Ahmad Hassan Textile Mills Limited

Ahmad Hassan Textile Mills Limited (PSX: AHTM) was established as a public limited company in 1989 under the Companies Ordinance, 1984. It manufactures and sells yarn and fabric. The company has its own in-house production capacity from the process of ginning to weaving.

Shareholding pattern

As at June 30, 2021, over 57 percent shares are held by the directors, CEO, their spouses and minor children. Within this category, a major shareholder is Mr. Muhammad Haris, the CEO of the company. The local general public owns about 31 percent shares followed by close to 11 percent shares in NIT & ICP. The remaining about 1 percent shares is with the rest of the shareholder categories.

Historical operational performance

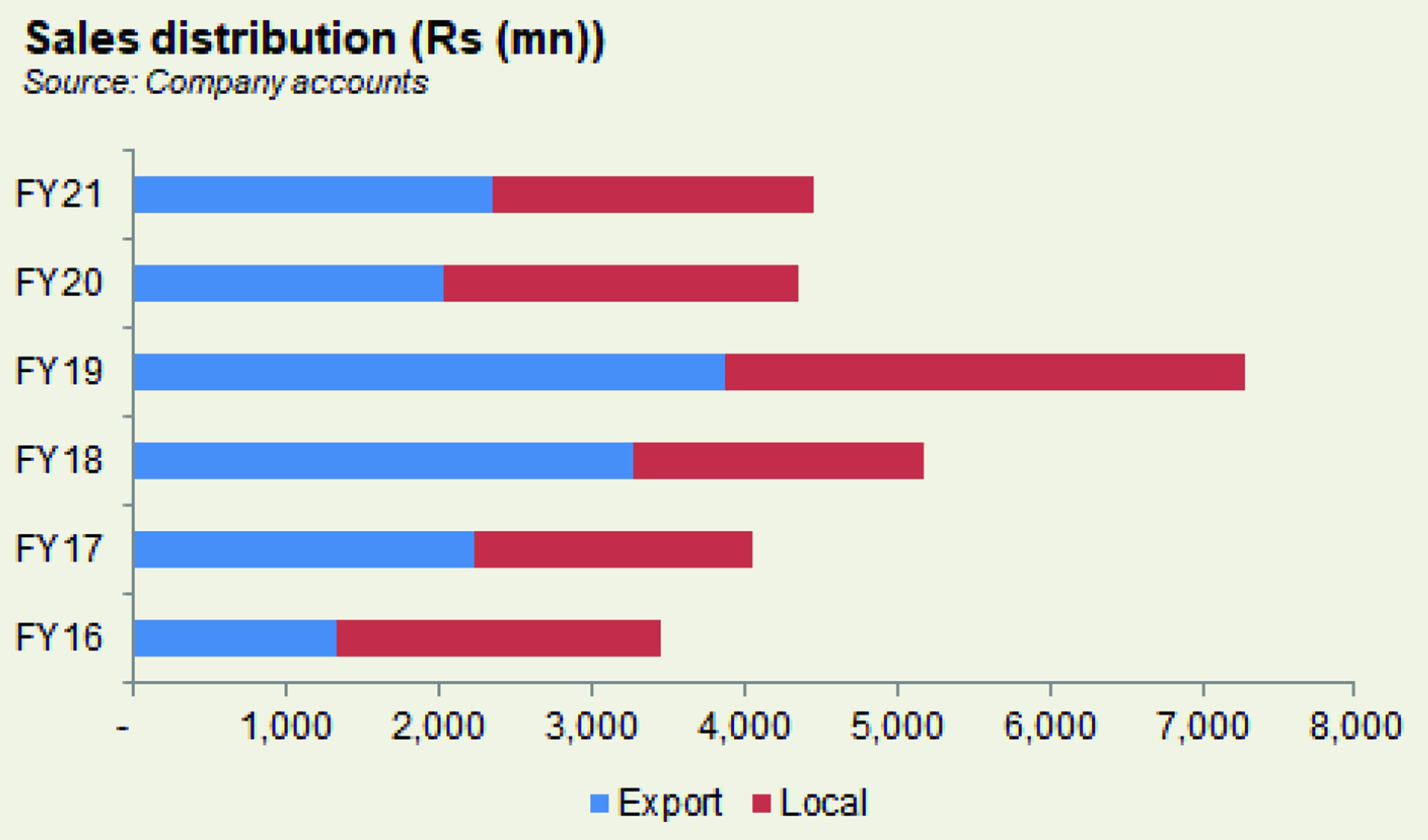

The company has experienced a fluctuating topline between FY12 and FY15 after which it has mostly been on a rise, except for in FY20. Profit margins in the last six years particularly have been increasing gradually.

In FY18, the company witnessed the largest growth in revenue thus far, at close to 28 percent to reach Rs 5 billion in value terms. Majority of this growth was associated with export sales that grew by 46 percent owing to currency devaluation that made exports competitive in the global market. Local sales, on the other hand, grew marginally by 4.6 percent. Segment-wise, both yarn sales and fabrics sales posted growth. With a marginal increase in cost of production as a share in revenue, gross margin was flat at close to 6 percent. But with operating expenses and finance expenses making a smaller share in revenue, the company posted a net profit of Rs 10 million versus a net loss of Rs 3 million.

Revenue was growth was even higher in FY19 as it grew by over 40 percent to reach Rs 7.3 billion in value terms. Local sales almost doubled year on year from Rs 1.9 billion to Rs 3.4 billion while export sales also posted a growth of 19 percent. The reason for a shift in focus from export sales to local sales is deliberate as there was stiff competition in the global market from regional countries. Again, with a marginal decline in cost of production, gross margin remained close to 6 percent. Similarly, with decrease in operating expenses as a share in revenue, net margin also improved albeit marginally, to 0.56 percent.

Previously the company had witnessed a marginal growth rate of 1 percent in revenue in FY20. But upon restatement of financial statements, sales have reduced by over 48 percent to fall to Rs 3.7 billion. In accordance, cost of production also reduced significantly year on year, but as a share of revenue, it reduced to almost 93 percent, allowing gross margin to improve to 7.2 percent. This also trickled to the bottomline that was also supported by a reduction in finance expense from 2.6 percent of revenue in FY19, to 1.7 percent in FY20. Thus, net profit increased notably to 3.1 percent. The restatement has been due to a demerger whereby the weaving division is retained by the company while the spinning division is transferred to Ahmad Hassan Spinning Limited.

In FY21, revenue posted a marginal growth of close to 2 percent to reach Rs 3.8 billion. While export sales posted a growth of almost 15 percent, local sales declined by 8.7 percent. A further breakdown reveals that direct exports had reduced, while indirect exports of fabric through Standardized Purchase Orders (SPOs) increased. This was combined with a reduction in cost of production to almost 92 percent allowing gross margin to increase to 8 percent that was the highest seen since FY15. With some support from other income and a further reduction in finance expense to less than 1 percent of revenue, net margin reached a peak of 4.4 percent.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by 23 percent year on year. This can be partly attributed to an increase in price of fabric. Despite the increases in cost of inputs as claimed by the company, cost of production as a share in revenue has decreased year on year allowing gross margin to improve to 10.5 percent for the year compared to 6.4 percent in 1QFY21. This also trickled to the bottomline that was supported by a combination of other income and profit on trading that was negligible in the same period last year.

The second quarter also saw revenue higher year on year, by 64.4 percent. But the effect of rising cost of inputs was reflected in 2QFY22 as gross margin reduced to 8.3 percent compared to almost 12 percent seen in 2QFY21. This also reflected in the bottomline as net margin was recorded at 3.5 percent compared to 7.7 percent seen in the same period last year.

The rising cost of inputs continues to pose a challenge for the industry’s profitability. In addition, the benefit of higher export orders for Pakistan due to regional competitors being closed due to a dire Covid-19 situation has also reduced as countries like India and Bangladesh return to the international market. But the government’s textile policy brings some hope for the industry players. For the company, it has commissioned a solar system that would help reduce the energy cost significantly.

Comments

Comments are closed.