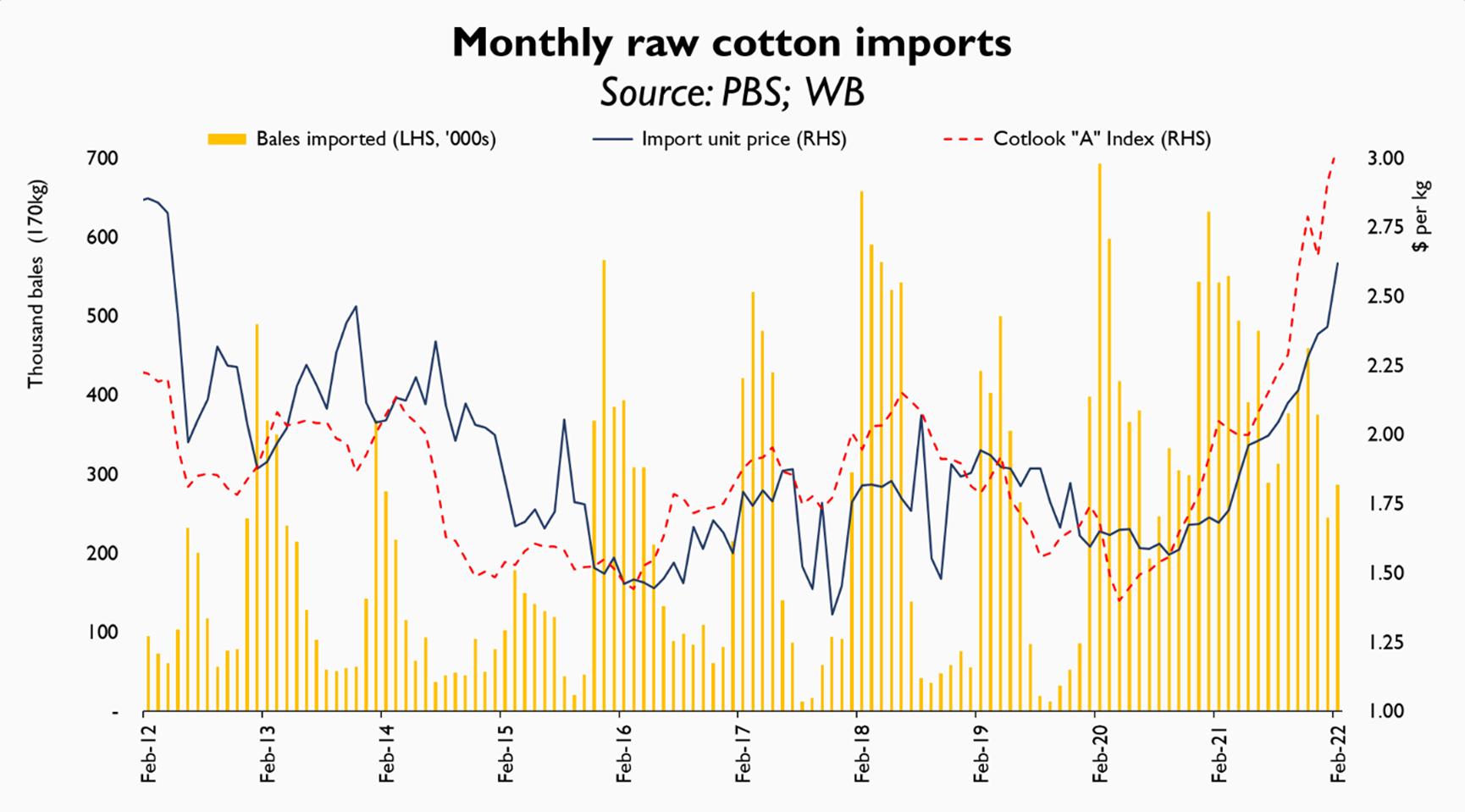

Pakistan’s cotton imports fell to 2.75 million bales during 8MFY22, down by 12 percent over same period last year. At monthly run rate of 0.35 million bales (of 170kg), full year imports may clock in a little over 4.1 million bales, against imports of 5 million bales during FY21.

Does the lower import quantum come as a surprise? Yes. Despite decade-high cotton prices in the international market, USDA has projected Pakistan's imported cotton demand in excess of 7 million bales (or 1.1MMT). This would have been highest-ever importing volume in country’s history, against previous peak imports of 5.2 million bales in FY08, almost 14 years ago.

The bullish forecast had come on the back of both buoyant textile exports, as well as lower-than-expected domestic cotton arrivals of 7.45 million bales (of 170kg). Market watchers will recall that USDA had projected cotton consumption at 14.3 million bales for FY22, up 5 percent over the estimate for the preceding year.

Although USDA’s forecast is in line with market consensus which places domestic demand at 15 million bales, that estimate has rarely withstood the test of evidence. Between FY19 and FY21, Pakistan’s actual production + imports averaged at 12.2 million bales, down from 14.3 million bales over previous decade. Even if the difference (in its entirety) is chalked up to underreporting in local production post-imposition of GST on ginning, annual consumption maxes out at 14.5 million bales.

FY22 was supposed to change that. Recent developments in both domestic and international market had supposedly tilted global textile trade in Pakistan’s favour, with exporters all set to grab a greater share of western export market. Reportedly, textile export volume has leapt ahead, buoyed by depreciated currency, trade finance and banking credit for expansion on concessionary terms, and competitive pricing for energy.

Yet, based on 8-month import data, demand for cotton during FY22 may struggle to keep up with last year’s volume, let alone record a fresh peak. This is based on estimated carryover inventory of 3 million bales from last year, local output of 7.5 million bales, and imports maxing out at 4.1 million bales (or 0.7MMT) by fiscal year end.

What gives? Consider that monthly imports are now down to 0.3 million bales (last 3M average) compared to 0.6 million bales, same period last year. Back then, import unit price had averaged 77 cents per lb during Q1-CY21, which has since risen to 115 cents per lb. Higher prices clearly appear to have depressed demand, even if temporarily. And with global commodity price spiral showing no end in sight, importedcotton consumption may remain subdued, until the next crop arrives in 6 months’ time.

Which once again raises the same BR Research loves to ask but itself struggles to answer conclusively: with little to no increase in long term cotton consumption (as indicated by local production + imports) by spinning industry and demand averaging between 13 -14 million bales, is the growth in textile export volume coming at the expense of local sales?

Comments

Comments are closed.