After witnessing a dip in revenues in FY20 due mainly to the shock of the early months of the pandemic, Pakistan’s telecom industry has staged a comeback of sorts in FY21, as per data from the latest annual report published by the Pakistan Telecommunication Authority (PTA). The telecoms watchdog’s report puts total telecom industry revenues at Rs644 billion in FY21, showing a growth of 9 percent year-on-year (FY20: -2%). In real terms, however, the industry revenue growth seems flat due to inflationary pressures.

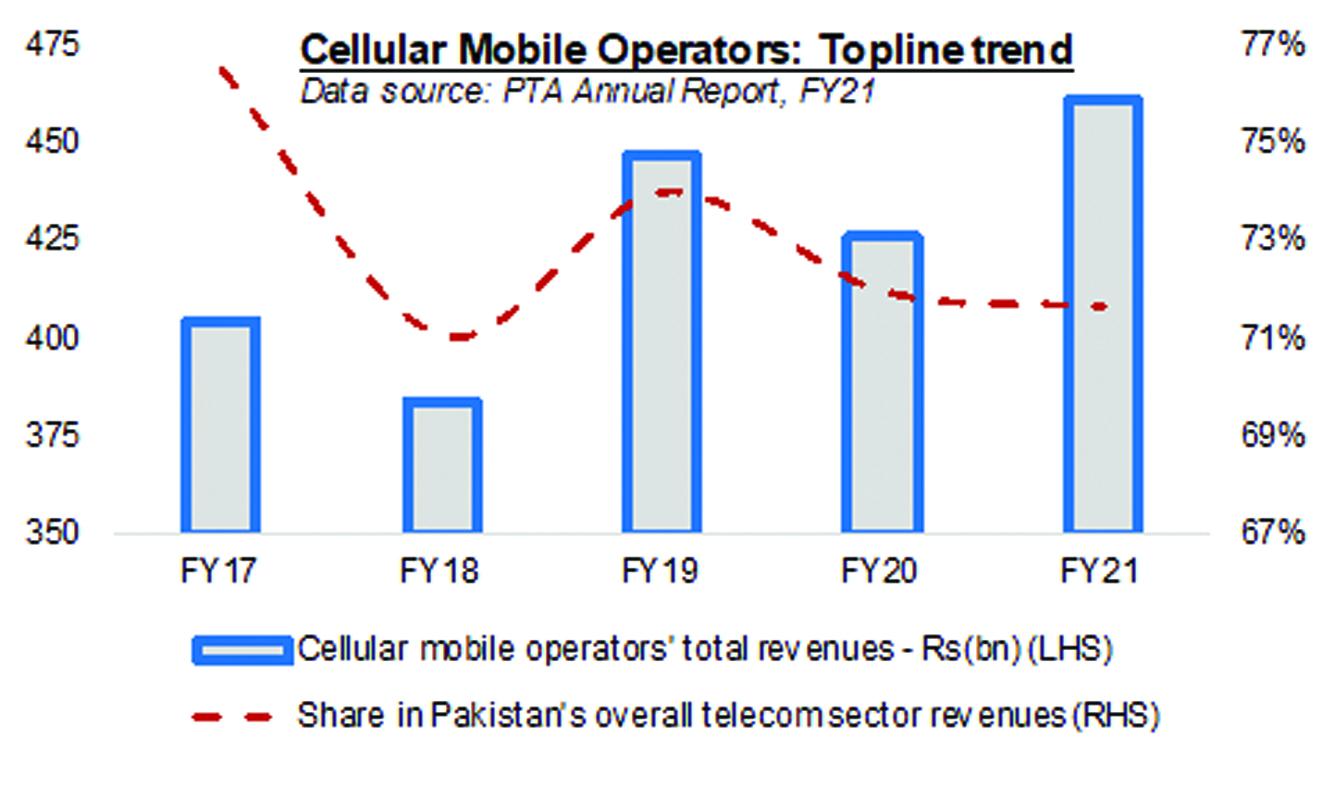

As ever, the industry’s growth trajectory remains dependent on cellular mobile sector, which usually provides roughly three-quarters of the industry’s topline per annum. In this piece, performance of cellular mobile operators (CMOs) is being analyzed (fixed-line and long-distance operators will be anaylzed in subsequent columns). During FY21, CMOs collectively reached Rs462 billion in revenues, returning 8 percent yearly growth (FY20: -5%). This helped lift industry spirits a bit in a tough operating year.

Not all CMOs have had a strong year, though. At the top is Jazz, which is the market leader by quite some distance. The Veon subsidiary posted annual revenues of Rs195 billion in FY21, jumping 12 percent year-on-year (FY20: -3%). Its formidable scale (especially post-Warid acquisition in 2016-17) and continued higher capital investments in its 4G sites expansion has helped Jazz reach a market share of 42 percent by sales during FY21, compared to the 39 percent average seen in the previous five years.

Second in line was Zong, with revenues of Rs105 billion in FY21, growing 10 percent year-on-year. (FY20: -5%). As a result, Zong’s market share reached 23 percent in the last fiscal, compared to previous five-year average of 19 percent. Telenor Pakistan wasn't far behind, with topline of Rs104 billion showing yearly growth of 3 percent (FY20: -2%). The operator is now ranked third in a four-player national market, with its market share declining to 22 percent in FY21, compared to the previous five-year average of 26%.

Ufone came last among the four operators, with its FY21 revenues standing at Rs55 billion, up 3 percent year-on-year (FY20: -14%). Its market share is on a steady decline, having 12 percent share in sector revenues during FY21, down from 13 percent to 14 percent share usually seen in previous years. Besides Telenor Pakistan, Ufone is the only other operator whose topline is yet to exceed pre-pandemic levels. Ufone has recently acquired sizable new spectrum, which is expected to bolster its subscription revenues.

Despite some amelioration in FY21, the sector’s key topline indicator – average revenue per user (ARPU) – remains stuck around Rs215 per month. While Jazz and Zong have better ARPUs than Ufone and Telenor, all operators seem to be struggling to raise ARPU to their respective pre-pandemic levels. There is certainly a lot of juice left in mobile broadband services, where current subscription tally at 110 million still has room to migrate tens of millions more 2G subscriptions onto 4G platform. That, however, requires singificant capex from all operators at a time when market seems to be getting more price-sensitive.

Comments

Comments are closed.