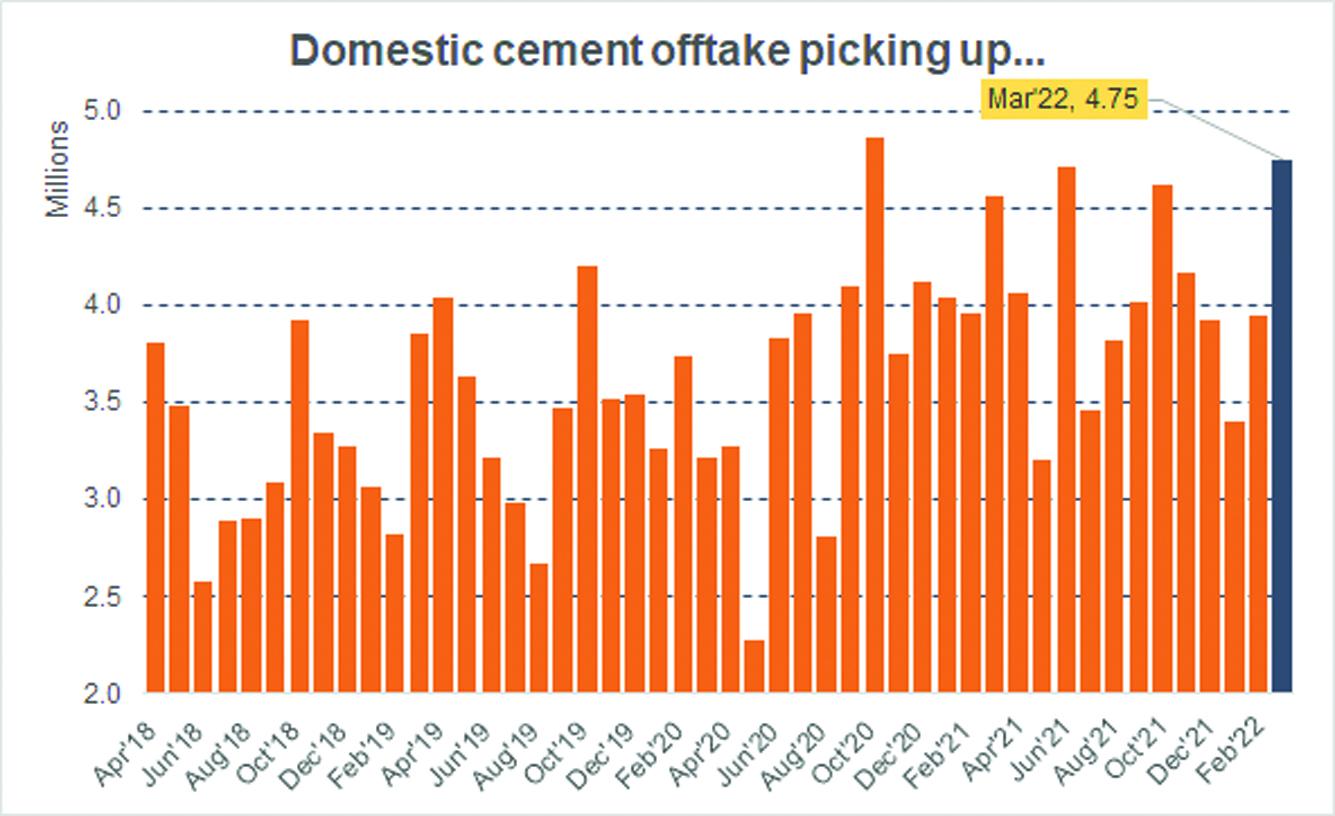

PM Imran Khan’s unceremonious exit, brimming with political drama and chaos, is sure to induce more economic uncertainty than ever before. The future of the Naya Pakistan Housing Program and its ambition of building 5 million houses certainly hang in the balance. Amid rising inflation and cost of materials, construction activities in private and public development, despite government incentives under the construction amnesty scheme and the SBP’s markup subsidy for home loans, have already been stalling. In March, even though, cement sector dispatched more than 5 million tons of cement to domestic and foreign markets, the industry’s demand has been cut by 6 percent cumulatively since July. In 9MFY22, domestic dispatches have remained as last year at 36 million tons while exports have dropped by 33 percent; not contributing 12 percent to the industry’s total dispatches compared to 16 percent last year.

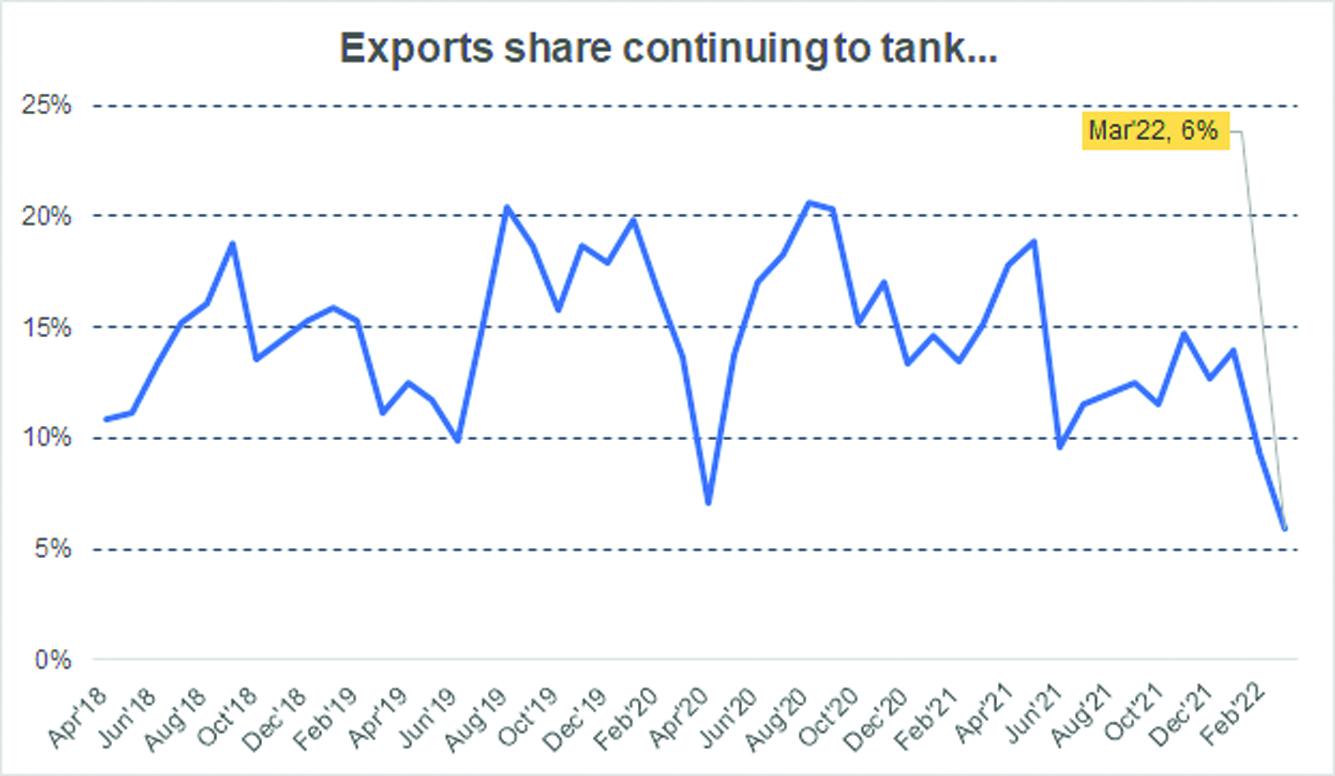

March, the last time under the ousted government, demonstrated some recovery in demand having reached the 5-million-ton mark again since Oct-21 but it is no where near the demand expectations for cement manufacturers that have entered a new expansion cycle. In monthly dispatches, exports share has tanked to nearly 5 percent owing to really high freight rates making exports abroad unviable. Exports have also fallen cross-border to Afghanistan owing to the political upheaval in that country. Construction is also halted in other markets such as Sri Lanka which are feeling the burn in their pockets due to inflating. Default in that country seems almost imminent. At such time, when inflation is very high, and commodity prices in the international markets due to the Russia-Ukraine war are continuing to spiral out of control, it becomes a matter of survival and not getting hit by the wrecking ball.

Cement’s major raw material, coal has fallen prey to chaotic demand-supply dynamics since covid-restrictions lifted. At first, it was China’s ballooning demand that sent prices hurtling forward and now it is massive bans on Russia that are keeping coal prices in flux. Some hope on the horizon exists to find equilibrium but in the interim, cement manufactures have been moving their coal procurement to Afghanistan’s cheaper coal (25-30% lower than South African variety) where many manufacturers in the north are using up to 70 percent Afghan coal in the mix. However, Afghan coal prices are also rising in tandem with global prices and rupee depreciation does not bode well on the imported cost front anyway.

The industry will get squeezed from both the revenue side and the cost side over the coming months. Demand expectations given the political situation in the country are weak. Rising construction costs—among which steel prices have nearly doubled—are keeping private constructors at bay. Those public projects where funding has been released will continue with construction. At such a time, if cement manufacturers continue to raise prices, it won’t be useful to margins since demand is already weakening. They will go by the ear. They might even reduce production or shut down plants if demand plummets too much. If Afghan coal becomes infeasible too, coal procurement would have to be delayed leading to reduce production once again.

Comments

Comments are closed.