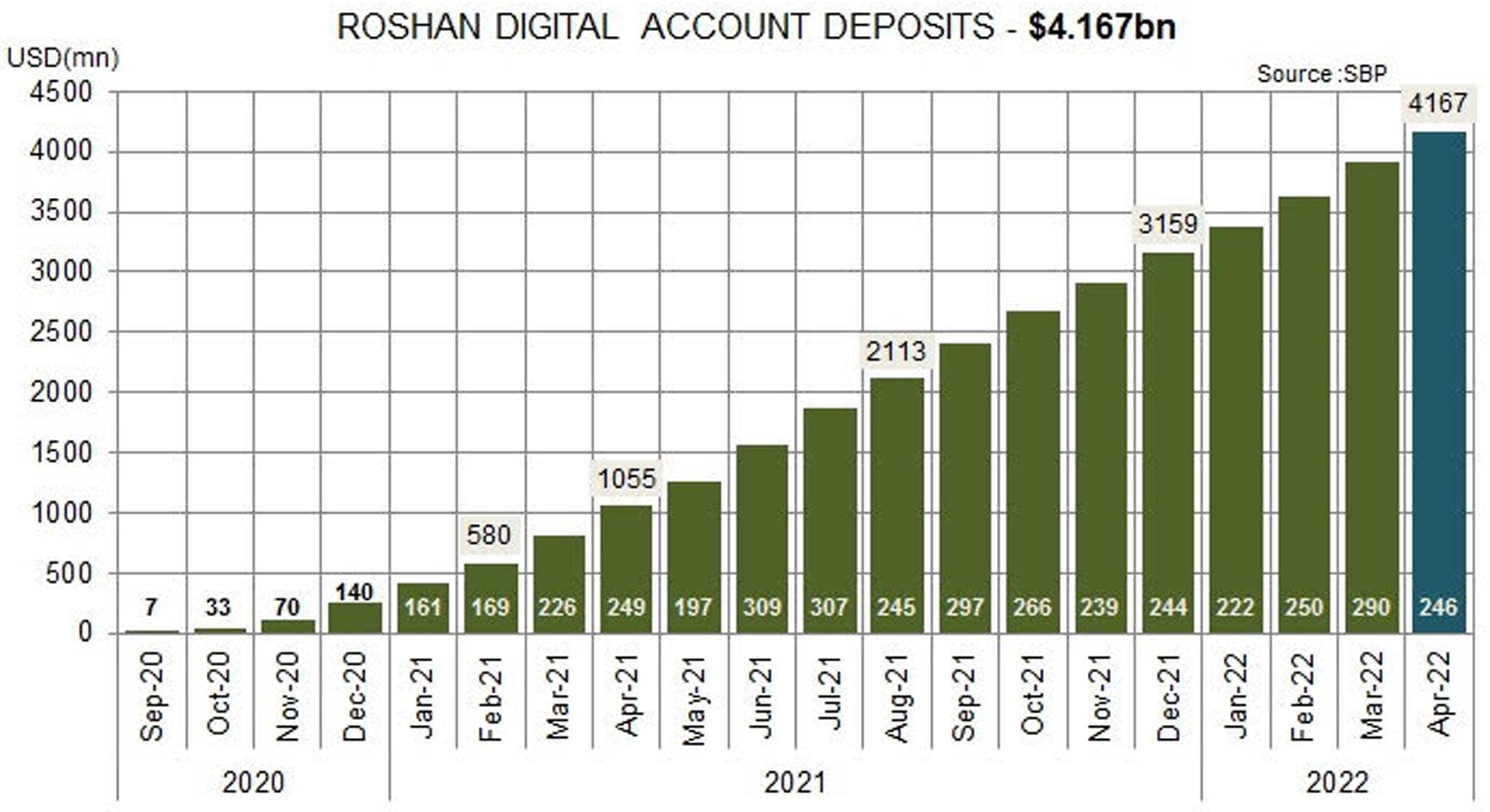

Last month when IK was ousted, there were threats by hardcore PTI expat supporters of taking money out from Roshan Digital Account (RDA) and lowering the remittances. These threats did not stop the money coming in the RDA. On gross basis (inflows only), the RDA is up by 6 percent to $4.2 billion in April 2022. The number of accounts opened (on gross basis) is by up 4 percent to 403,750.

The average inflow per account was $10,095 by March end and the toll is $10,320 in April. The ticker size is relatively small. Hence, the outflow for any political event had to be slow.

However, that doesn’t mean there wasn’t any outflow. Unfortunately, SBP only publishes gross inflows and there is no public data available on the outflows. Sources reveal that outflows were higher than average in April; but the on net basis there were inflows in April.

There were a few days when people started taking out money at relatively higher speed in April. However, that trend reversed once the new government was formed, and the usual business of inflows kept on coming while the outflows pace got slower to normalcy.

The good thing is that RDA is becoming an established instrument and is proving to be a valuable source of funding in days of financial crunch. In early days of RDA, there was criticism on higher than market returns on Naya Pakistan certificates (NPCs) available only through RDA. The criticism was spot on.

However, this space supported RDA’s high rates as it could be deemed as discounted prices for the newly introduced product. Having said that, now seeing the rates on Pakistan’s international bonds in the secondary market and drying of other external financing options, anything coming in RDA at prevailing rates is more than welcome.

On gross basis, the inflows in NPCs are standing at $2,753 million (conventional $1,464 mn and Islamic $1,289 mn) while $38 million are invested in the stock market. The NPC inflows accounted for 66 percent of the total RDA in April and the ratio has been consistently being same (at about 2/3rd of total RDA) for the past many months.

The SBP should publish the outflows number to give better and accurate picture and for markets to get to know about fear of the outflows in the last month. Then the SBP reserves are thinning – at around $10 billion and a good chunk out of it is deposits from other central banks which cannot be used. In such a grim situation, the markets need to know what the net position of RDAs is – especially NPC!

Comments

Comments are closed.