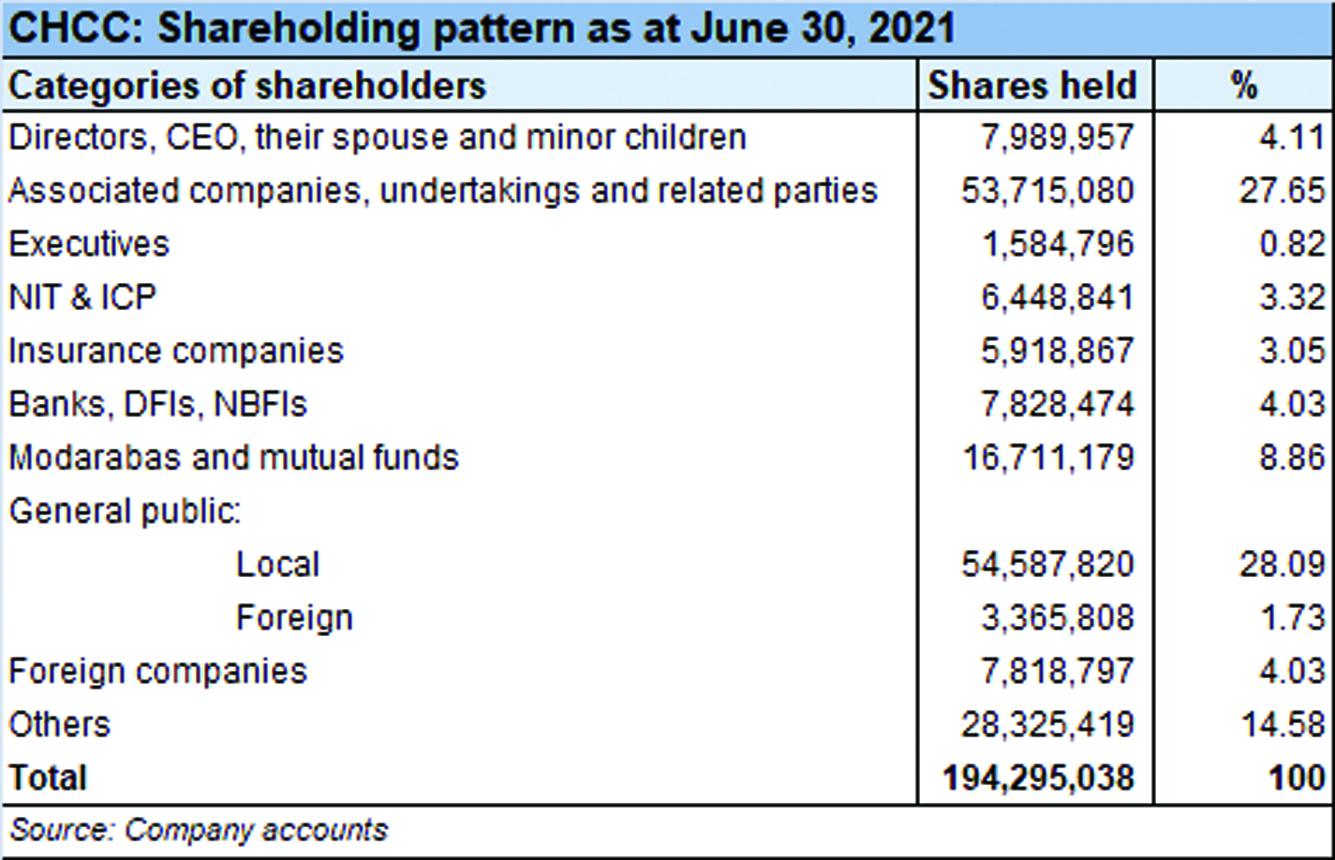

Shareholding pattern

As at June 30, 2021, close to 28 percent shares are held by the associated companies, undertakings and related parties. Within this, majority of the shares are owned by Faruque (Private) Limited. The local general public holds 28 percent shares, followed by over 14 percent held under the “others” category. The directors, CEO, their spouses and minor children own 4 percent shares. About 9 percent shares are held in modarabas and mutual funds, while the remaining roughly 17 percent shares are with the rest of the shareholder categories.

Historical operational performance

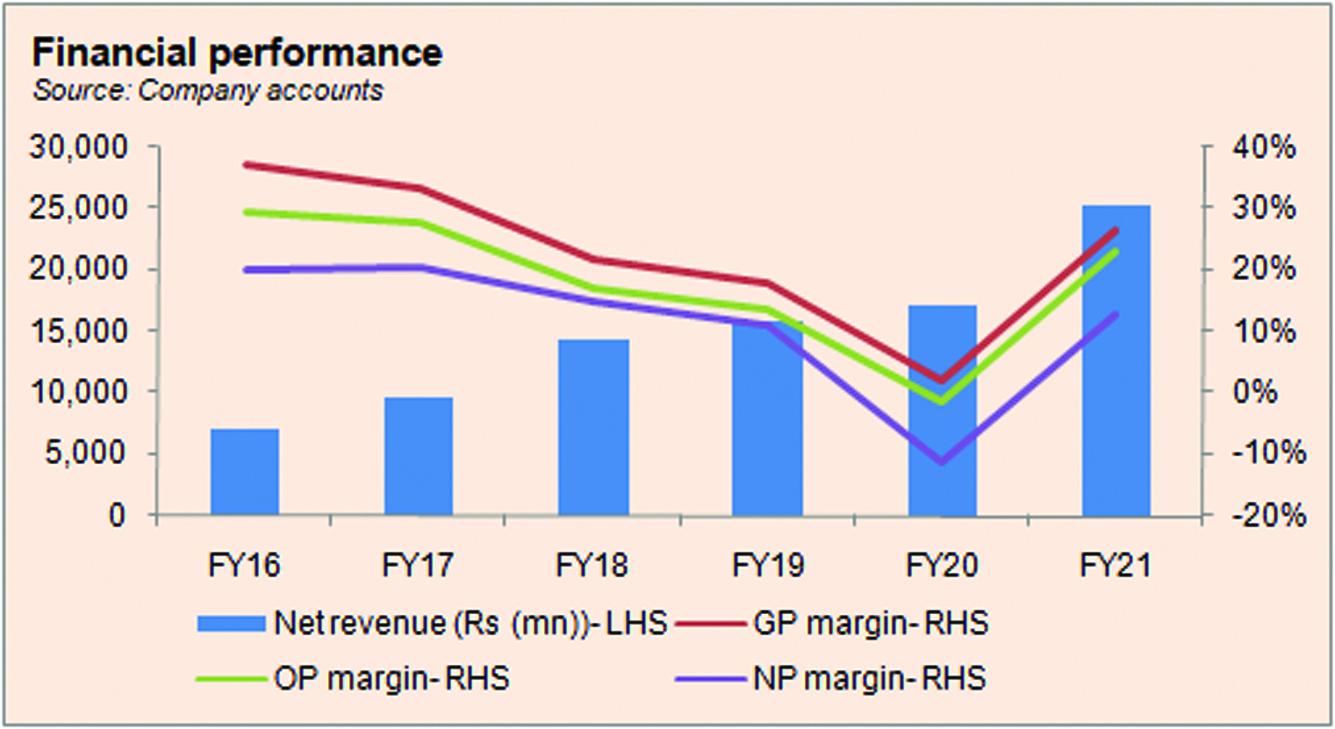

Cherat Cement has consistently seen a growing topline since FY10. Profit margins, in the last few years have declined until FY20, before improving again in FY21.

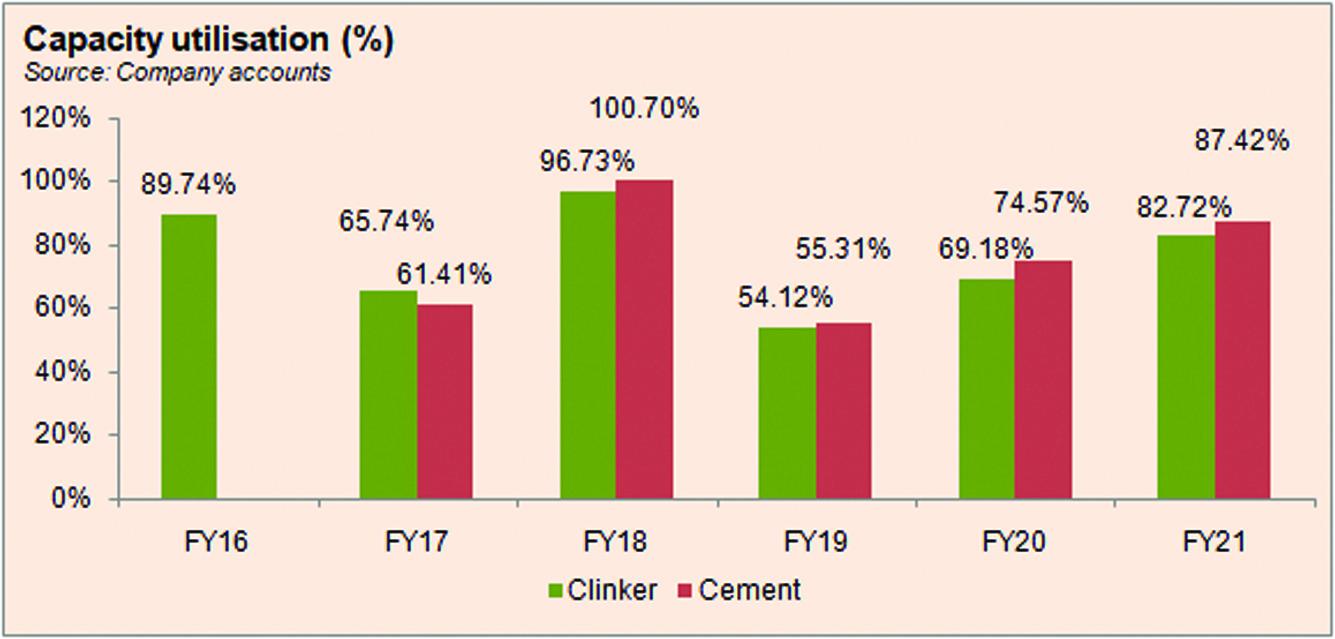

During FY18, the company witnessed the biggest rise in revenue by over 49 percent. Local sales volumes for cement were higher by 65 percent. This was on the back of a strong domestic demand as well as an increased production capacity for the year as the company began operations on its Cement Line 2. Higher production also allowed the company to make some export sales to Afghanistan that increased by 52 percent year on year. The overall cement dispatches for the company witnessed a growth of 63 percent. However, the rise in revenue was accompanied by a more than corresponding rise in cost of production due to increase in coal prices. Thus, gross margin reduced to almost 22 percent, down from previous year’s 33.3 percent. This also trickled to the bottomline with a net margin of 14.8 percent.

Revenue growth was relatively subdued in FY19 at over 10 percent, with topline nearing Rs 16 billion. Sales volumes for the company were almost flat year on year. The overall industry also saw a marginal growth of 2 percent, with exports increasing by 37 percent due to rise in exports by sea. However, cost of production continued to climb up as it made almost 82 percent of revenue. This was attributed to a rise in input costs as cost of raw materials and fuel and power expenses made a larger share of the total cost of production year on year. Combined with an escalation in finance expense, that made over 7 percent of revenue; net margin declined further to 11 percent for the year.

In FY20, revenue growth stood at 7.7 percent for the year with topline crossing Rs 17 billion. The overall dispatches of the company grew by 35 percent as the company began operations on its third cement line in January 2019. Local sales volumes grew by 36 percent; while exports also saw a 32.4 percent rise. However, the effect on topline was relatively subdued due to a decline in selling price. Coupled with this was the rise in cost of inputs such as electricity that reduced gross margin to 2.26 percent. With finance expense growing to almost 15 percent of revenue, the company incurred a loss of almost Rs 1.9 billion.

Revenue recovered in FY21 as it grew by 47.5 percent to reach an all-time high of Rs 25 billion. The company’s domestic sales registered an increase of 18.4 percent, while export sales grew by almost 8 percent. Overall, the company’s cement dispatches increased by 17 percent. This was attributed to a rise in demand that was largely curtailed in the previous year due to the outbreak of the Covid-19 pandemic. There was also the announcement of the construction package, more construction activities and greater allocation of funds under PSDP that provided the boost to the industry. The higher revenue led to greater profitability as gross margin was recorded at 26.7 percent. Combined with the decrease in finance cost due to lowering of interest rates, net margin was recorded at 12.7 percent.

Quarterly results and future outlook

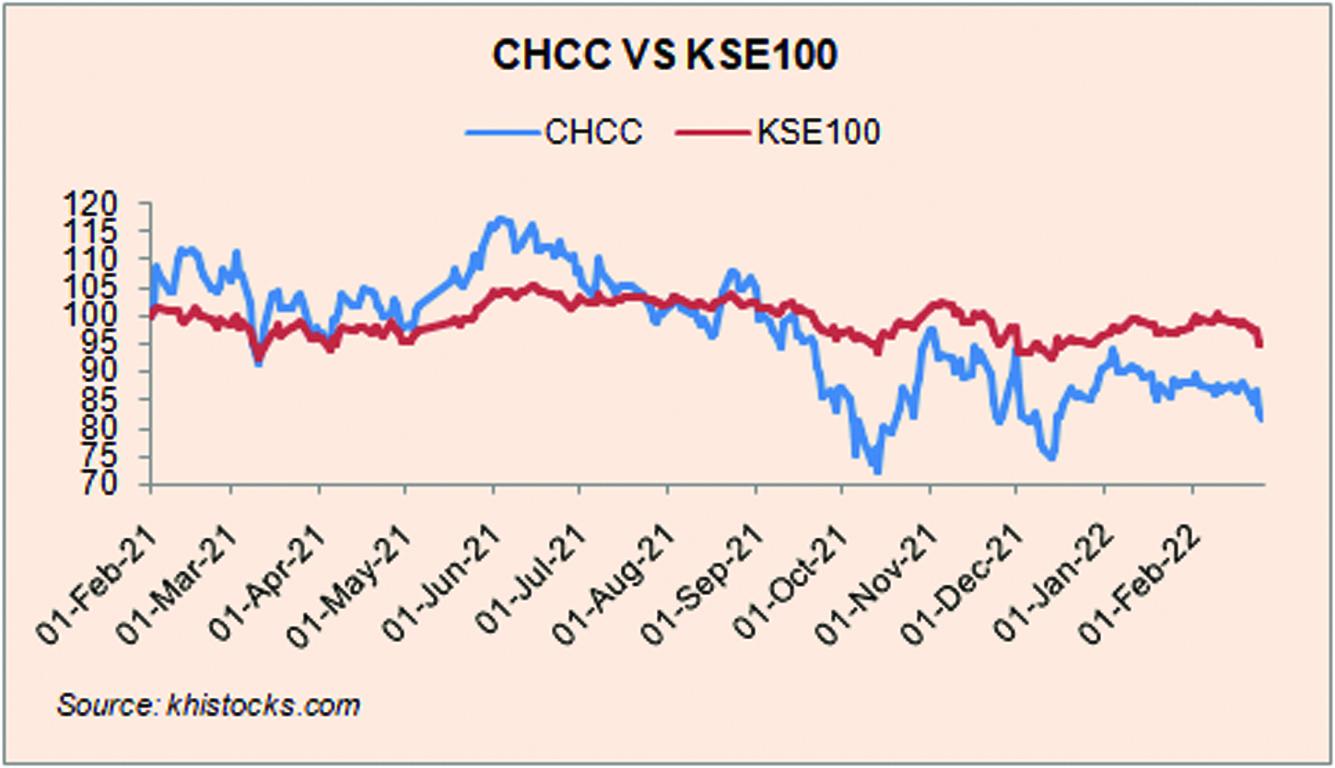

In the first quarter of FY22, topline was higher by over 37 percent year on year, while local sales volumes reduced almost 3 percent. The increase in revenue was attributed to a rise in selling prices. Thus, profitability was better year on year with a net margin of 16.6 percent that was supported by a reduction in finance expense. The second quarter of FY22 also saw an increase in revenue by over 19 percent year on year. The total dispatches for the company were lower by 6 percent year on year due to slow demand and political unrest in Afghanistan that impacted exports to the country. However, due to a rise in selling price, profitability has been better at a net margin of 15.4 percent or the period.

The company faces several challenges such as rising input costs, inflation, and currency devaluation that could impact future demand. Exports have already been deterred by the uncertainty on the Afghanistan front. Moreover, interest rates are also rising that could impact finance expense in the future.

Comments

Comments are closed.