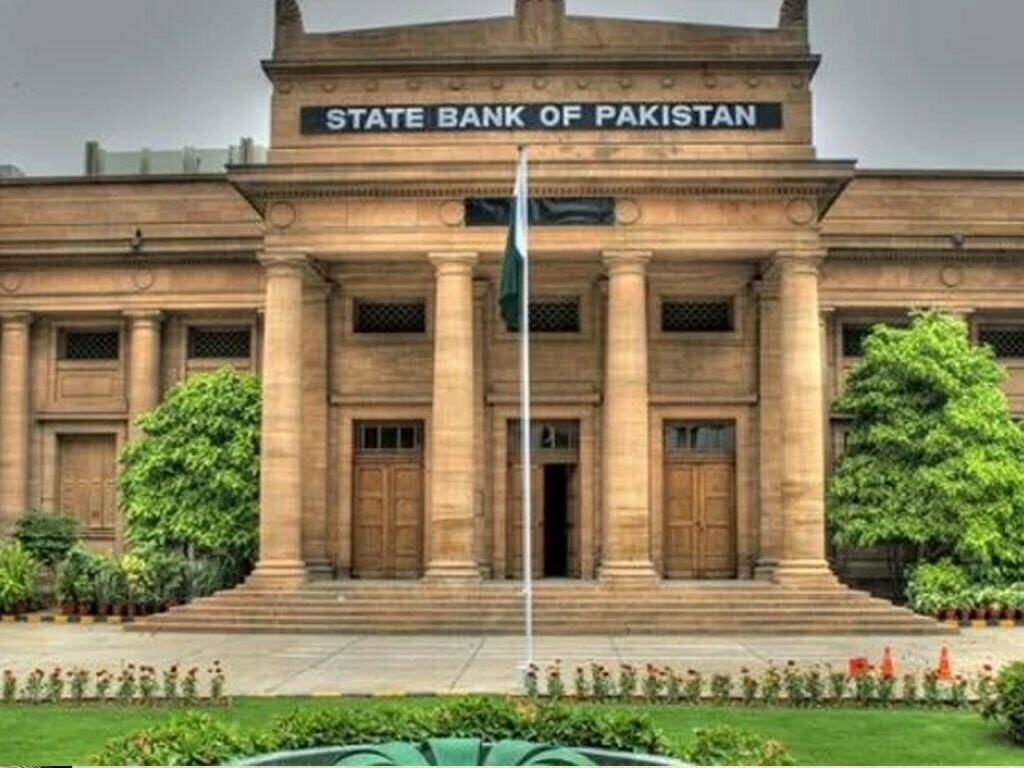

SBP, govt refute 'baseless' claims on proposal to restrict foreign currency accounts

- Ministry of Finance and central bank's joint statement comes in response to claims on social media that govt was considering putting restrictions on withdrawals from Foreign Currency Accounts, Roshan Digital Accounts and Safety Deposit Lockers

The Ministry of Finance and the State Bank of Pakistan (SBP) on Monday refuted “baseless claims” circulating on social media regarding foreign currency accounts, Roshan Digital Accounts (RDAs) and safety deposit lockers.

In a joint statement, the Government of Pakistan and the central bank assured all account holders maintaining foreign currency accounts, Roshan Digital Accounts (RDA) and safety deposit lockers in banks in Pakistan that their accounts and lockers are completely safe, and that there is no proposal under consideration to put any restriction on them.

“Rumors are circulating on social media that the government or State Bank is considering freezing or placing restrictions on withdrawals from foreign currency accounts, Roshan Digital Accounts and safety deposit lockers.

“Such rumours are absolutely incorrect and baseless,” read the statement.

The government clarified that such a proposal has neither been considered presently nor in the past.

Govt to prioritise agriculture and exports in upcoming budget: Miftah

"Moreover, foreign currency accounts including Roshan Digital Accounts are legally protected under the Foreign Currency Accounts (Protection) Ordinance 2001, and the Government and the State Bank are committed to protecting all the financial assets in Pakistan including the ones mentioned above.

It said that the government and SBP are taking all necessary measures to ensure macroeconomic stability in the country.

"The recent difficult decisions taken by the government, including the reduction of subsidy on petroleum products, will pave the way to reach an agreement with the International Monetary Fund (IMF) and release of the IMF tranche and financial assistance from other multilateral agencies and friendly countries.

"We are confident that these measures will relieve the temporary stress being faced due to elevated global commodity prices and geo political tensions, and eliminate uncertainty in the economy."

The statement comes as Pakistan's economy faces difficulties on multiple fronts, including a widening current account deficit and repayments on external debt. With the removal of energy subsidies, inflation is also likely to increase its pace in the coming months. Additionally, pressure on the rupee is likely to sustain, and on Monday, the rupee shed 1.07% of its value against the US dollar.

Amid such an economic scenario, rumours started to circulate on social media that a proposal to put restrictions on withdrawal of foreign currency from bank accounts was being considered to stop the outflow of dollars.

Comments

Comments are closed.