The Searle Company Limited

The Searle Company Limited (PSX: SEARL) was established in 1965 as a private limited company. It was converted into a public limited company in 1993.It manufactures pharmaceutical and other consumer products. Holding over 54 percent shares, International Brands Limited is SEARL’s holding company.

Shareholding pattern

As at June 30, 2021, close to 55 percent shares are held under associated companies, undertakings and related parties. Within this, International Brands Limited is a major shareholder. The local general public holds 15 percent shares, while over 7 percent shares are with each of the following: modarabas and mutual funds, and foreign companies. Over 6 percent are held in joint stock companies, while the directors, CEO, their spouses and minor children own less than 1 percent share in the company. The remaining roughly 9 percent shares are with the rest of the shareholder categories.

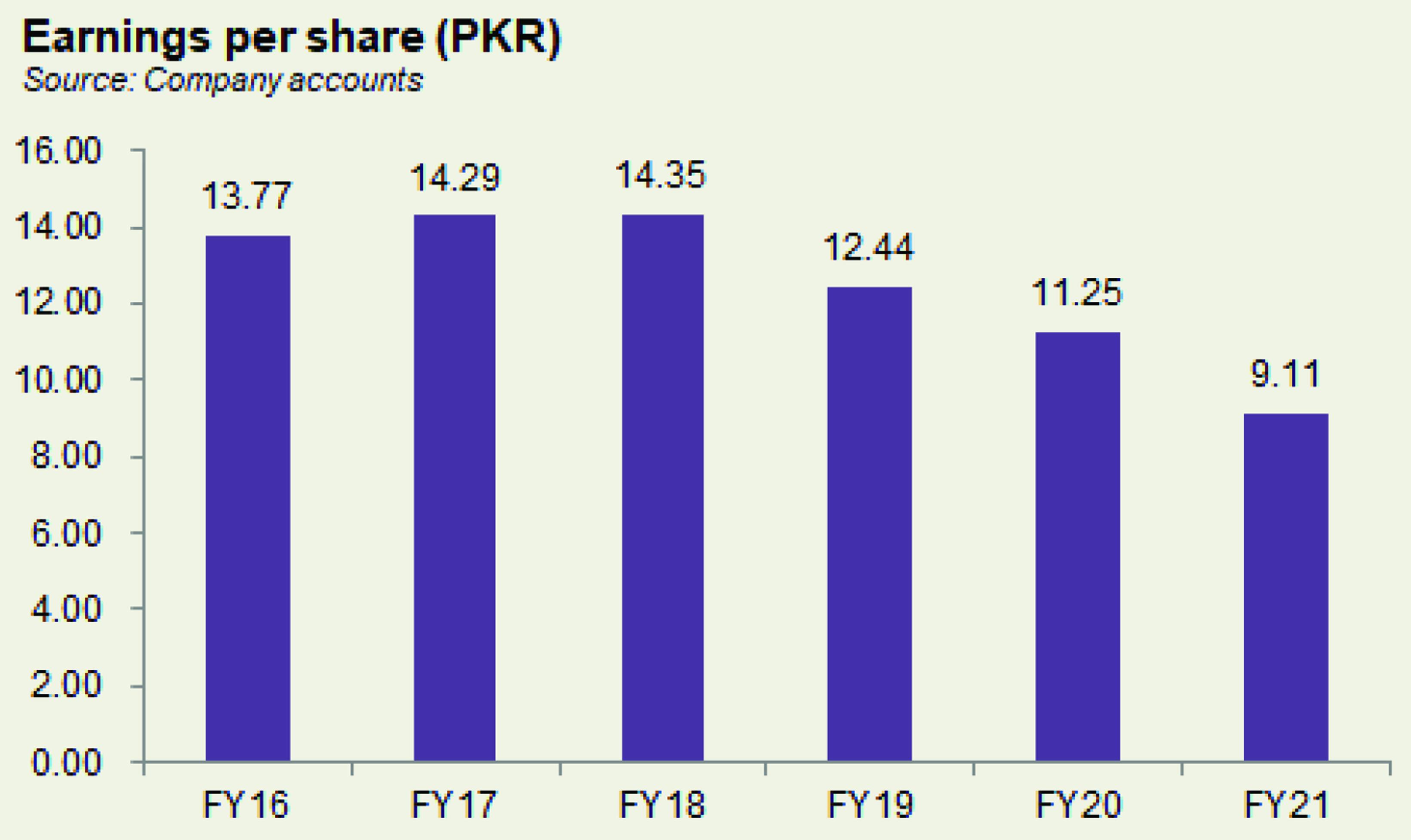

Historical operational performance

Searle has consistently seen a growing topline over the years. Operating and net margin have followed a gradual downward decline, while gross margin increased in FY20 and onwards.

In FY18, revenue grew by almost 18 percent to cross Rs 12 billion in value terms. Export sales posted a growth of 33.7 percent while local sales grew by 20 percent. Pharmaceutical division that is a major contributor to revenue witnessed an 18.5 percent increase. Moreover, the consumer segment grew by 30.5 percent. However, gross margin reduced to 35 percent, compared to last year’s almost 39 percent, due to currency devaluation that rendered imports expensive. Note that the industry at large relies on imported raw materials. But net margin was maintained at 24 percent due to support from other income that grew to Rs 3.2 billion compared to Rs 2.3 billion in FY17.

Revenue continued to grow in FY19 reaching Rs 14.5 billion. Both export sales and local sales registered an increase, by 33 percent and 14 percent, respectively. But despite the growth in topline, gross margin continued to fall, reducing to 33.8 percent for the year. This was due to rising cost of production that consumed 66 percent of revenue. However, the decline in net margin that was recorded at 18 percent, was more prominent as dividend income from Searle Pharmaceuticals (Private) Limited reduced notably, whereas finance expense more than doubled in value terms to make up almost 3 percent of revenue.

Despite the slowdown in economic activity at the start of the year and the onset of Covid-19 in the second half of FY20, revenue for SEARL increased by nearly 14 percent. Export sales grew by over 25 percent while local sales registered an incline of over 11 percent. The increase in topline was attributed to stock piling and panic buying before the lockdown. This was not just limited to wholesalers but patients as well, particularly for chronic disease therapies. On the other hand, cost of production dropped to 50 percent of revenue due to “discontinuing toll manufacturing services obtained from its wholly owned subsidiary Searle Pharmaceuticals (Private) Limited. While this had a positive impact on gross margin, net margin however fell to almost 15 percent as other income shrunk to Rs 781 million from last year’s Rs 3 billion. Additionally, finance and other expenses also grew considerably to consume almost 4 percent and 2 percent, respectively.

Revenue growth in FY21 was flat at less than 1 percent with topline remaining close to Rs 16.5 billion. However, gross margin improved to over 51 percent as cost of production feel to an all-time low of 48.4 percent of revenue. During the year, the company acquired OBS Pakistan (Private) Limited. However, the improvement in gross margin was not reflected in net margin as the latter reduced owing to an increase in operating expenses as well as finance cost. The latter was due to the acquisition transaction. But the company notes that the acquisition is expected to enhance future profitability that will offset the rise in expenses.

Quarterly results and future outlook

The first quarter of FY22 was revenue higher by over 14 percent year on year. This has been attributed to the increasing awareness and expenditure on health care in addition to development of vaccines and branding, etc. The rationale is applicable to the pharmaceutical sector in general. However, the drop in other income coupled with an increase in finance expense due to acquisition had an adverse impact on net margin that fell to 10 percent for the period compared to 14.5 percent in 1QFY21.

The second quarter saw topline lower by almost 3 percent year on year. The decline was largely witnessed in export sales that fell by over 19 percent year on year. This can be attributed to supply chain issues and inconsistency in trade situation due to Covid-19. The decline in topline reduced gross margin to over 51 percent versus nearly 53 percent in 2QFY21. But net margin was more or less flat other income increased while tax expense reduced significantly.

The third quarter witnessed revenue growth of over 19 percent year on year. Again, majority of the growth came from local sales while export sales continued to contract. Owing to costs, gross margin was marginally impacted, however, net margin improved considerably to 11.5 percent compared to 7.4 percent on the back of an increase in other income that came from dividend earnings from subsidiary companies, particularly Searle Biosciences (Private) Limited and Searle Pakistan Limited (formerly OBS Pakistan (Private) Limited). SEARL has experienced a growing topline; however, profitability is threatened due to rising input costs in addition to rising finance expense. The latter has consumed over 10 percent of revenue in 9MFY22.

Comments

Comments are closed.