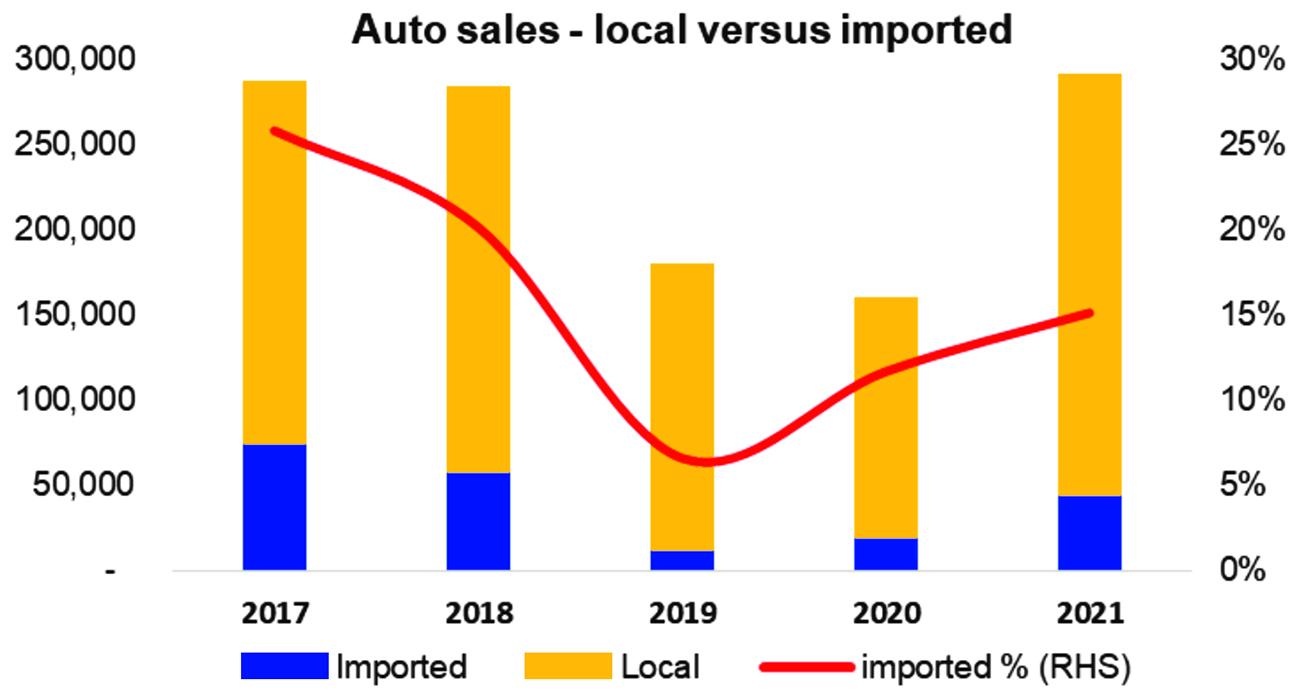

The automobile industry saw a number of new entrants come into competition to the three Japanese players, due to incentives offered under the automotive policy 2016-21. The production capacity increased from 275,000 to roughly 385,000. However, the overall sales (imported and local) of the cars have not increased – there were 288,000 units (excluding LCVs) being sold in 2017 and the number was 291,000 in 2021. In between, sales were below the 200,000-mark in 2019 and 2020.

The overall industry number has not changed. There are however shifts in composition. The share of local sales (CKD) is increasing – the imported cars (CBUs) sold were 74,000 in 2017, coming down to 44,000 in 2021. Local assembling has grown from 213,000 to 247,000—one-third of the capacity is not being utilized.

The interesting shift in the industry is the growing demand of SUVs (mainly compact SUVs). The share of SUV in cars was 7 percent in 2017 and it has gone up to 22 percent in 2021 – and is expected to grow further. This is in line with the global trend. In many countries, share of SUVs is over 50 percent and in India it has gone up from single digit to around forty percent in the last ten years.

Prior to the new entrants, SUV was mainly a rich man car in Pakistan. Toyota Fortuner and Honda BR-V were the two options in CKD. Then some demand was filled by imported cars – where Toyota Land Cruiser was the top seller. Then there were some hybrid options where Honda Vezel was the leading car.

Lucky Motors saw the opportunity and they came with a plan to be mainly an SUV company (apart from one car, all their models are SUVs). They introduced Sportage (a compact SUV) at a sweet price spot. Many sedan (Corolla and Civic) consumers shifted to Sportage. Today, it’s the top selling SUV in Pakistan. Kia doesn’t publish its numbers – industry estimates are that around 20,000 Sportage were sold in 2021. The company has launched three other cars in compact SUV segment; but none of these seem to be a raving success so far.

Seeing Lucky Motors, many others ventured in the same segment. Hyundai Tuscan is liked by many; but the local sponsors (Nishat Group) Is not aggressive and happy to sell fewer units at decent profits. Then there are number of other SUVs (Chinese and Malaysian) being introduced by their respective local partners. Some are making cars here and others are importing.

The general thinking is that if a company is assembling locally, that company is serious in the business and would invest in dealership network and its spare parts and second-hand markets to develop. This would mean that the investor is not a trader and would stay to provide after sale services.

Unlike, three Japanese players, none of the new player have investment of principal. They all are contract manufacturers. That is why the local sponsor commitment is important to gauge its presence in the long run. Here Lucky and Nishat groups are strong and they have made decent investment in plants and dealerships. They are likely to stay. Some of others some may stay, and rest will fizzle.

In 2021, over 13,000 new cars (CBUs) were imported. That is an unusual number. In the last four years average new CBUs import were 1,400. The increase is mainly due to new entrants (Chinese and Malaysian) which are importing new SUVs and selling in the market.

MG is on top of the list. It was launched with a fan-fare and promise. MG-HS was too good for its price at the time of launch. The sponsors were smart in marketing and their spent was primarily in marketing. They saw the opportunity and didn’t wait for local production and kept on selling the imported (CBU) units. To-date they have sold 10,000 MG-HS – all CBUs. Now the government has applied a regulatory duty on MG-HS category cars. The price of imported unit has increased by an exorbitant amount. Now the survival of MG-HS or any other car by MG is on local production. They have not yet gotten the license to assemble. The process of acquiring license is on-going for over a year. If MG doesn’t get the license, it’s probably dead.

Then there are other players who are mainly relying on imported units to penetrate in the market. In 2021, 695 Haval (Jolian and H6) and 387 Proton Saga & X, new CBUs are being imported. However, not every new Chinese player is relying on imports. Changan is doing it the right way. The company is not selling CBUs as such – just like Kia-Lucky and Hyundai-Nishat. The have recently launched a compact SUV- Oshan. It’s a beautiful futuristic car at a decent price. Many say it’s giving the right value for money. The company has decent number of dealership and seems serious in the business.

However, that doesn’t mean other new entrants are not serious. But till they start producing and selling locally assembled cars, their future will remain questionable. How much the car market will grow in Pakistan depends on a lot of different factors, not just more options made available in the market. The more prominent and visible trend is the conversion to SUVs, which will see more hybrid options into the mix. A big Japanese carmaker is coming up with CKD crossover option, for consumers to watch out.

Comments

Comments are closed.