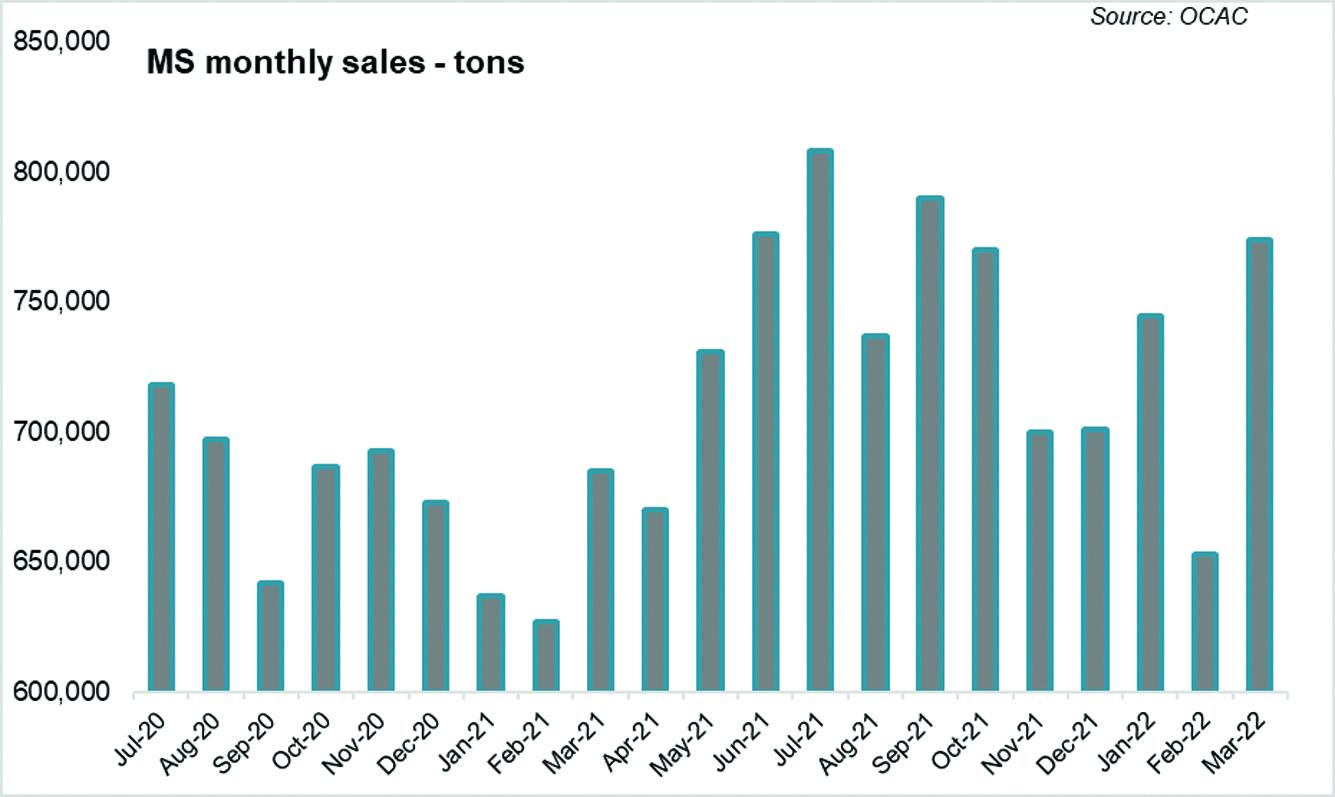

After a slower February 2022, petroleum product sales in March 2022 are back to being robust. Sales of petroleum products by the oil marketing companies in March 2022 were seen increasing by 23 percent year-on-year. The return of robustness in March however is evident from the month-on-month increase in total OMC sales by 19 percent.

The year-on-year growth in OMC volumes was led by furnace oil that increased by 34 percent, followed by 29 percent growth in HSD volumes, and 13 percent rise in MS volumes. The trend was similar in month-on-month growth in OMC volumes with FO leading. While the rise in furnace oil volumes was dictated by higher furnace oil consumption in the power sector amid low availability of gas and RLNG, the rise in HSD volumes is due to improved demand from the transport sector and agriculture activity as well as increased usage in generators and power sector. Motor spirit sales grew in March 2022 due to improved economic activity and car sales. However, a key factor in month-on-month growth in diesel and petrol sales was the capped prices by the government and higher number of days in March versus February.

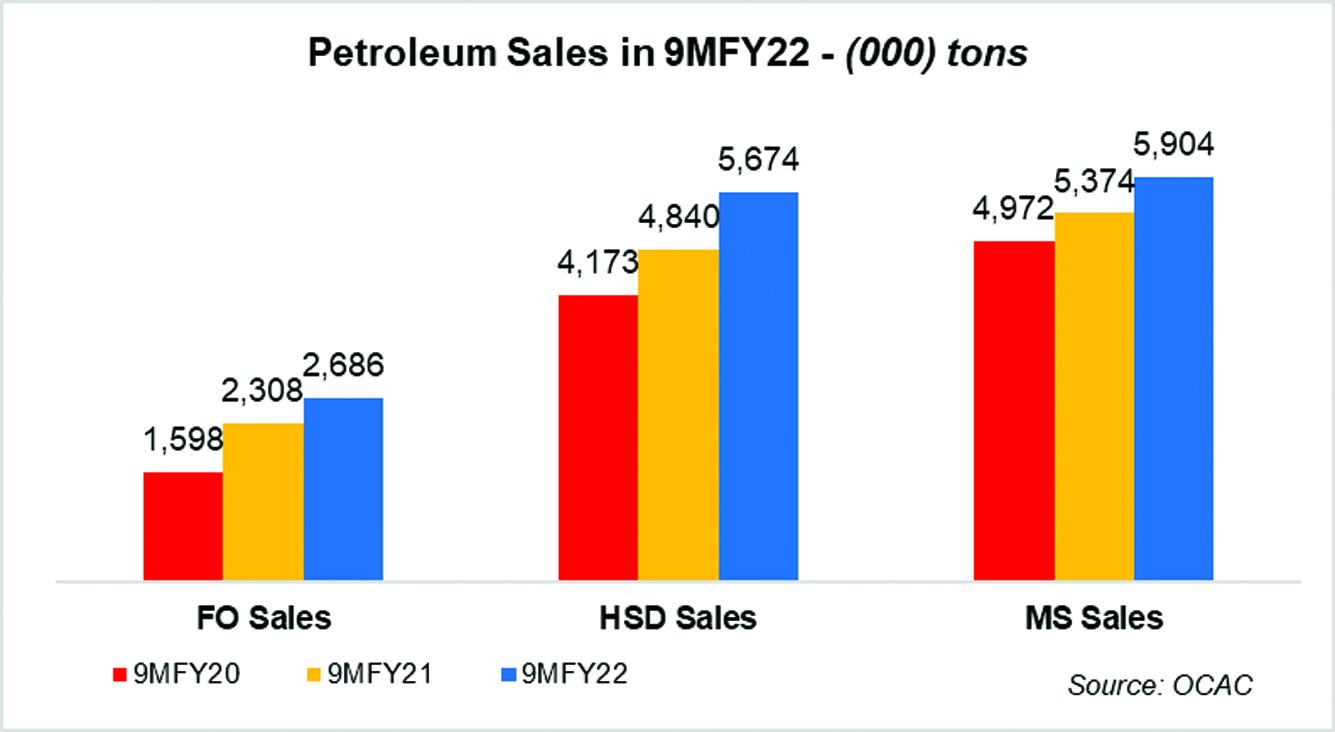

Overall, in 9MFY22, petroleum sales were seen growing by 19 percent year-on-year with double digit growth for all three products. This was led by diesel sales increasing by 17 percent, followed by furnace oil, and motor spirit with growth of 16 percent, and 10 percent, respectively.

In the coming weeks and months, where some are expecting that petroleum consumption – that is, OMC sales - could see a dip due to the current turmoil along with increasing commodity prices affecting demand, the expectations of higher furnace oil consumption cannot be ruled out as the country enters summers when demand from power sector may tilt towards furnace oil because of the defaults on RLNG commitments. Whether price control will continue to provide buffer for petrol or diesel is however uncertain as the policy may be reversed amidst ongoing political turmoil.

Comments

Comments are closed.