D.G. Khan Cement Company Limited

D.G. Khan Cement Company Limited (PSX: DGKC) was set up in 1978 under the repealed Companies Act, 1913 (now Companies Act, 2017). It has two plants at Dera Ghazi Khan, another at Khairpur Distt. Chakwal, and yet another at Hub Lasbela District (Balochistan).

The company’s products include Clinker, Ordinary Portland, and Sulphate Resistant Cement.

Shareholding pattern

As at June 30, 2021, around 32 percent shares are held under associated companies, undertakings and related parties. Within this category, Nishat Mills Limited holds 31.4 percent shares which makes it the largest shareholder. The local general public owns 19.5 percent shares, followed by over 6 percent owned by insurance companies and modarabas and mutual funds. Mr. Mian Umer Mansha and Mr. Mian Hassan Mansha also hold 6 percent shares each. The remaining roughly 23 percent shares are with the rest of the shareholder categories.

Historical operational performance

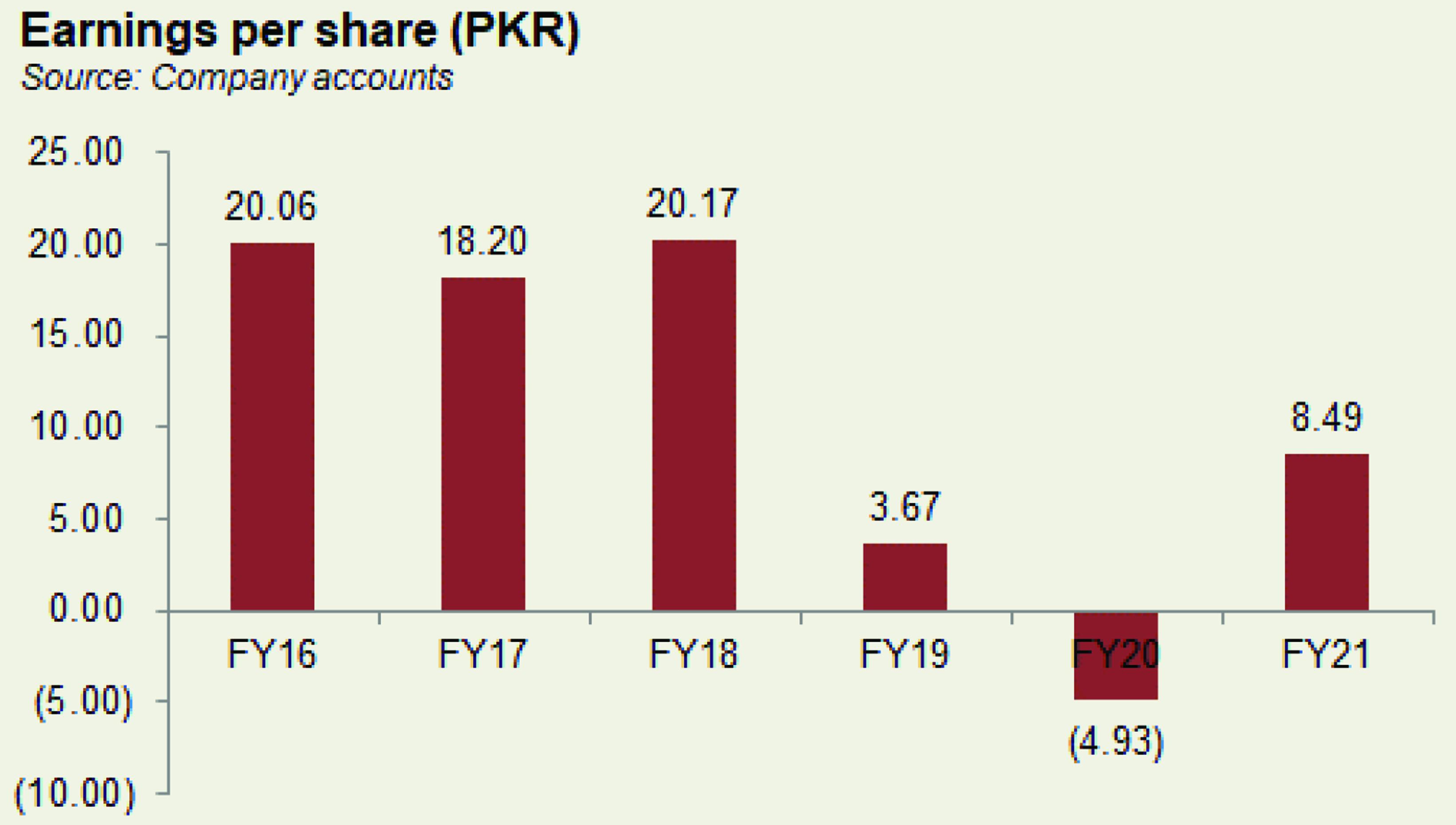

Since FY12, the company has mostly seen a growing topline with the exception of FY15 and FY20. Profit margins, on the other hand, have been declining between FY16 and FY20, before improving again in FY21.

In FY18, revenue grew only marginally by close to 2 percent. Total dispatches posted a growth of 7.4 percent. Local sales, on the other hand, grew by 12 percent while export sales witnessed a substantial decline of 21 percent that affected the overall topline growth. The decline in exports was due to lower exports to India, Afghanistan and Sri Lanka, while the company faced competition from Iranian cement in the African market. Till now, 77 percent of the exports were taking the land route, but with a new plant set up near the port, the company is also looking to utilise the sea route. Moreover, it is looking to expand export destinations particularly that do not have limestone reserves. Production cost, on the other hand, escalated to 71.5 percent of revenue from last year’s 60.7 percent. Thus, gross margin shrunk to 28.5 percent. While this also reflected in the operating margin, net margin was better at 28.8 percent, compared to 26.46 percent in FY17, due to a positive tax expense.

The company witnessed the biggest increase in revenue as it grew by over 32 percent to cross Rs 40 billion in FY19. Total cement sales grew by 16.4 percent while local sales exhibited a growth of 22 percent. Export sales, however, continued its downward trajectory as it fell by 41 percent. While production from the new plant increased, it could not find export markets due to a slowdown in the world economy. In addition, exports to India were impeded by the Pulwama incident, while Iranian cement dominated the Afghan market. On the other hand, production cost increased further to consume nearly 87 percent of the revenue that reduced gross margin to 13 percent. Moreover, finance expense escalated to Rs 3.3 billion due to borrowing for the Hub plant. Thus, net margin was recorded at almost 4 percent.

After growing for four consecutive years, revenue contracted by 6 percent in FY20. Volumetrically, cement sales reduced by 2 percent, whereas clinker sales increased as 1.7 million metric tons of clinker were exported. The domestic sales were impacted by the lower cement selling price, in addition to the onset of Covid-19 that affected demand, and rising competition. As cost of production consumed nearly 96 percent of revenue- the highest ever, gross margin also fell to an all-time low of 4 percent. With further expenses, the company posted a net loss of for the first time since FY12, of Rs 2 billion.

In FY21, topline registered a growth of close to 19 percent to cross Rs 45 billion in value terms. This was attributed to stability in cement prices, coupled with demand recovery as business activities resumed gradually. On the other hand, the company’s Waste Heat Recovery Plant became operational in the second half of the year that reduced cost pressure thus, production cost reduced as a share in revenue to 82 percent. As a result, gross margin improved to close to 18 percent. Moreover, the reduction in discount rate decreased finance expense as a share in revenue, thus, net margin also improved to 8.25 percent for the year.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by 6 percent year on year. While in terms of volumes, there was a decline in total cement sales, in terms of value there was an improvement on the back of stable cement prices. There was also a significant improvement in production cost year on year that had a positive impact on net margin. The latter was recorded at over 8 percent versus a net loss of Rs 351 million in 1QFY21. Bottomline in 1QFY22 was also supported by other income that grew substantially year on year due to dividend income.

The second quarter saw higher revenue as well year on year by over 43 percent. It followed a similar trend as volumes decreased slightly, however in terms of value there was growth due to the selling price factor. However, the entire burden of inflationary pressure could not be passed on to the consumer, therefore, gross margin declined year on year to 16.9 percent. This also reflected in the net margin that was lower at 7.8 percent. Revenue also increased in 3QFY22 by almost 46 percent. Moreover, the impact of inflation was evident in production cost that was higher year on year thereby reducing gross margin to 18.6 percent. With a significant reduction in other income, decline in net margin to 9 percent was more pronounced, compared to 18.8 percent in 3QFY21. The ongoing economic and political stability, in addition to Ukraine-Russia war is impacting the business sentiments. The company also faces the risk of shrinking cement export markets.

Comments

Comments are closed.