Cement exports have been tanking, greatly compounding the effectson total industry output of a slowing domestic market where demand has trudged forward at snail speed.This is certainly to become more pronounced in the coming months as political climate at home heats up and the newly formed government tackles more pressing issues within the economy. Inflation has really bummed out demand and within construction, where prices for building materials have gone up several folds (read: “Construction costs: Breaking back!”), new construction demand may take a backseat.

Under normal circumstances, exports provide a buffer for the cement industry to unload excess supply of cement and maximize capacity utilization wherever it makes economic sense. But exports have become unsustainable overseas as well as cross-border. One reason is a clear slowdown in construction demand around the world as markets grapple with dangerously high inflation. Freight rates have been up 4-5x over the past year since covid hit and the supply chain disruptions have still not resolved, now only excacerbated by the ongoing Russia-Ukraine war. There is a continued shortage of containers which has caused

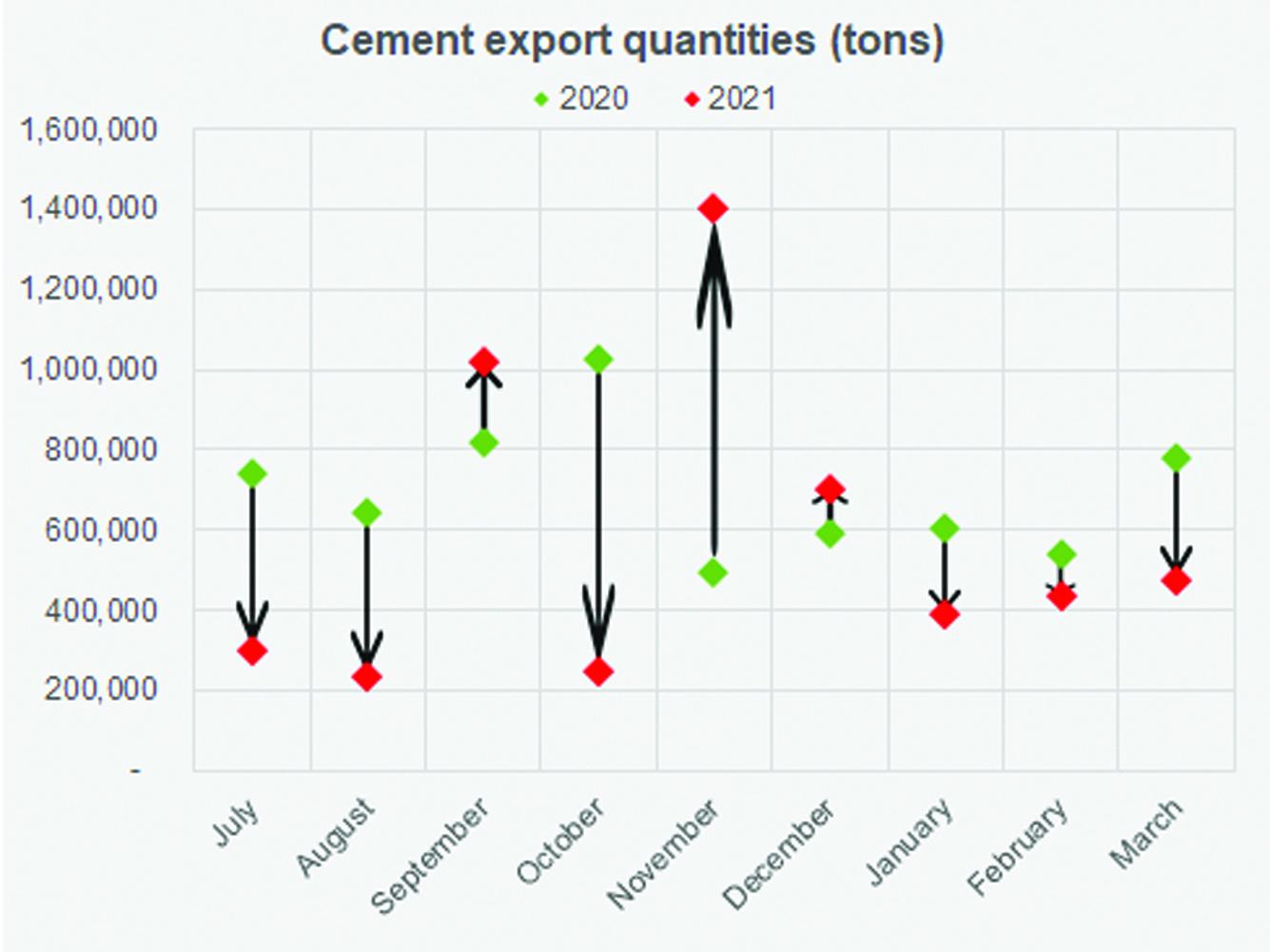

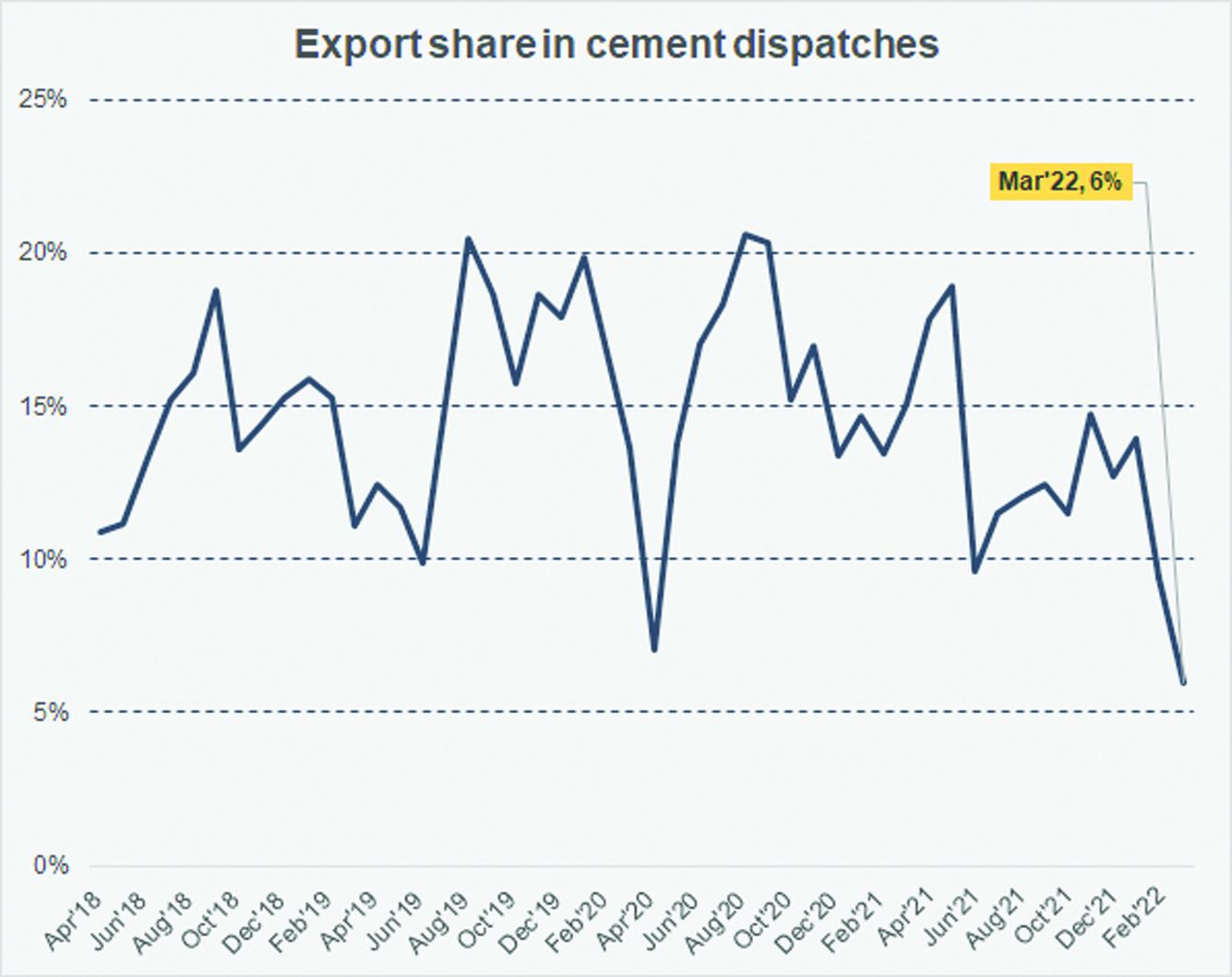

Numbers show exports share in total dispatches has dropped to 6 percent—and 12 percent cumulatively for the period 9MFY22 (9MFY21: 16%). Based on PBS data, each month since July, the industry has sold less and less quantity of cement abroad compared to last year. The export price fetched (estimated dollar per ton) is also substantially higher (see graph) which is making exports uncompetitive.

Until recently, Pakistan was exporting a large quantity of cement to next door neighbor Afghanistan despite other suppliers like Iran biting into some of Pakistan’s cement market share. Over the years, reliance on Afghan market was reduced by cement manufacturers exploring other export avenues and gaining market access in other regional markets such as Sri Lanka. India was also at one point a big market for Pakistani cement until the country slapped countervailing duties on Pakistani goods, upwards of 200 percent that made exports impossible.

The situation right now is worse. With US exit from Afghanistan, the country is facing a massive political and economic upheavel. Banking channels were suspended in Afghanistan which is causing financial challenges for the country, specially in keeping trade going. Afghan traders were found buying dollars from KP to resume their trading activities. Through SRO 176(I)/2022 providing an ammendment to the Export Order, the government of Pakistan has allowed exports of 14 items in Pakistani rupee. But these exports are not entitled to zero rated sales tax, rebate against excise and duty drawbacks.

These are making Pakistani exports to Afghanistan unviable, given also a reduced demand for construction in the country already.

Other markets are also drying up. Sri Lanka has officially defaulted on its loan obligations and will be focusing on providing essential items to its population with construction and development taking a backseat.

Overseas, Pakistani cement manufacturers have to contend with high frieght costs making their exports uncompetitive. Markets such as South Africa have imposed a ban on cement imports for state projects. Other African markets where Pakistani cement has access are also undergoing similar economic slowdowns, already constituting only about 5-6 percent share in total Pakistani exports.

At the end, no hopes can be latched onto exports as cement manufacturers grapple with reduced domestic demand which lies in sharp contrast with optimistic demand expectations held by all and sundry prior;in part due to ousted PM’s extravagant promises of building 5 million houses.That was a long shot anyway.

Comments

Comments are closed.