KSE-100 rises 0.7%, breaches 43,000 point barrier once again

- Investor positivity on beginning of talks with IMF strengthened market spirits

The Pakistan Stock Exchange (PSX) extended gains on Wednesday and the benchmark KSE-100 index breached the 43,000 point mark once again, owing to political clarity and optimism over start of talks between the Pakistani government and the International Monetary Fund (IMF).

Pakistan, IMF begin crucial talks in Doha as economy stumbles

Successful negotiations between the two sides will provide much-needed relief to the cash strapped economy of Pakistan and support the country’s macroeconomic indicators. They will also act as a cushion for the dwindling local currency that closed at Rs198.39 against the greenback in the inter-bank market on Wednesday.

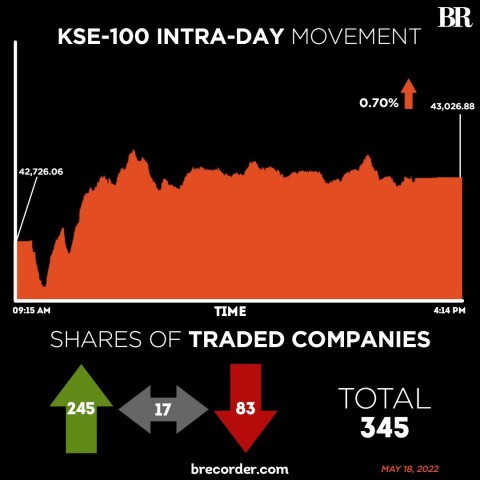

The day kicked off with a slide but robust investor sentiments assisted the index in erasing losses and pushed the market to an intra-day high of 435 points. Buoyed by negativity over persistent rupee devaluation, the rally lost steam and the market receded partially towards midday.

The KSE-100 index traded range-bound for the remaining part of the session and recorded minor fluctuations before closing on a positive note.

KSE-100 ends 0.14% higher in range-bound session

At close on Wednesday, the KSE-100 ended with a gain of 300.82 points, up 0.7%, to finish at 43,026.88.

In a report, Capital Stake said PSX staged a rally, with indices trading in green for most part of the day while volumes appreciated from last close.

According to analysts, news that talks between Pakistan and the IMF have begun to strike a staff-level agreement for the release of $1 billion tranche under the Extended Fund Facility (EFF) improved investors confidence.

On the economic front, the rupee plunged past Rs200 in the open market and traded as low as 201 against the greenback.

Currency’s collapse continues: Rupee closes at 198.39 in inter-bank market, crosses 200 in open

Sectors painting the benchmark KSE-100 index in green included cement (56.83 points), technology and communication (56.21 points) and fertiliser (41.62 points).

Volume on the all-share index surged to 278.8 million from 197.92 million a day prior. The value of shares traded increased to Rs6.91 billion from Rs6.18 billion recorded in the previous session. WorldCall Telecom was the volume leader with 27.08 million shares, followed by Cnergyico PK with 24.14 million shares, and Telecard Limited with 23.22 million shares.

Shares of 345 companies were traded on Wednesday, of which 245 registered an increase, 83 recorded a fall, and 17 remained unchanged.

Comments

Comments are closed.