Much has been said about the relentless rise in food prices under PTI’s tenure. Over the past four years, food sub-index of national CPI rose by 55 percent, in close lock step with currency value. The rise and rise of basic food items during this period has helped lay emphasis on excessive national dependence on import, especially for kitchen essentials such as daal and cooking oil.

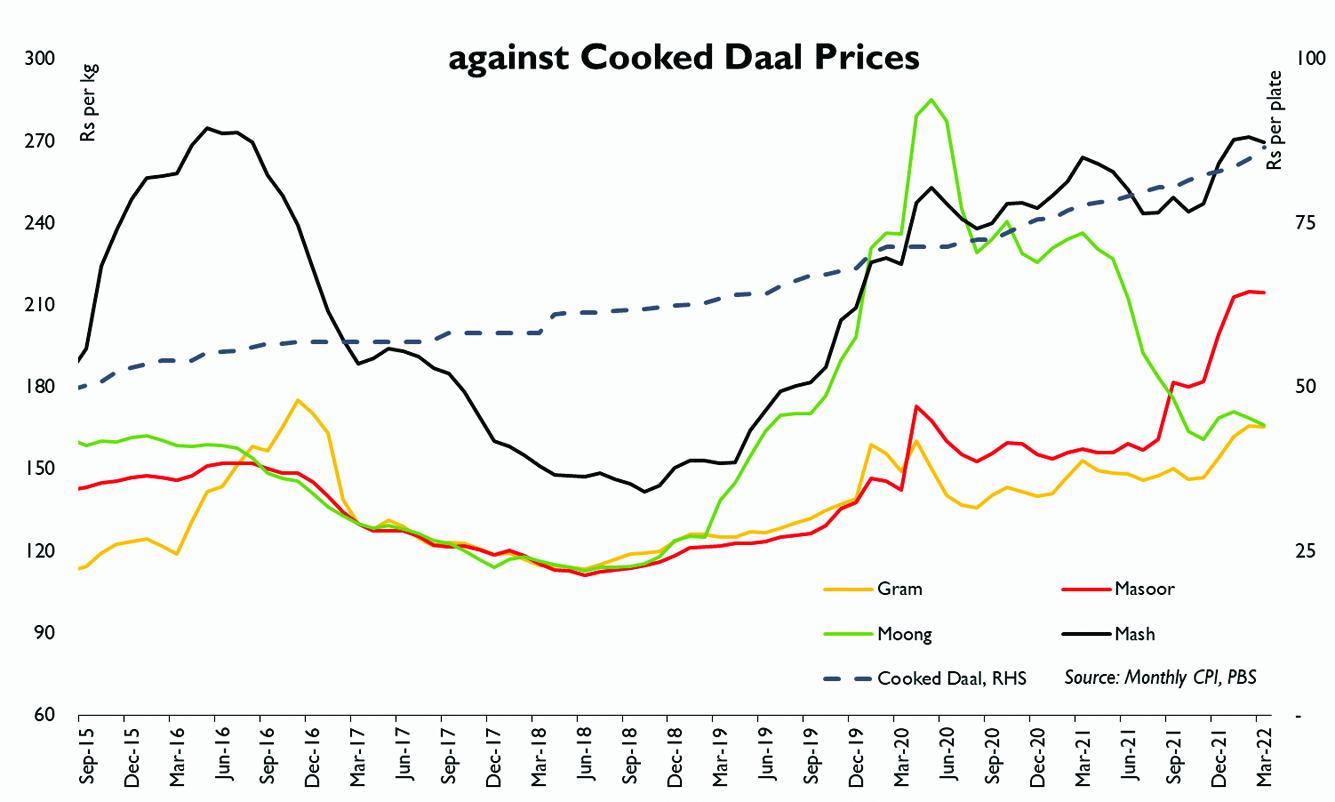

But despite several rounds of Rupee depreciation and a roaring commodity crisis across the globe, pulses offer a glimmer of hope. According to monthly SPI statistics that tracks prices for the bottom income quintile across the country, price of average plate of cooked daal has risen by less than the dollar since PTI came to power nearly 3.5 years ago.

Although the relative difference in growth may not appear much to write home about, the contrast becomes stark when one accounts for change in production over the same period. Since 2018, domestic gram production – colloquially known as daal chana and the staple pulse of the masses - has fallen precipitously, declining by nearly 30 percent by 2021. Over the medium term, fall in gram production has been particularly spectacular, falling from 0.75 million tons in FY13 to a little under 0.23 million tons by FY21. As per provisional statistics, output during the outgoing FY22 will be hardly any higher than last year.

Given that daal chana (or gram) accounts for as much as 40 percent of total volume of pulses consumed locally, the relative stability in daal prices is of particular significance. Consider that over the past 10 years, Pakistan went from self-sufficiency in daal chana (gram) to importing at least 50 percent of annual demand.

Yet not only has the country not faced the specter of daal shortage, daal prices have risen much slower than prices of other staples such as flour or sugar; and in fact, at nearly the same pace as basmati rice, of which Pakistan exports a significant marketable surplus. All this, it bears emphasis, at a time when the currency has virtually been in a free-fall.

The answer to this mystery is of course a competitive import market. Pulses imports have so far been subject to little market intervention, with tens of small to medium sized trading firms fiercely competing with each other in a relatively low tariff environment.

Unfortunately, currency stability considerations have meant that the $0.75 billion annual import bill of pulses is now attracting growing scrutiny. Last week, SBP imposed cash margin requirement on pulses import, including gram dry whole – Pakistan’s favorite daal. Of course, SBP’s actions are driven by preference for demand suppression, without any due consideration to socio-economic concerns of affordability.

The bank can do precious little to increase local production in the short-term, while the likely increase in consumer prices as a result could mean smaller serving sizes for the poorest. Pakistan pulses production has fallen over the past decade for one basic reason: its competition for acres with wheat during Rabi season. This means that gram is unlikely to become the preferred choice of growers at a time when country is also in the throes of a wheat shortage.

The stability in international prices of pulses is an under-rated phenomenon and has significantly contributed to Pakistan not spiraling into large scale food shortages and riots, despite the 75 percent rise in price of essentials such as wheat. Raising barriers to import for food essentials such as pulses is a grave error, especially at a time of extreme political and economic uncertainty. If imports bill is to be curtailed, SBP must find other avenues. The cash margin requirement is a grave error that must be redressed immediately.

Comments

Comments are closed.