MLCF: Running out of luck

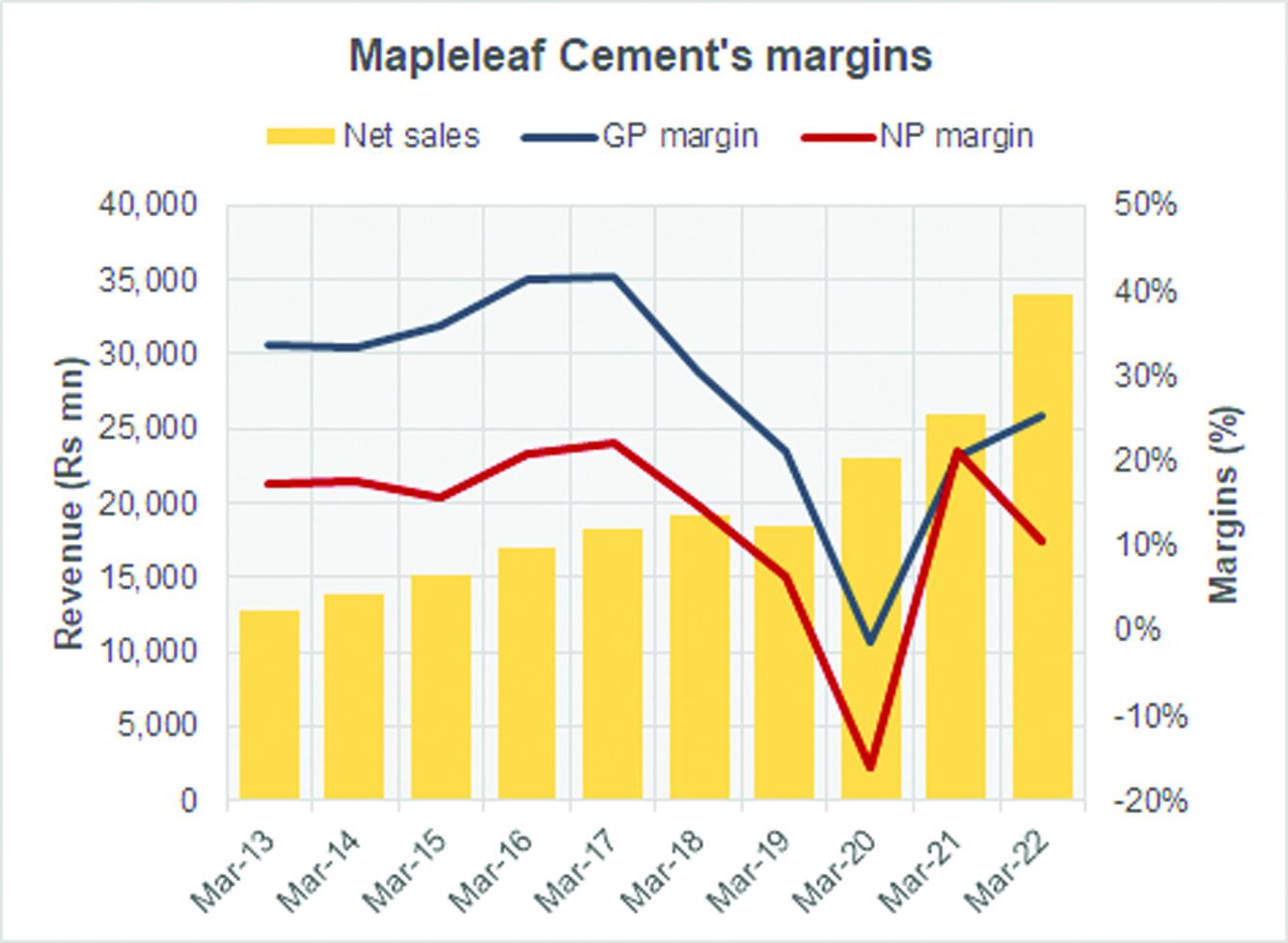

Mapleleaf Cement’s nine-monthly financial performance leaves much to be desired but given current economic conditions; considering commodity prices in the international markets running amok and a clear dullness in cement demand, Mapleleaf (PSX: MLCF) probably could not have done better.

Improved retention through increases in cement prices across the domestic market led to a strong growth in the top-line (30% in 9MFY22) despite a decline in domestic dispatches of 2 percent. The company’s exports also plummeted; falling by 63 percent in 9M owing to Afghanistan becoming an ever-difficult market to export to. The neighboring country is facing a political and economic upheaval with the exit of US troops leading to suspension of formal banking channels. This has left Afghan traders with little to no foreign currency to import with. The Pakistani government has recently allowed the export of essential items (including cement) to Afghanistan in rupee but many of these goods’ trade is subject to taxes which are otherwise exempt. This makes such exports unviable.

Export share in the total sales mix for MLCF has dropped to 2 percent from 6 percent last year, which had already fallen in recent years. Revenue per ton sold however, due to improved prices in the domestic market rose to 39 percent shielding margins from free-falling because costs have only been ballooning. Skyrocketing coal prices and higher fuel prices have sent costs hurtling forward. Many cement manufacturers like MLCF have moved their coal supply contracts from South Africa to Afghanistan which was more affordable. The coal mix leaned more on Afghan coal in recent quarters, however Afghan coal has also become more expensive following international prices and a sudden increase in demand cross-border.

Nevertheless, costs per ton sold grew at 31 percent, lower than the revenue per ton sold which facilitated the increase in margins during 9M. The company’s overheads and finance costs as a share of revenue remained the same at 11 percent where overheads increased from 6 percent to 7 percent while finance costs dropped from 5 percent to 4 percent, eventually the two balancing out.

A major component supplementing Mapleleaf’s profitability was “other income” which stood at nearly 60 percent of its before-tax earnings in 9MFY21. This has dropped to a negligible value ultimately translating to the drop in the bottom-line of 35 percent.

This drop will likely maintain in the coming quarter as higher costs of construction are likely to keep demand at bay. Domestic markets will remain sombre amid political instability in the country and impending macroeconomic crises as consumers face higher inflation and delay hefty spending. Meanwhile, hikes in policy rates will push finance costs up. Petrol and electricity prices are expected to increase which will impact production and transportation costs. Meanwhile, Afghan coal is no longer that cheap. Time for cement companies to hunker down and wait for the storm to pass.

Comments

Comments are closed.