SBP allows DFIs to participate in Open Market Operations

- Approval would facilitate DFIs in their liquidity management

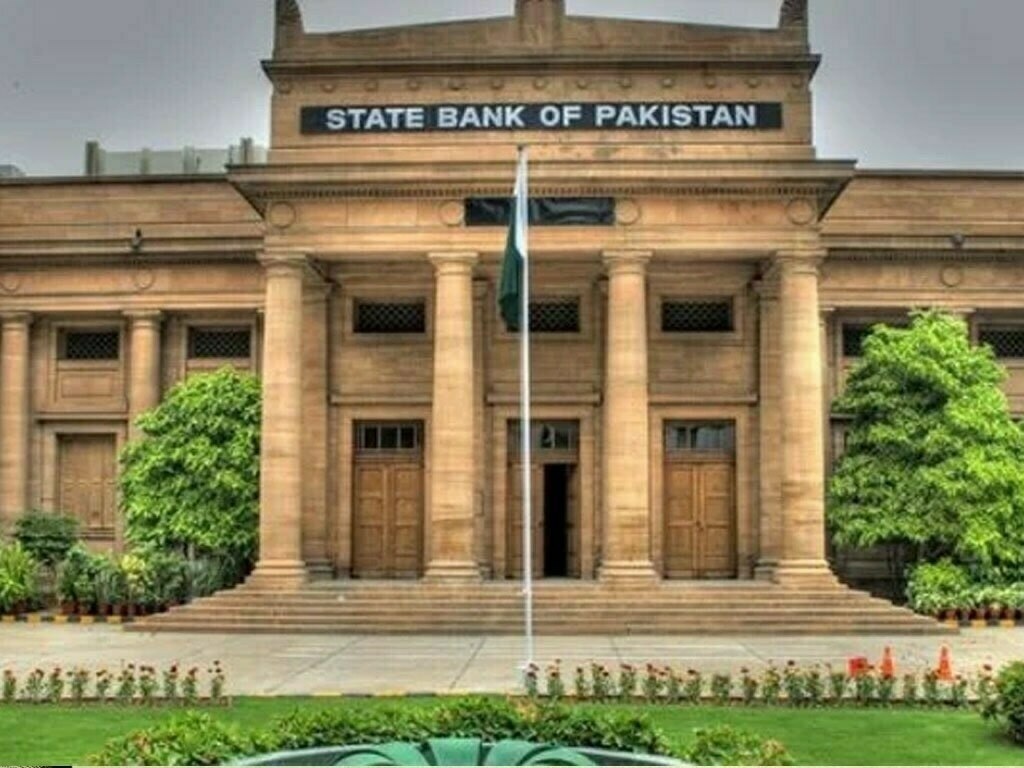

The State Bank of Pakistan (SBP) on Tuesday has allowed Development Finance Institutions (DFIs) to participate in Open Market Operations (OMOs). The central bank is of the view that the approval would facilitate DFIs in their liquidity management.

The central bank, while referring to DMMD Circular No. 12 of 2017 in terms of which all schedule banks and primary dealers are allowed to participate in OMOs, stated: “It has been decided to allow Development Finance Institutions (DFIs) to participate in OMOs with a view to facilitate them in their liquidity management”.

“Accordingly, DFIs would also be eligible to participate in OMOs as per instructions and procedure for OMOs stipulated in master circular.”

The central bank said that all other instructions on the subject will remain unchanged.

SBP unveils master circular on OMOs

Released in 2017, the central bank released a master circular on "open market operations" aimed at facilitating the participating institutions.

According to the master circular, the SBP will not accept any bid on telephone and all eligible participants will be required to submit their bids through Reuters Dealing System or fax/electronic mode in case of unavailability of Reuters Dealing Terminal for any reason.

As part of its monetary policy implementation, the State Bank conducts open market operations (OMOs) to keep the money market overnight repo rate close to the SBP target "policy rate" introduced under the revised Interest Rate Corridor Framework. All scheduled banks and Primary Dealers are allowed to participate in these OMOs; however, the SBP may also conduct special OMOs in which only Primary Dealers will be eligible to participate.

As per the master circular, Government of Pakistan Market Treasury Bills, Pakistan Investment Bonds and any other security notified by the SBP for this purpose will be eligible securities for OMO and the securities classified by the eligible participants under Held to Maturity category cannot be used in OMOs.

Comments

Comments are closed.