Macter International Limited

Macter International Limited (PSX: MACTER) was set up as a private limited company in 1992. In 2011, it was converted into a public limited company and in 2017 it was listed on Pakistan Stock Exchange. The company manufactures and markets pharmaceutical products.

Shareholding pattern

As at June 30, 2021, over 65 percent shares are held by the directors, CEO, their spouses and minor children. Within this category, two major shareholders are Asif Misbah, the CEO of the company, and Swaleh Misbah Khan, one of the directors. The general public owns over 18 percent shares, followed by 16 percent in banks, DFIs, NBFCs, insurance companies, etc. The remaining less than one percent share is with the rest of the shareholder categories.

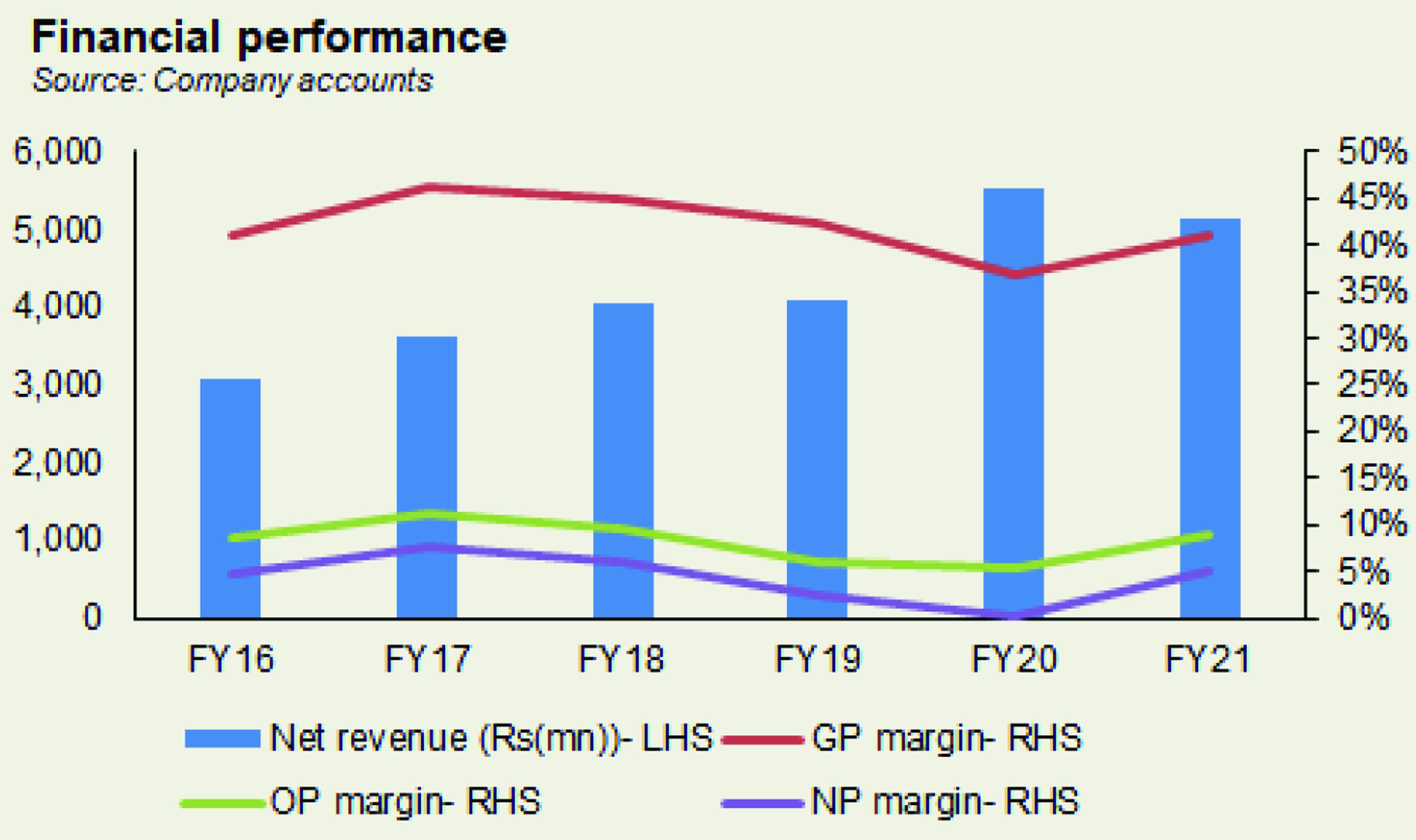

Historical operational performance

The company has seen a growing topline since its PSX listing in FY17, except for in FY21 when it contracted by nearly seven percent. Profit margins, on the other hand, gradually declined between FY17 and FY20, before improving again in FY21.

In FY18, revenue posted a growth of over 11 percent to cross Rs 4 billion in value terms. Institutional sales grew by 13 percent while export sales registered a 28 percent incline. However, the total revenue growth was subdued by lower price levels in Hepatitis-C portfolio whereby new but relatively cheaper brands were introduced. Coupled with this was the higher proportion of low-margin institutional sales, as well as currency devaluation and increase in minimum wages that together reduced gross margin to nearly 45 percent. With little changes in other elements, this also trickled down to the bottomline with net margin also recorded at a lower six percent, compared to last year’s 7.55 percent.

Revenue growth in FY19 was marginal at less than one percent. While the prescription business grew by 14 percent, the overall sales growth was dampened due to a 30 percent reduction in institutional sales as a result of a change in procurement criteria in Punjab. Export sales also reduced, by 50 percent. This was attributed to remittances challenge in a prime export destination of an African country. On the other hand, currency devaluation and inflation increased the cost of doing business that caused gross margin to reduce to over 42 percent. Moreover, administrative expense also made a larger share of revenue year on year, while finance expense grew due to increase in interest rates and working capital requirements. Therefore, the decline in net margin was more pronounced with the latter recorded at 2.6 percent for the year.

Despite the slow pace of economic activity at the start of FY20 that was further crippled in the second half due to the onset of Covid-19 pandemic, Macter International witnessed an all-time high revenue growth of over 35 percent to reach Rs 5.5 billion. The major contributor to this growth was the institutional sales. But the latter registered most of this growth in the first nine months of FY20, whereas the last quarter was impacted by the outbreak of Covid-19. This also impacted prescription sales in the fourth quarter as there were fewer patients and out-patient departments for most hospitals were also closed. But the higher revenue did not translate into higher profitability as institutional sales that were a major contributor to total sales was also a low-margin segment. Thus, gross margin fell to nearly 37 percent. Operating margin, however, was more or less flat at close to 5 percent as operating expenses made a lower share in revenue. But net margin was again lower year on year at less than one percent due to a substantial rise in finance expense arising from higher interest rates and higher working capital requirements.

In FY21, revenue declined by almost seven percent. This was attributed to exceptionally high public tender business in the previous year. Despite the loss in revenue, gross margin improved to 41 percent during the year as low margin institutional sales made a smaller portion in the sales mix, while prescription sales recovered as patient flow in hospitals resumed. This also trickled to the bottomline that also received support from a reduction in finance expense. The latter was due to lower interest rates and lower borrowing. Thus, net margin improved to five percent.

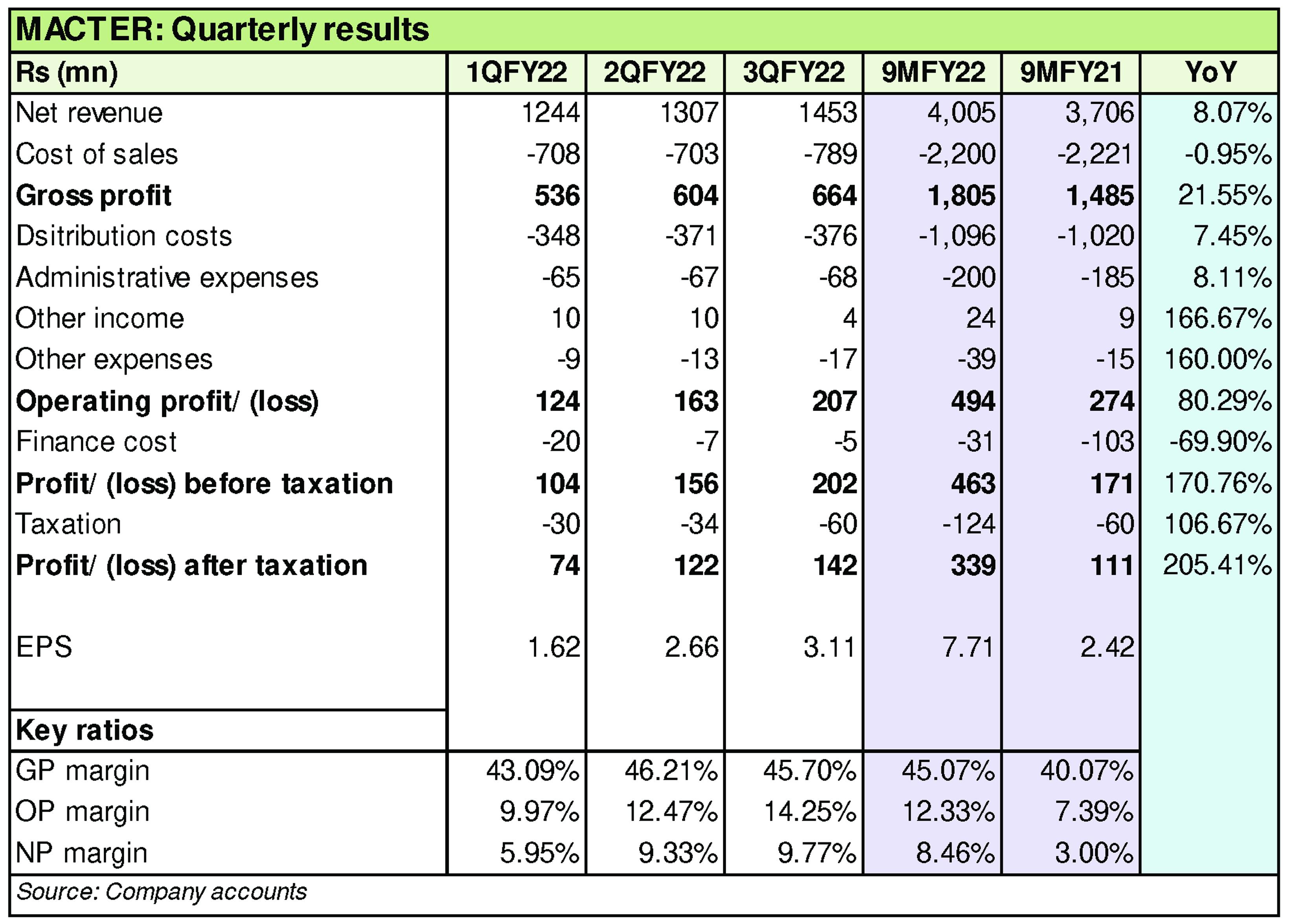

Quarterly results and future outlook

The first quarter of FY22 saw an almost 6 percent decrease in topline year on year. This was due to large public tender seen last year. Aside from this, the core prescription sales had begun to recover. With lower institutional sales, gross margin also improved to 43 percent, compared to 37.4 percent in 1QFY22. This also reflected in the net margin that was also higher at 5.9 percent for the year, versus 2.2 percent in 1QFY21. The second quarter saw a seven percent increase in revenue year on year attributed to improvement in prescription sales. However, profitability was again better due to high-margin segment making a significant portion of total sales.

The third quarter saw an almost 25 percent in revenue year on year. This was again attributed to the business tilting towards high-margin prescription sales, while the share of public tender sales reduced. This is reflected in the substantial improvement in net margin year on year with 9.8 percent seen in 3QFY22 versus three percent in 3QFY21. With business skewing towards high margin sales, and proceeds from the rights issue seen in the last three quarters being directed towards plant and machinery and capacity building, the company expects consistent profitable growth.

Comments

Comments are closed.