A urea shortage; lower cultivated area; and a war in Europe. Is another wheat crisis in the offing? Not yet. Between now and June, PTI government can take several pre-emptive measures to avoid a looming supply-demand mismatch from morphing into a full-blown crisis. But it will have to do more than merely announcing import plans from a country facing severe economic sanctions from the West.

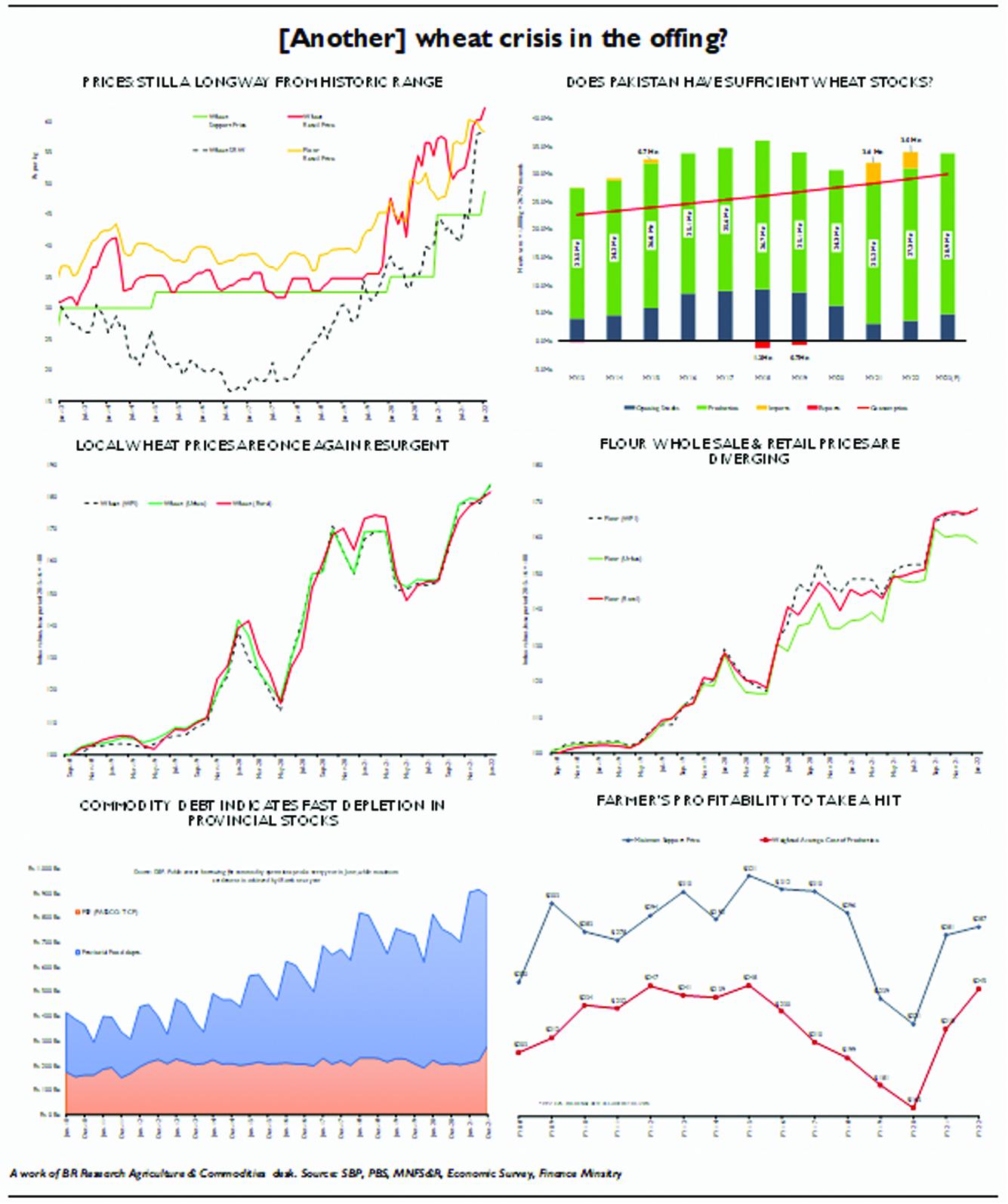

First, domestic stock situation at present is not nearly as bad as early January 2020, when retail prices rose by 13 percent in less than a month. At that time, flour had virtually disappeared from the local market for over a week, as administration failed to stabilize the market due to low carryover inventory.

In contrast, according to BR Research estimates, Passco stocks rose by an estimated one million tons (imported wheat) during Sep - Dec 2021, long after local procurement season was over. These stocks had not been released in the local market till December close. Meanwhile, provincial Food departments have released stocks at a record pace to stabilize prices, with nearly two million tons released during the last quarter of calendar year. Local grain market may not be flush, but it is not exactly experiencing a ‘shortage’ yet, either.

However, supply situation in the local market is exposed to several near-term risks. If official stocks continue to be released at present pace, provincial governments will run out of inventory by March end. Open market prices have begun to reflect this development, as wheat and flour prices take divergent trends. So far, administrative measures have ensured that retail flour price remains under control. On the other hand, rising prices in the international market; demand from Afghanistan; and, forecast of lower output in the upcoming season have created upward price pressures in the grain market, with wholesale wheat price rising to Rs 2,500 per 40kg (or $350+ per ton).

Back in 2020, the (then novice) incumbents were faced with a similar predicament. National output fell short of target amid pandemic-induced demand uncertainty. In March that year, the PTI government foolishly announced a very high procurement target of 8 million tons, nearly one-third of national production. MSP was also raised marginally but remained significantly lower than the open market price (or import-parity price).

As a result, farmers showed reluctance to sell at officially notified rate of Rs 1,400 per 40kg (or $220 per ton), forcing government’s hand to use coercive measures to meet its procurement target. Secondary market prices for both wheat and flour spiralled out of control, rendering officially notified prices irrelevant.

Has PTI learned its lesson? Last week, the ECC rejected a summary to increase minimum support price over Rs 1,950 per 40kg. At $280 per ton, this base price is (once again) significantly lower than prevailing prices in the international and local (wholesale) grain markets. The federal government seems hesitant to raise the base price as it will in turn either be forced to raise flour price at retail level (with inflationary consequences), or raise the quantum of subsidy. Sounds like a wise strategy? Hardly.

Each time the incumbents have attempted to cap grain prices, they have learned the hard way that market prices bow to no god except those of supply and demand. While wheat prices may very well collapse during procurement season (May and June), they rise back up again no later than September. Attempts are then made to calm the market by flooding it with Food department stocks, only for prices to rise back up again once public sector stocks start to run out.

If the government resorts to ‘proven’ tactics yet again, and caps MSP below market clearing rate, it will only be fleecing farmers to no one else’s benefit. A lower local market price will inadvertently create incentive for smuggling, a symptom of long-term governance failure that is not going to be fixed overnight. Meanwhile, whether local market faces a shortfall or not will depend on whether PTI successfully avoids falling into the price control trap.

As odious as it may be, raising the official base price will be the right thing to do in the present circumstance. Back in January 2022, BR Research had recommended that government should raise the intervention price at least up to historic market equilibrium range of $300 per ton (or Rs 2,100 per 40kg). BR Research’s earlier call to raise the intervention price was based on steep differential between international and local prices, which in the past has led to disappearances (euphemism for smuggling). Since then, the outbreak of war between Russia and Ukraine – responsible for 30 percent of world exports – has caused a fresh price spiral in the international market, reinforcing BR Research’s earlier position.

But setting an intervention price need not imply that the public sector must expand its footprint. Although it would be foolish to expect public sector to exit wheat market overnight, especially now during a period of severe price volatility, government can still lower its expenditure by drastically reducing the procurement target. As BR Research has previously insisted, an intervention price is different from an MSP in that it only requires administration to step in (to protect farmers) if the market price falls below threshold, chances of which are extremely low in the upcoming season anyway.

By letting the private sector enter wheat procurement during harvest season, government can both allow market price to settle at its fair value (which it reaches, sooner or later anyway), and curtail leakages and disappearances, as incentive for smuggling will reduce greatly. Retail price of flour shall very well rise – as it has become inevitable under present circumstance, which governments can partially mitigate by continuing targeted subsidy through Ehsaas, Utility Stores, and other avenues. Remember, a price spiral is not same as a shortage. PTI would do well to heed lessons from 2020, and avoid the temptation to dictate the market.

Comments

Comments are closed.