January 2022 saw a lot of firsts for power generation, and the resultant required increase in fuel cost for the month should not come as a surprise. Hydel generation share at 5.8 percent was the lowest for any January since at least 2013, if not all-time. Share from RLNG based generation at 7 percent is the lowest in four years. Coal based power generation contributed 33 percent to overall generations – another first. The absolute coal-based generation at 2.9 billion units was a record too.

Furnace oil-based generation is never too far away and was the highest in three years in terms of total share. High Speed Diesel was back in the mix and big time – at 0.59 billion units, this is the highest monthly HSD based electricity generation since at least January 2016; Combined, RFO and HSD based generation at 1.8 billion units was the highest since May 2018.

Combine that with the ever-rising global energy commodity price trend and you have the highest unit values for coal, HSD, and furnace oil. There was not enough RLNG for much of the winters. In a lot of other cases, a number of RLNG plants were lower on the merit order. In other cases, there just was not enough imported gas available to follow the merit order and the alternate HSD fuel had to be burnt. More than a fifth of all generation was based on either HSD or FO – and that cost an average of Rs24/unit on account of fuel charges alone.

Recall that hydel’s loss has usually been FO’s gain and January 2021 was no different. The fuel bill at Rs106 billion for January 2021 is more than double from January of last year, and the second highest ever, despite being January being a low demand month. The fuel component has been comfortably outdoing the capacity charge component for the past few months, ever since the commodity price spiral started.

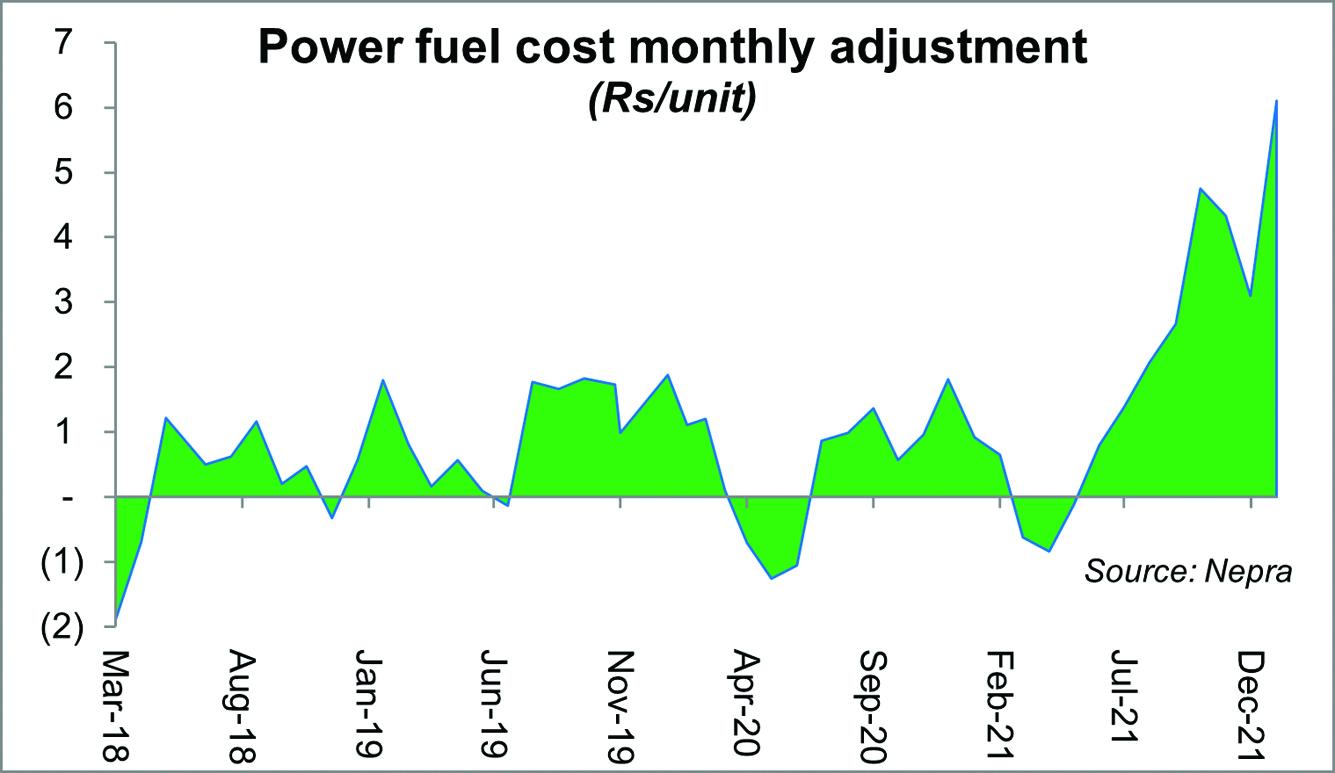

Some were expecting the fuel adjustment to come down from the highs of November 2021, only for January 2022 to throw a requirement in excess of Rs6/unit. The inflationary impact on electricity prices for March 2022 would be north of 60 percent year-on-year. One hopes the drop in hydel does not sustain beyond January. Nuclear generation has also been on the rise. That said imported gas remains a priced commodity; hard to get. Oil prices may have not gone crazy but have shown little signs of cooling off either. Little suggests any respite in the fuel cost component for the next few months.

Comments

Comments are closed.