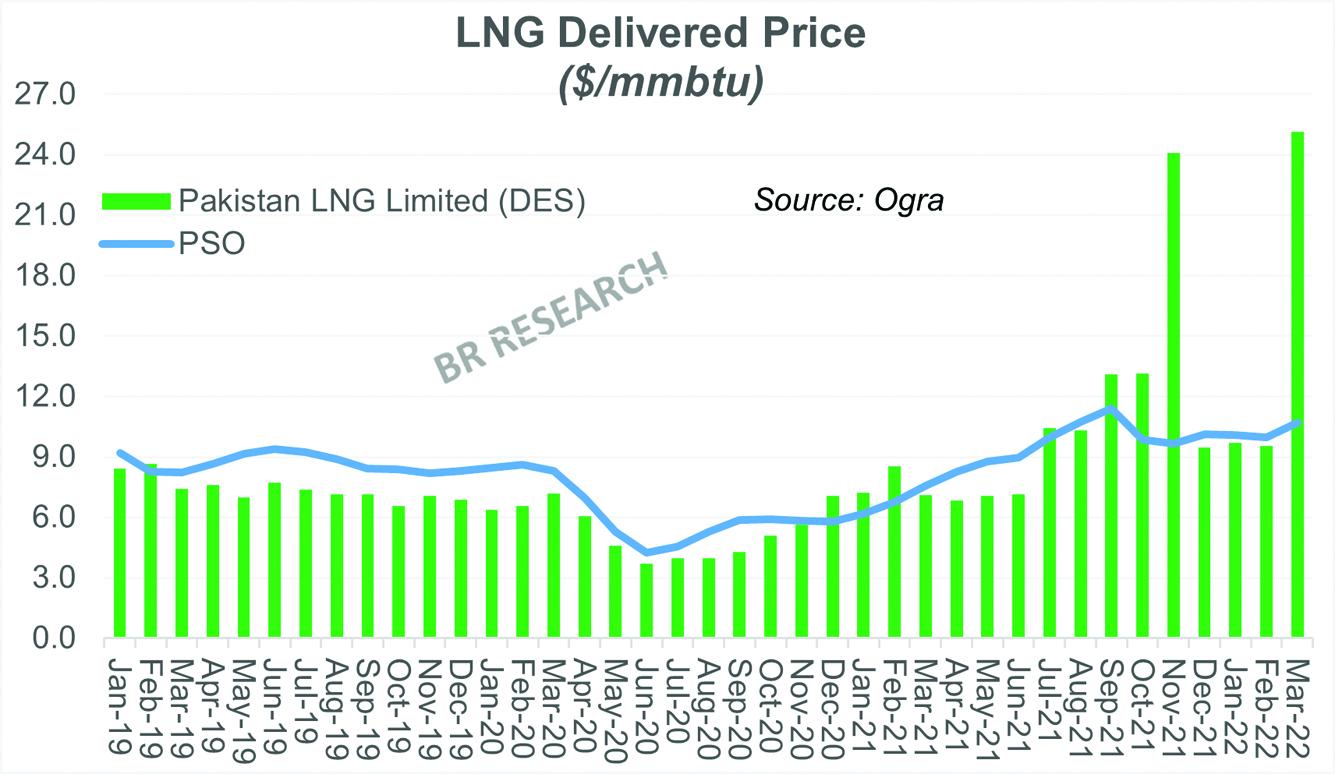

The LNG fiasco has lasted longer than earlier expected. The Russia Ukraine scenario is still playing out, but LNG supply for the next two to three months is still in limbo. Prices may have softened from the last week highs but remain significantly higher from last month or the previous peak seen in October 2021. The marginal cargoes are all expected to go to Europe at the current spot rates, which have gone to as high as $60/mmbtu in extreme cases.

Pakistan has attracted just one bid from the spot market for March 2022 at a delivered ex-ship price of $25.12 per mmbtu. This is the highest everprice for an LNG cargo for Pakistan, beating the previous high of $24/mmbtu in November 2021. The distribution price for consumers shot up to $31.8/mmbtu excluding GST. The blended RLNG price including the long-term cargoes from Qatar shot up to $15.8/mmbtu – also the highest ever monthly price at distribution.

The slope for RLNG delivered ex-ship prices is based on last three-month average, and that means the weighted average RLNG price is slated to be even higher for April and possibly May. Brent price for March 2022 is based on Dec-Feb average price of $84.7/bbl. For next month, December will go out and be replaced with March – which could take the average Brent for slope to near $100/bbl – a 15 percent month-on-month increase. The long-term supply DES alone is expected to surpass $13/bbl. Add other retainage costs, and ever-increasing T&D losses – and it will reach the consumer at no less than $16/bbl.

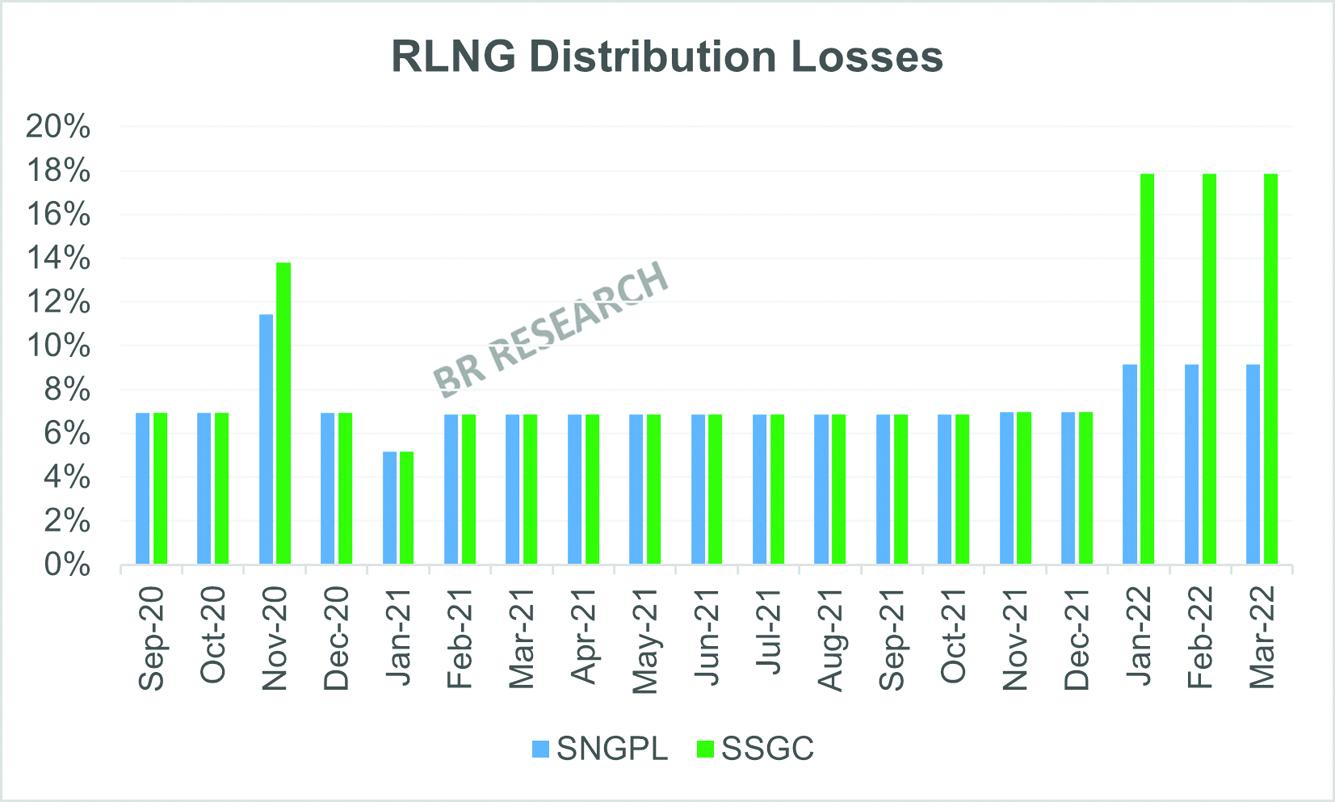

Distribution losses, meanwhile, have risen significantly from last year, adding to the consumer end price. In case of SSGC, the distribution losses made part of the final price have almost doubled to 18 percent, from 9 percent last year.This is well over the tolerance that the regulator has for UFG allowances in case of natural gas.

Be that as it may, as the mercury rises, the need for RNG plants to be running at full throttle will arise again. It remains to be seen if enough imported gas will be made available to have the efficient plants running on merit order. The fuel component of electricity generation is expected to stay high in the near future.

Comments

Comments are closed.