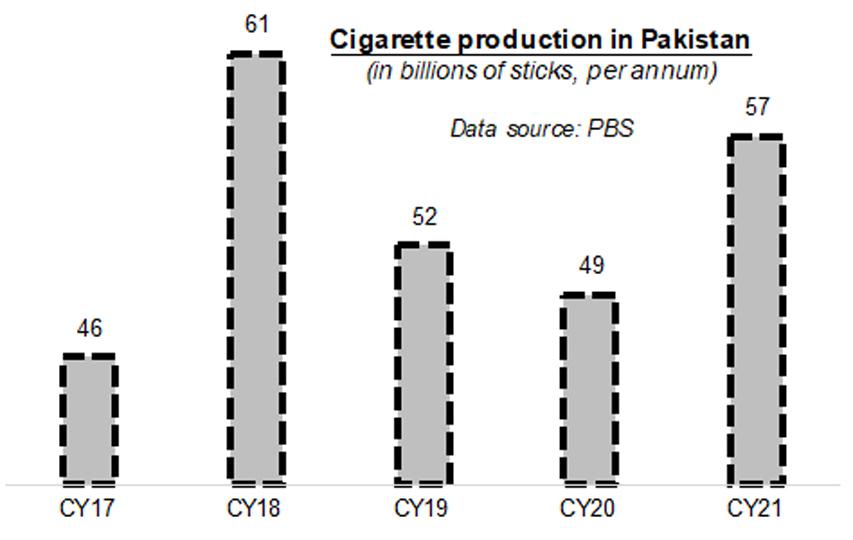

Cigarette makers have been on fire lately with rising output. As per calculations based on recent production data from the Pakistan Bureau of Statistics, the reported cigarette production in Pakistan stood at 57 billion sticks during CY21, showing a yearly growth of 16 percent. That’s an additional ~8 billion sticks produced last year compared to CY20. This marks one of the sharpest growth spurts for the formal tobacco sector in recent years.

With 4.75 billion cigarette sticks produced on average per month during CY21 (CY20 average: 4.11 billion cigarette sticks per month), the formal players were seen making progress in getting close to their practical capacity to produce 6 billion+ sticks per month. Already in January 2022, the cigarette production had been reported by the PBS at 5.6 billion sticks, a yearly growth rate of 23 percent.

In the past five years, peak production was seen at 6.3 billion sticks in April 2018, as per the PBS data. Whereas the lowest monthly output was reported at 1 billion sticks during June 2019.Analysis of past five years of data shows that cigarette output often takes wild swings in the months immediately after June. And June, well, it is the month when federal budget is announced, with changes (increase, decrease or no change) in FED that is levied on cigarettes, thus impacting retail prices of cigarette packs.

Considering sharp swings in output, it is difficult to make full sense of cigarette production data. Smoking is a sticky habit, so one would normally expect low single-digit increase in annual cigarette production (or conversely, one would expect marginal yearly decline in output if there is a gradual trend of folks kicking this habit). In Pakistan’s case, there is no confirmed trend of smokers actively disavowing this addiction – in fact, it is generally assumed that the number of smokers is on the rise due to growing youth population.

Over the past five years, calculations based on official data show that there was 32 percent year-on-year growth in cigarette output in CY18; this was followed by 15 percent decline in CY19; a further output drop of 5 percent was seen in CY20; a reversal came in CY21, with 16 percent yearly production jump. Such abnormal output growth pattern in a mature industry is mysterious, considering there cannot be sudden double-digit increase (or decrease) in either the number of smokers or cigarette usage percapita.

The argument that is usually put forth by the formal industry to explain such significant deviations in annual cigarette output mostly revolves around their claims of illicit manufacturers undercutting formal sector sales via cheap, duty-non-paid (DNP) cigarettes. The argument goes that whenever the federal government imposes higher FED on cigarettes, it hurts formal players’ competitiveness by expanding their unfavorable retail-price-differential with DNP brands. The higher cigarette output in recent months, therefore, is attributed by industry players to government’s decision to not raise the FED in FY22 budget.

The DNP sector exists, but there is lack of consensus on whether it is large enough to impact formal sector. As per latest information, the top-two tobacco players have recently suggested that the illicit/DNP cigarettes have a 37 percent market share in overall cigarettes that are sold in Pakistan. This claim is contested by anti-smoking campaigners and public health activists, who characterize such lofty estimates as part of big tobacco’s strategy to dissuade government from further raising FED on cigarettes.

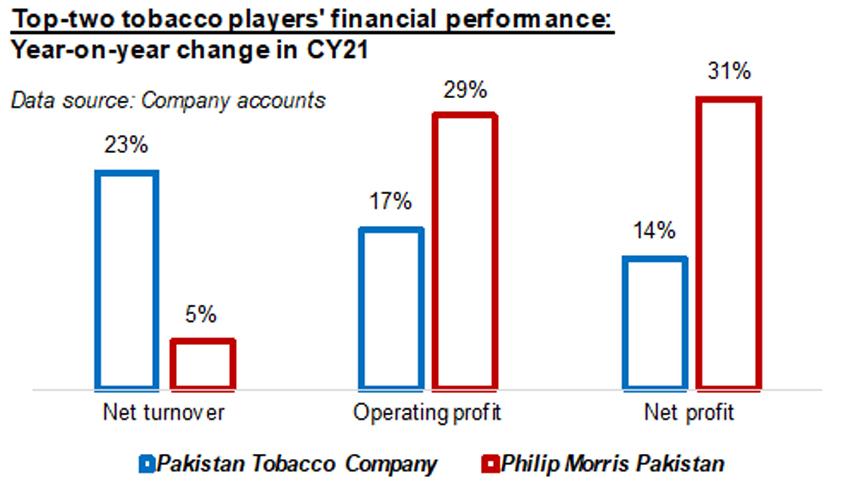

Meanwhile, industry fortunes witnessed strong growth last year, as shown in latest financials of the duopoly, Pakistan Tobacco Limited (PSX: PAKT) and Philip Morris Pakistan Limited (PSX: PMPK). During CY21, net turnover grew for PAKT by 23 percent year-on-year to Rs75 billion; for PMPK, it grew by 5 percent year-on-year to Rs17.5 billion. Net profit increased for PAKT by 14 percent year-on-year to Rs19 billion; for PMPK, it expanded by 31 percent year-on-year to Rs2.3 billion.

Let’s see what CY22 has in store for the tobacco industry. All eyes will now be on the next budget, which is due in a few months’ time. However, the likelihood of an FED hike on cigarette sales currently appears to be low. If that turns out to be the case, it should support cigarette output growth, and, in turn, further boost industry financials for the remainder of this year.

Comments

Comments are closed.