Thatta Cement Company Limited

Thatta Cement Company Limited (PSX: THCCL) was established as a public limited company in 1980. The company manufactures and markets cement at its production facility located in District Thatta, in the province of Sindh.

Shareholding pattern

As at June 30, 2021, over 51 percent shares were held by associated companies, undertakings and related parties. Within this category, over 21 percent shares are owned by Sky Pak Holding (Private) Limited and almost 15 percent shares held by Al-Miftah Holding (Private) Limited. The local general public owns nearly 23 percent shares followed by almost 12 percent in banks, DFIs, and NBFIs. The directors, CEO, their spouses and minor children own less than 1 percent shares. The remaining roughly 14 percent shares are with the rest of the shareholder categories.

Historical operational performance

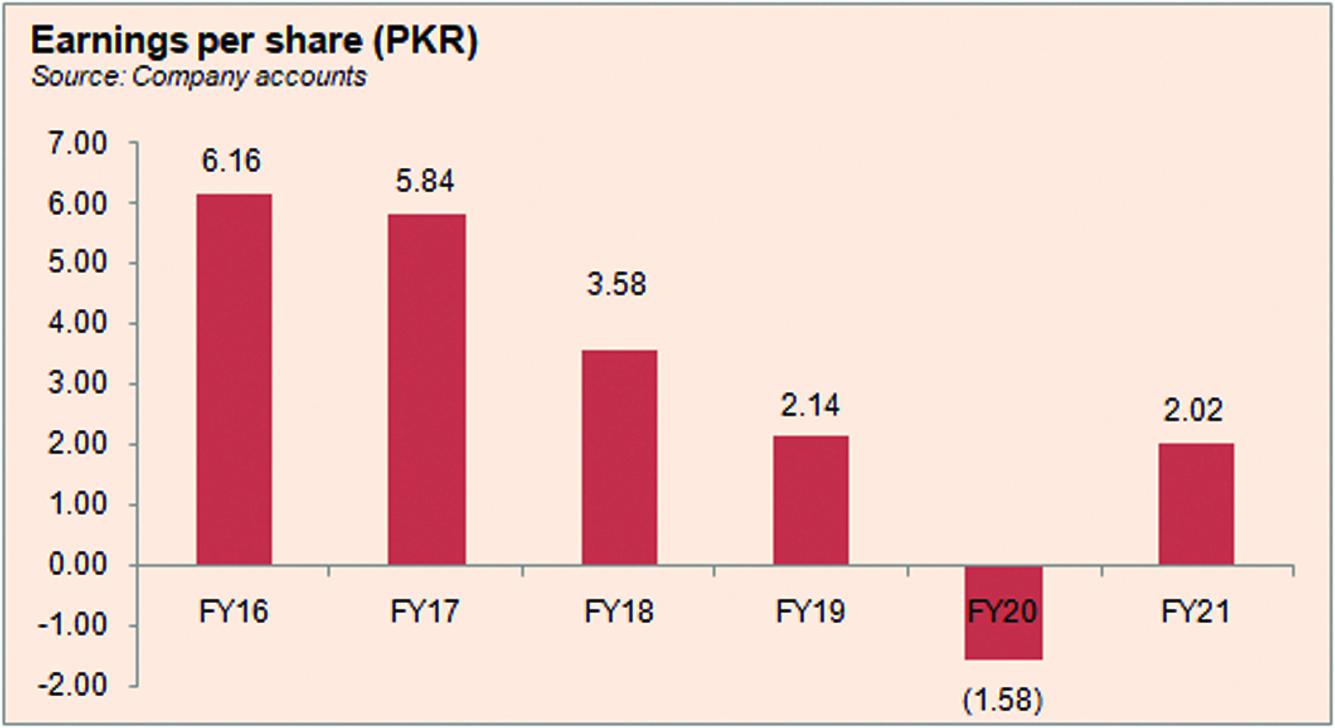

Thatta Cement has mostly seen a rising topline with the exception of a few years, while profit margins in the last six years have declined between FY16 and FY20 before rising again in FY21.

In FY18, the company saw the biggest contraction in revenue thus far at 22.3 percent to fall below Rs3 billion. The company’s production for clinker and cement, both were low, whereas cement dispatches were lower by 4.2 percent. This was attributed to a price competition between the companies after an increase in installed production capacity. Thus, gross margin reduced to 26.6 percent. This also trickled to the bottomline as net margin was also recorded at a lower 12.56 percent compared to 15.9 percent seen in FY17.

Revenue recovered in FY19 as it grew by 22 percent to reach Rs3.5 billion. There was almost 16 percent rise in clinker production whereas cement dispatches were lower by 6.46 percent. Clinker dispatches increased by 12 times. The decrease in cement dispatches were attributed to excess capacities that also resulted in a price competition. Despite the decrease in volumes, the company managed to increase revenue through export of clinker. However, gross margin continued to shrink to 19.4 percent due to rise in coal prices in addition to increases in other input cost. While cost of raw material consumed and fuel expenses have increased in value terms, it has reduced as a share in total cost of production year on year. The decrease in net margin to 6 percent is more pronounced due to rise in distribution expense owing to export related expenses.

In FY20, the company witnessed yet another largest contraction in revenue as it fell by over 49 percent to reach Rs1.7 billion. Production of both clinker and cement were lower by double-digits at 45.1 percent and 46.14 percent, respectively. Cement and clinker dispatches were also lower by double-digits at 46.7 percent and almost 56 percent, respectively. The decline in overall demand was attributed to tax reforms and imposition of axle load policy. Moreover, the outbreak of Covid-19 also impacted the industry due to lockdowns and border closures. Thus, gross margin fell to an all-time low of almost 3 percent. With further expenses incurred, the company eventually posted a loss of Rs 158 million.

Topline bounced back in FY21 as it grew by over 38 percent to cross Rs 2 billion. As the economy opened up, the pent up demand from last year released that is reflected in higher production for clinker and cement as well as higher dispatches for both. Demand was also encouraged by an increase in construction activities and infrastructure projects. The higher revenue translated into higher profitability as gross margin was recorded at almost 16 percent that also trickled down to the bottomline with a net margin of 8.3 percent. Cost of production also reduced to 84 percent of revenue from a high of 97 percent seen in the previous year.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by over 56 percent year on year. This can be attributed to lower revenue in the same period last year that had just seen business activities gradually starting to resume. While the company saw an increase in production of both clinker and cement, dispatches increased only for cement by 73 percent while clinker dispatches reduced by over 70 percent. The rise in revenue allowed profitability to improve year on year at a net margin of 2.7 percent compared to a loss of Rs 7.6 billion in 1QFY21.

The second quarter of FY22 saw its topline higher by 38 percent year on year. However, this did not translate into higher profitability as cost of production consumed over 92 percent of revenue for the quarter. The high cost of inputs, inflation and currency depreciation increased the cost of production and also made exports unfavorable in the global market, thus reducing export sales. The growth in revenue was majorly seen coming from local sales. Thus, net margin was lower at 4.5 percent compared to 11.8 percent in 2QFY21. On one hand, the cost of inputs, volatility in coal prices, and uncertainty in possible export destinations such as India and Afghanistan are some of the challenges faced by the industry, the support and incentives for the sector from the government can encourage demand, on the other hand.

Comments

Comments are closed.