Tobaccos: FED raise on the cards?

The tobacco industry’s output has been on a rising trajectory lately, even as top cigarette makers anxiously wait for the next federal budget. There is uncertainty over whether the cash-starved new government will raise the federal excise duty (FED) on cigarette sales. Higher FED on cigarette retail would not only help the government to raise tens of billons more in tax revenues, it would also allow the government to score some public health credentials, as health activists demand higher FED on cigarette.

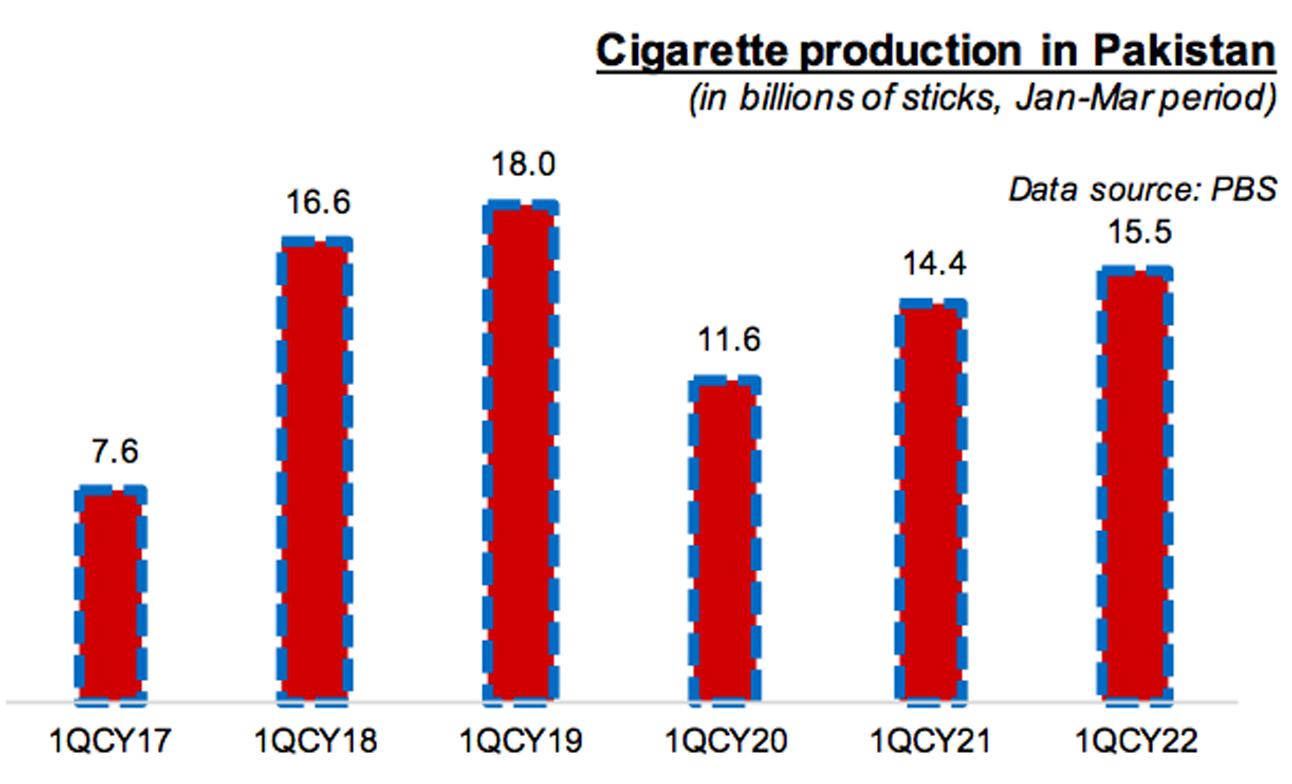

As per latest data from the Pakistan Bureau of Statistics (PBS), cigarette production in the period Jan-Mar 2022 reached 15.52 billion sticks, reflecting annual growth of 8 percent (additional output of 1.16bn sticks in this period). Production averaged 5.2 billion per month sticks in this period, thereby getting closer to the industry’s peak production capacity of 6 billion+ sticks per month, which was last seen in April 2019.

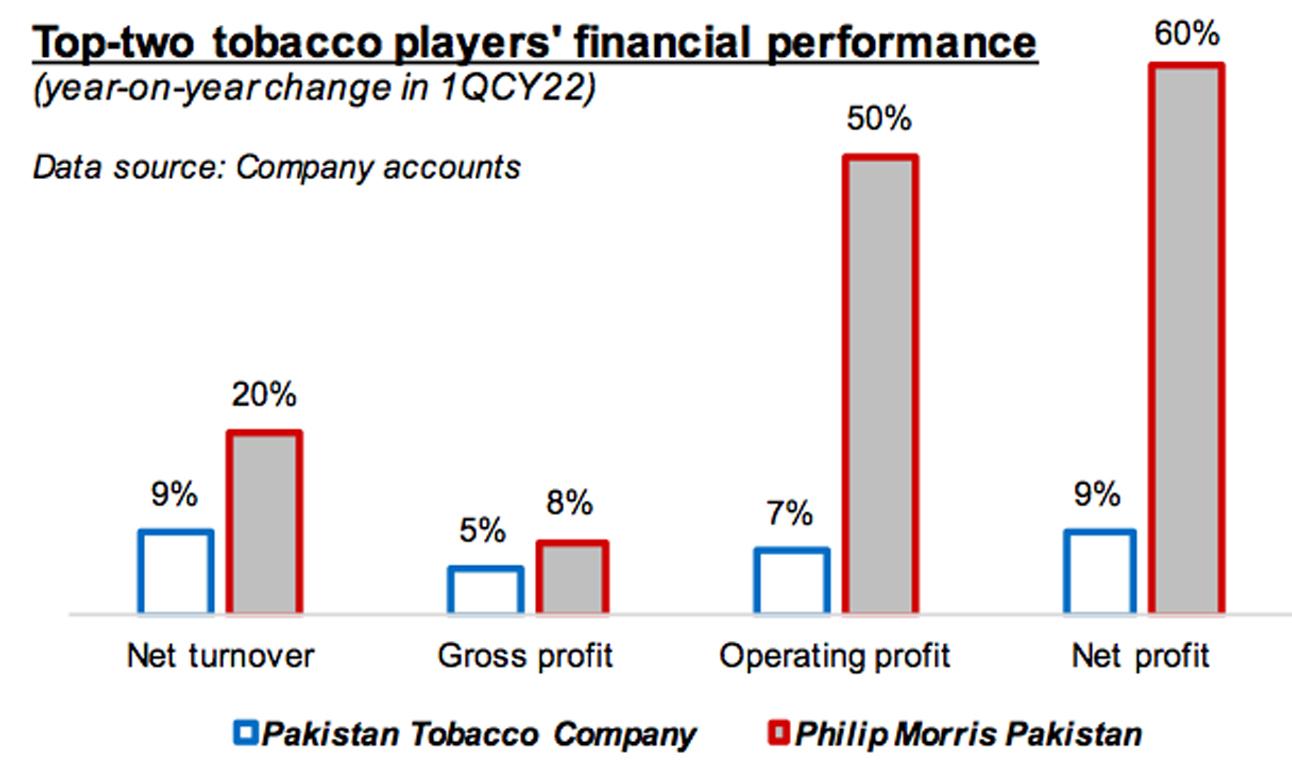

During the quarter under review, the two major tobacco players both registered significant increase in bottomline, after recording strong double-digit growth in net profits during CY21. The market leader, Pakistan Tobacco Company Limited (PSX: PAKT), grew its net turnover and net profit each by 9 percent year-on-year during 1QCY22. The second-ranked player, Philip Morris (Pakistan) Limited (PSX: PMPK), raised its topline and bottomline by much higher 20 percent and 60 percent year-on-year, respectively.

While PAKT is apparently undergoing topline slowdown on top of a high base, its net turnover was about 4 times as high as PMPK in 1QCY22, thanks to huge amount of scale at the former’s disposal.Meanwhile, in recent quarters PMPK has driven its profitability (which grew out-of-proportion relative to its gross turnover in 1QCY22), thanks to cost-optimization measures and low operating expenditures.

Since announcement of FY22 budget (which did not raise FED on cigarette), tobacco processing has been even stronger. PBS data show that during Jul-Mar FY22, documented players produced 46.07 billion sticks, showing year-on-year growth of 17 percent (6.6bn more sticks relative to 9MFY21). This was the highest absolute addition in the Jul-Mar period in recent years. In relative terms, 9MFY22 growth was at par with 18 percent yearly growth in 9MFY21 (when output grew by 6bn, to reach 39.47bn sticks).

The continuation of this growth momentum is highly contingent on the path the federal government chooses to embark on the question oftobacco-related FED in the upcoming budget. In the past, it has been observed, based on PBSdata, that an increase in FED was associated with a noticeable decline in cigarette production in the months after the budget announcement. Whereas, a neutral budget (no FED increase) or a favorable budget (lower FED) previously supported higher output levels in the industry.

Reading through the latest public statements from the leading players, it appears that all is still not well despite rising production. PAKT, in its latest Directors’ Review released last month, warned that “DNP (duty-non-paid) brands being retailed at not just lower than theGovernment mandated minimum price of Rs62.75/pack, but even lower than theminimum excise and sales tax payable on a pack of 20 cigarettes, i.e., Rs42.12/pack, are aserious detriment to sustainability and viability of legitimate tobacco sector”.

In its latest Director Report released earlier this month, PMPK also made a similar case, noting“The tax-paid cigarette industry in Pakistan continues to be challenged by the widepresence of non-tax paid illicit cigarettes, which constitute approximately 37-40 percent of total cigarette consumption in Pakistan. Non-tax paid illicit cigarettes continue tosell at an average price of Rs38 per pack while the minimum price prescribedunder tax laws for levy and collection of Federal Excise Duty and Sales Tax isRs63 per pack”.

While such statements coming from the tobacco industry are not new, what has changed in recent months is the severity of the fiscal challenges that are faced by an embattled government that has just come into power. Let’s wait and see how the new government chooses to deal with the tobacco FED issue.

Comments

Comments are closed.