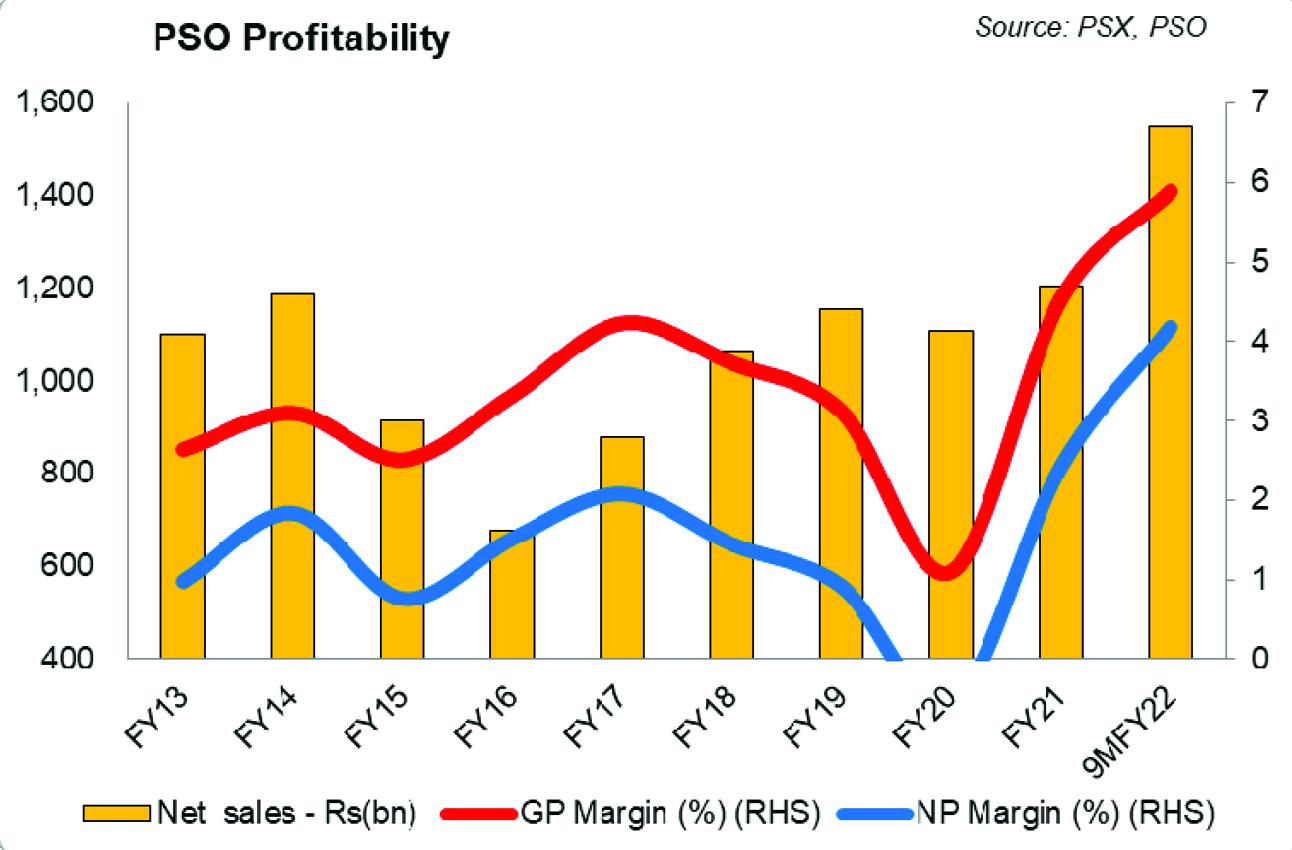

The oil marketing companies have seen robust sales of petroleum products in the 9MFY22 due to high demand despite high prices. These two factors have fueled profitability of OMCs in the current fiscal year so far. The financial performance of Pakistan State Oil Limited (PSX: PSO) for 9MFY22 shows that the largest and the leading oil marketing company saw a whopping increase in its profitability, which stemmed from growing volumes as well as high petroleum prices.

The latest quarter 3QFY22 revenues for PSO grew by 82 percent year-on-year, while 9MFY22 revenues were up by double. Net sales for 9MFY22 at Rs1.55 billion were highest ever and even more than the annual sales in the company’s history. Growth in volumes stood at around 24 percent for 9MFY22 where the three key fuels: furnace oil, diesel and petrol were up by 22 percent, 26 percent, and 16 percent respectively. Similarly, the growth key fuels for 3QFY22 were also in double digits - playing an instrumental role in lifting the topline of the OMC. Noticeable growth in volumes also helped PSO grow its market share in all the three products. Also high oil prices during the period helped PSO grow its topline.

But the growth in topline was not the only factor pushing up gross margins for PSO in 9MFY22. The OMC incurred colossal inventory gains on the back of higher oil prices, which supplemented the lift in gross margins from 6.04 percent in 9MFY21 to 7.73 percent in 9MFY22.

On the expenses side, the distribution and marketing expenses remained lower. PSO’s operating profits grew by more than 3x in 9MFY22 with support from other income as well as the topline and gross profit growth. Finance cost however was also seen growing during the period due to higher interest rates and increase in short term borrowings, while other income growth was massive due to interest income on late payment.

PSO’s bottom-line surged by more than 3.7 times in 9MFY22 where much of the growth came from volumetric growth and inventory gains, reviving consumption and demand of petroleum products, price increase, higher other income as well as the company’s increased retail footprint and up gradation in fuel quality.

Comments

Comments are closed.