The consumption of petroleum products continue unabated as the petroleum product prices remain frozen. After 23 percent in March 2022, the petroleum products sold by the oil marketing companies in April 2022 were up by 25 percent year-on-year. The growth was largely led by furnace oil that increased by over two times in April 2022 versus April 2021, while motor gasoline and high-speed diesel also witnessed double digit growth of 10 and 13percent year-on-year, respectively.

The month-on-month growth of petroleum products’ consumption was also over 15 percent but was however slightly impacted by the Holy month of Ramzan as sales of motor gasoline dropped by 4.4 percent. However, HSD and FO remained robust due to increased agricultural activity and demand from the power sector, respectively. This also allegedly resulted in fuel shortages.

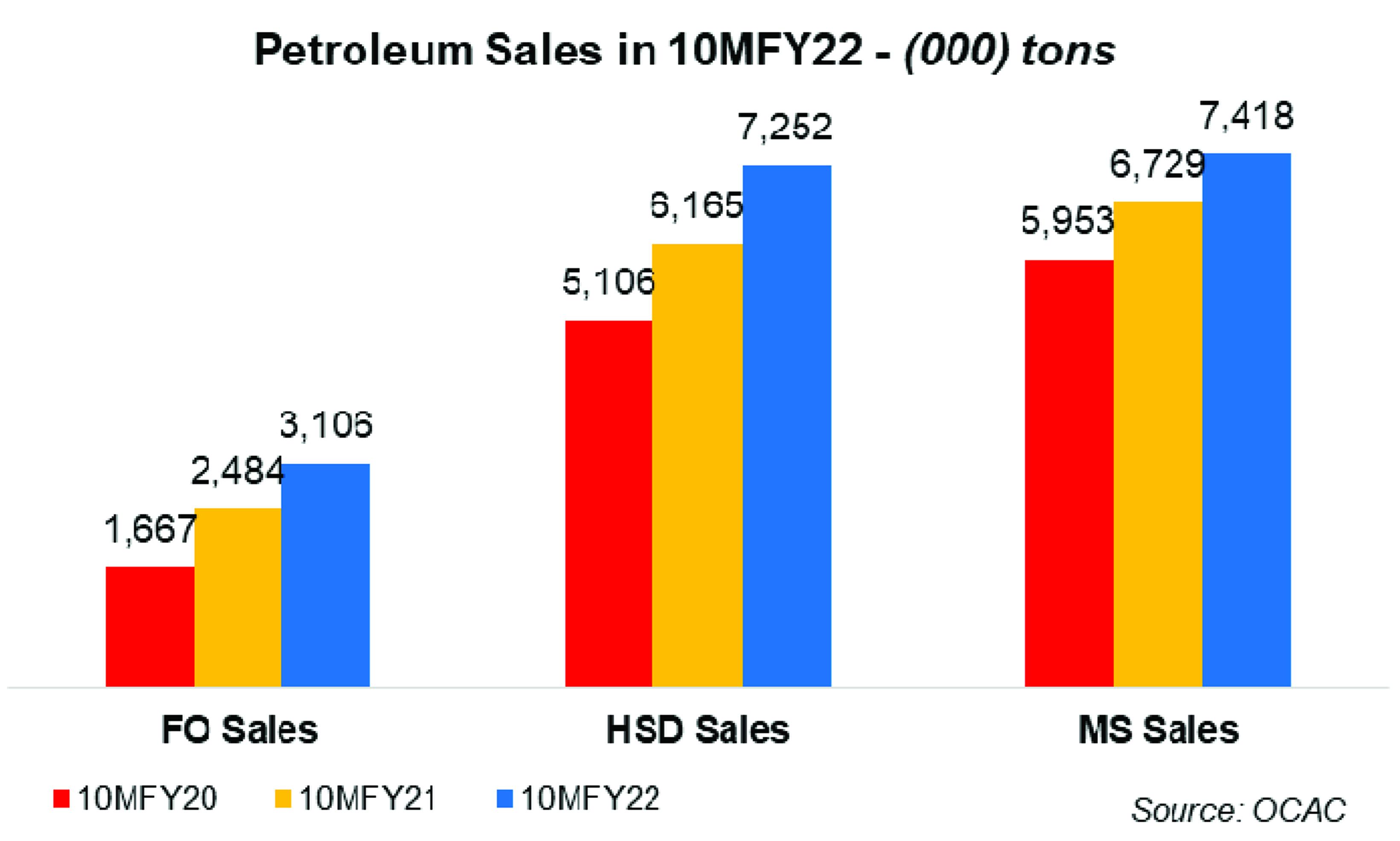

Overall, in 10MFY22, petroleum sales of the three key products were seen growing by over 16 percent year-on-year with double digit growth all the three products. This was a led by FO sales increasing by 25 percent, followed by HSD and motor spirit with growth of 18 percent, and 10 percent, respectively.

Continued rise in sales as well as rising international oil prices has put the country in a tight spot as the new government is still to unfreeze and increase petroleum prices. The unpopulous decision is much more crucial with every passing day and the burden the government will bear will continue to mount as the consumption will continue to go up in the coming months and there is no mechanism in place to curtail or squeeze demand. Higher furnace oil consumption cannot be ruled out as the country enters summers and demand from power sector will definitely rely on furnace oil because of the defaults on RLNG commitments earlier. Whereas diesel and petrol demand will also continue to rise as a relatively slower month of Ramzan is over.

Comments

Comments are closed.