As federal cabinet dithers in face of a storm, provincial governments have stepped up and showed initiative. Earlier this week, Punjab government recommended increase in minimum support price (MSP) of wheat, matching Sindh government’s earlier decision to Rs 2,200 per 40kg. So far, ECC is yet to ratify the decision.

Last year, Sindh government’s decision to unilaterally raise wheat MSP went unchallenged by federal government, putting an end to controversy over whether administrative prices must only be fixed with consensus in a common goods market. That Punjab government has gone against its own party’s decision in Islamabad shows that local political economic trumps fiscal considerations. Price parity between two provinces will now ensure Punjab no longer faces risk of losing local production to Sindh. Punjab-1, Sindh-0.

Unless currency depreciates precipitously, the new base rate is fair and remunerative. Farmer profit margin will rise to 30 percent, at minimum per acre profit of Rs 18,000. Since chances of bumper crop are low, notified official rate shall serve as a reference price for open market transactions once government procurement is achieved. Unless international market prices go on a tear in post-harvest months (June onwards), risk of hoarding and smuggling shall be mitigated to some extent.

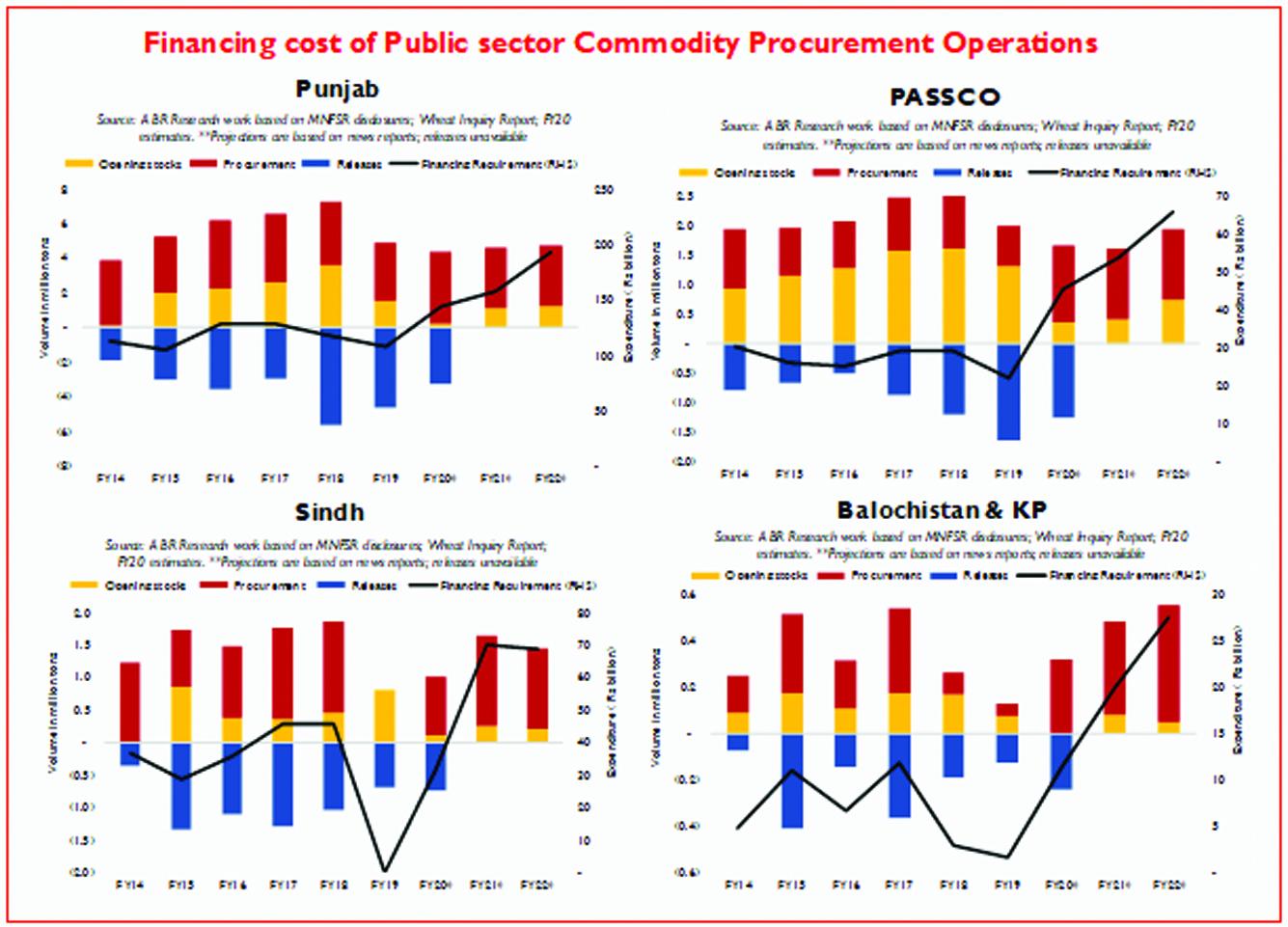

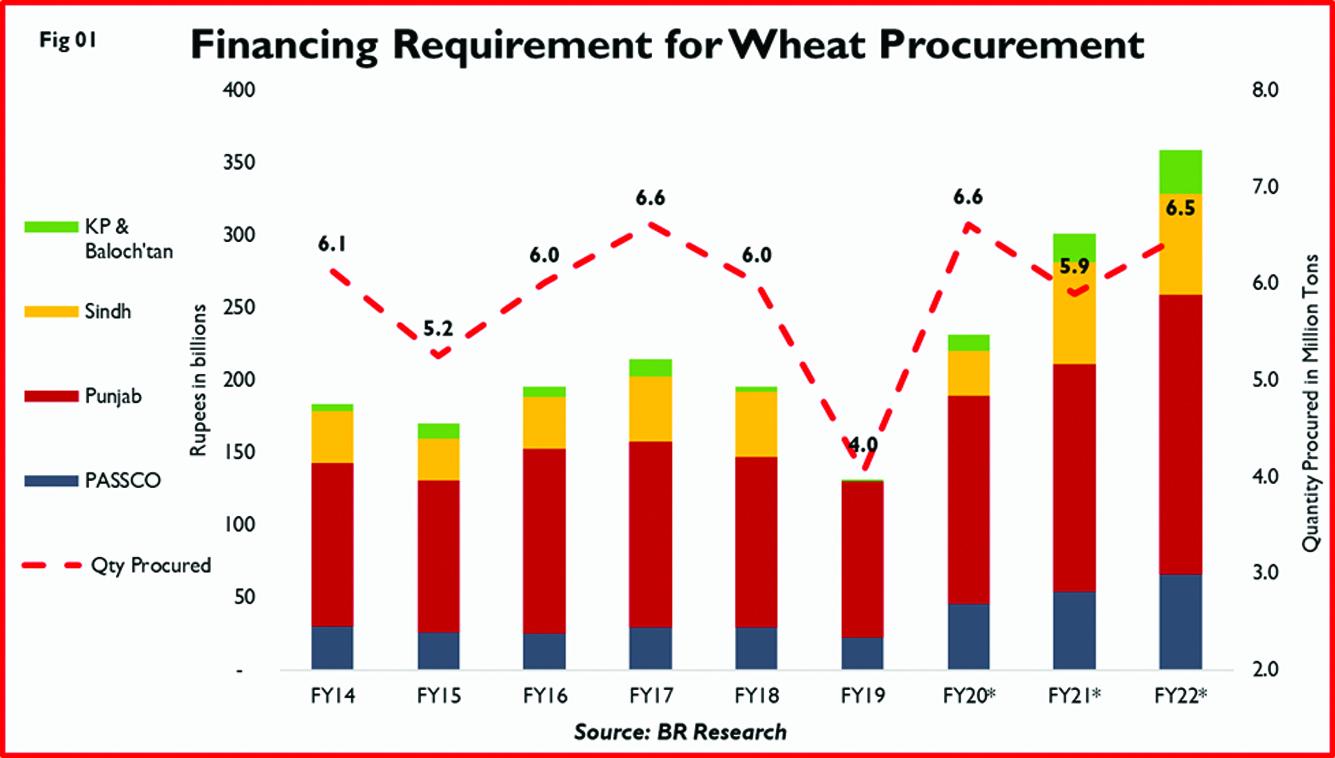

Now comes the hard part: financing procurement operations at sky-rocketing prices. At new base rate, the MSP is 22 percent higher than last year, which itself was 28 percent higher over the preceding year. Since PTI has come to power, the base rate alone has escalated by 69 percent, raising outstanding public sector commodity debt by Rs 125 billion.

Given fears of production falling short of domestic demand, comparisons with 2020 wheat season are predictable. Back then, GOP announced a national procurement target of 8.25 million tons at MSP of Rs 1,400 (per 40kg), but managed to procure only 6.6 million tons. At new MSP of Rs 2,200, federal and provincial governments will need to spend Rs132 billion more to procure the same quantity. By June 2022, commodity operations debt will cross Rs 1 trillion for the first time in history, bringing annual interest payments alone to Rs 75 billion.

And now to the most distressing bit, despite surging commodity debt, GOP will be hard pressed to maintain flour prices at the current level. During FY22, wheat release price was fixed at Rs 1,950 against purchase price of Rs 1,800. Retaining flour prices at this level would mean issuing a subsidy of at least Rs 30 billion to flour mills. Even then, there will be little to no guarantee whether the subsidized flour actually reaches the consumers, since the differential will be too mouth-watering for unscrupulous to ignore.

GOP still has time to avoid this eventuality. As BR Research has previously advocated, policymakers must replace the minimum support price with an intervention or reserve price and restrict its procurement operations to strategic reserves maintenance and government-to-government imports. Not only will this help avoid further build up of commodity debt, but it shall also free up vital fiscal space.It must also switch blanket subsidy on flour with targeted subsidy through Ehsaas, Utility Store Corporations, and Sasta Bazaars; as imperfect as those may be. Lifeline consumers deserve protection, but that won’t happen through blanket subsidies to quota mills.

Reducing GOP footprint from public sector procurement means that flour prices will rise in the short-term. But unless policymakers are prepared to burn an even larger fiscal hole, this is inevitable. Provinces have done the right thing by raising the official rate to market parity price as it shall protect farmers. Federal government must also show courage and imagination, and turn a crisis into an opportunity to reform wheat market. The billions spent on subsidizing state grain trading must no longerbe allowed to go to waste.

The principal beneficiaries of flour subsidy are commercial banks and quota mills; don’t let them milk the public kitty dry.

Comments

Comments are closed.