PAKT: topline slowing down?

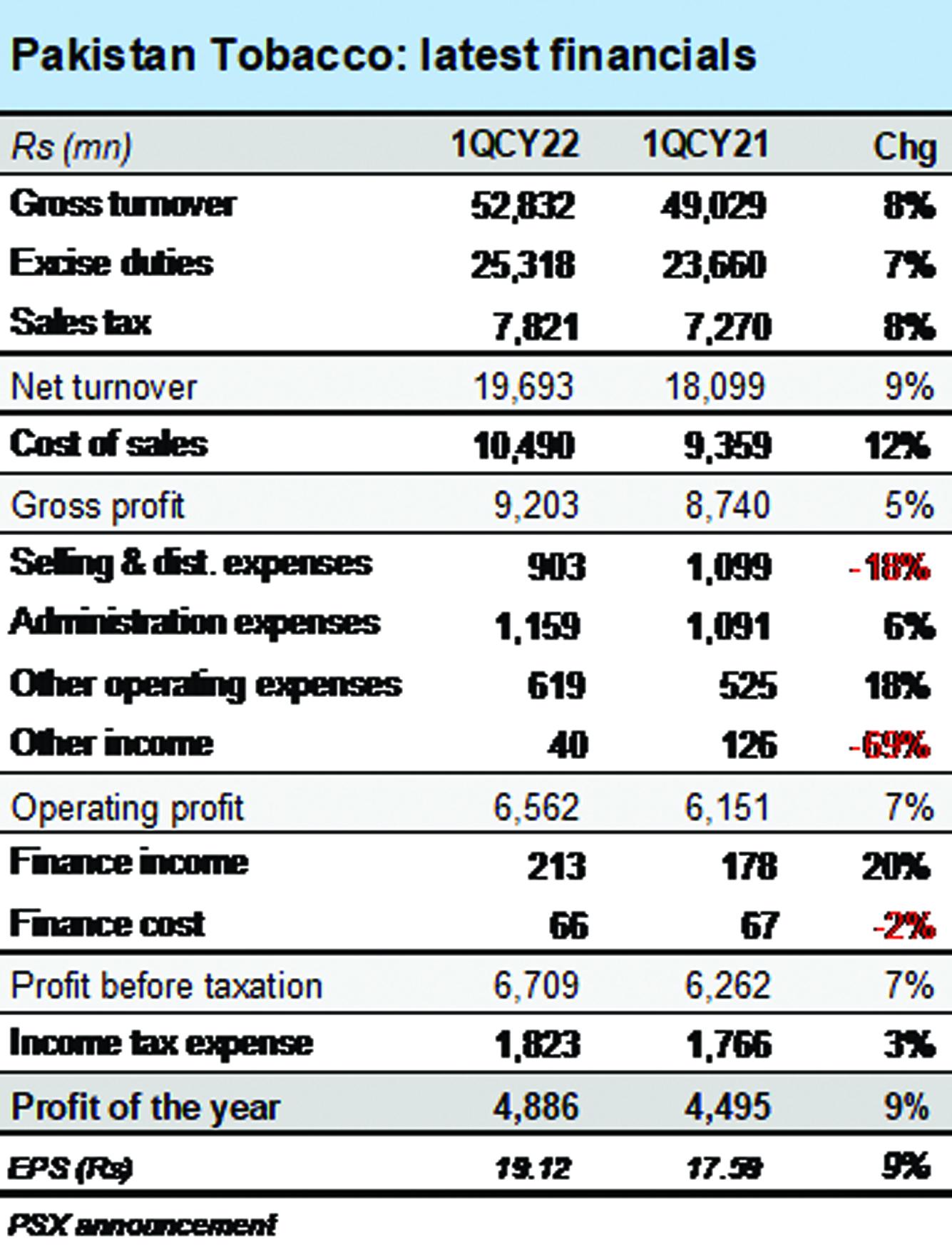

After showing strong growth in both its topline and bottomline during CY21, Pakistan’s tobacco giant is off to a relatively steady start in 2022. As per the latest financials posted to the stock exchange for the quarter ended March 31, 2022, Pakistan Tobacco Company (PSX: PAKT) expanded its gross turnover by 8 percent year-on-year to reach Rs53 billion, whereas the net profits also grew by a proportional 9 percent year-on-year.

Will 2022 be a slow year for PAKT revenues, just as CY19 and CY17 were during the past five years? Maybe not, as official data from the Pakistan Bureau of Statistics in recent months shows that average cigarette production has been above 5 billion sticks per month, reflecting double-digit yearly growth in volumes. Having said that, a lot also depends for formal industry fortunes on whether the new government takes the big decision in the next federal budget to raise the FED on cigarette sales.

For PAKT, the apparent slowdown is in both local and export sales. Domestic turnover, which accounts for 98 percent of the tobacco major’s topline, grew by 8 percent year-on-year to reach Rs52 billion in 1QCY22. Limited room for price increase in these conditions increases dependence on volumetric growth. Exports, which make up about 2 percent of gross turnover, increased by 7 percent year-on-year to Rs1.1 billion.

What the firm retains as net revenues post-FED and GST payments saw some improvement. Thanks to comparatively lower FED levied on cigarette sales during the quarter (47.9 percent of gross revenues in 1QCY22 versus 48.3 percent of gross revenues in 1QCY21), the net turnover equated 37.3 percent of gross turnover, which was a gain compared to 36.9 percent retention ratio observed in the same period last year. The sales tax collected as percent of gross sales remained the same at 14.8 percent.

That gain, however, was neutralized by out-of-proportion, 12 percent yearly growth in ‘cost of sales,’ which consumed 20 percent of gross turnover, in contrast with 19 percent during 1QCY21. As a result, the gross profit growth was only 5 percent year-on-year to reach Rs9.2 billion. The corresponding gross margin declined by one percentage point over 1QCY21 to come down to 17 percent.

Facing inflationary pressures that impacted core costs, PAKT did well to reduce operational spending. During the quarter, the combined toll on selling expenses, administrative expenses and other operating expenses declined by one percent year-on-year to stand at Rs2.68 billion. If it weren’t for the massive fall in the firm’s ‘other income,’ the operating profit growth would have been higher than the actual reading of 7 percent.

The operating margin at 12.4 percent was a slight deterioration of 10 basis points over 1QCY21. In the end, better ‘finance income’ and proportionally-lower booking of income-tax expenses helped PAKT’s net profit to rise by 9 percent year-on-year to Rs4.88 billion in 1QCY22. The net margin stayed at 9.2 percent, just the same as in 1QCY21. Let’s see what the ongoing quarter has in store for the firm volume-wise.

Comments

Comments are closed.